PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851075

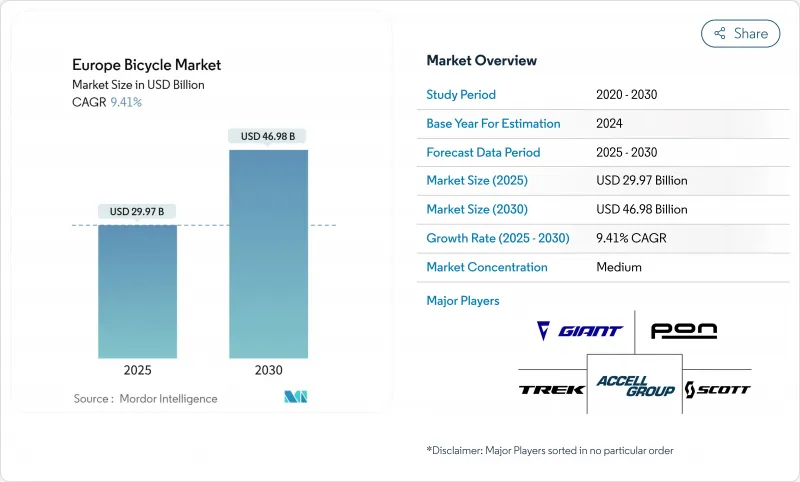

Europe Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe bicycle market, valued at USD 29.97 billion in 2025, is expected to reach USD 46.98 billion by 2030, growing at a CAGR of 9.41%.

The market's expansion is driven by the continent's shift toward sustainable urban mobility, supported by government infrastructure investments and corporate wellness programs addressing traffic congestion and environmental concerns. Consumer preferences are evolving toward premium and specialized segments, particularly in e-bikes, where buyers demonstrate willingness to invest in advanced features and technology. Additionally, the increasing adoption of cycling for fitness and leisure activities, combined with growing environmental consciousness, positions bicycles as both a recreational choice and a sustainable transportation solution. The market benefits from a robust distribution network, encompassing traditional brick-and-mortar retailers, specialized bicycle shops, and growing online sales channels. Furthermore, innovations in bicycle design, materials, and manufacturing processes continue to enhance product durability and performance, meeting the diverse needs of both casual riders and cycling enthusiasts.

Europe Bicycle Market Trends and Insights

Growing Traffic Congestion in Cities Drives Adoption of Bicycles for Daily Commuting

Urban congestion in European metropolitan areas has reached critical levels, prompting cities to adopt cycling as a primary solution for first- and last-mile connectivity. The European Commission's Expert Group on Urban Mobility recommendations in February 2025 emphasize cycling infrastructure development within Sustainable Urban Mobility Plans . Cities like Brussels demonstrate successful implementation through initiatives such as the Good Move plan, which aims to reduce car traffic by 24% by 2030 . The integration of cycling with public transport systems creates efficiency gains by reducing pressure on transit networks while extending their reach. As municipalities implement low-emission zones and car access restrictions in city centers, coupled with rising parking costs and congestion charges, cycling has become both an economically advantageous and necessary component of urban mobility systems. The adoption of cycling infrastructure has shown measurable improvements in air quality and noise reduction in urban areas where comprehensive networks have been implemented. Additionally, cities that have invested in dedicated cycling lanes and secure bicycle parking facilities report increased citizen satisfaction and higher rates of modal shift from private vehicles to bicycles.

Rising Health Consciousness and Fitness Trends Accelerate Cycling Activities

Post-pandemic health awareness has accelerated the shift toward active transportation, with cycling gaining traction as both a fitness activity and a sustainable commuting solution. Corporate wellness programs increasingly reflect this trend by offering bike subsidies, mileage reimbursements, and cycling allowances as part of broader employee benefits. For example, SAP supports employee cycling through financial incentives for purchasing bicycles and e-bikes, as well as providing on-site parking and maintenance facilities. This institutional encouragement has fueled demand for premium bicycles and gear, creating new value-driven segments in the market. Simultaneously, urban centers are investing in cycling infrastructure, such as dedicated bike lanes and secure storage, to support this modal shift. As priorities continue to evolve around preventive healthcare and work-life balance, cycling is becoming firmly embedded in the modern lifestyle, particularly in Europe's metropolitan areas. The integration of cycling into daily routines has also prompted manufacturers to develop innovative products that cater to both recreational and professional cyclists, from advanced safety features to performance-enhancing technologies.

Alternative Transportation Options Such as Motorcycles and Rapid Transit Systems Reduce Bicycle Adoption Rates

The extensive public transport networks in major European cities create competition for bicycle adoption, particularly where metro and bus systems provide faster travel times and protection from weather during longer commutes. Cities with comprehensive rapid transit systems face integration challenges, as cycling often competes with subsidized public transport instead of serving as a complementary first-and-last-mile solution. In Southern European markets, motorcycle and scooter sharing services have gained popularity by offering motorized transport that attracts consumers concerned about physical effort and weather exposure while cycling. The emergence of integrated mobility-as-a-service platforms presents opportunities for cycling to become part of comprehensive transport solutions rather than a standalone option. Transportation authorities are working to develop infrastructure that enables seamless transitions between cycling and public transit through secure bike parking facilities at stations and bike-friendly carriages on trains. Municipal governments are also implementing policies to encourage multimodal transport integration through unified payment systems and coordinated route planning applications.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Government Initiatives Promote Adoption of Sustainable Transportation

- Growing Environmental Awareness and Focus on Sustainability Boost Bicycle Adoption

- Proliferation of Fake Bicycle Products Negatively Impacts Market Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The electric bicycle segment commands a dominant 48.76% market share in 2024 and is expected to expand at a CAGR of 11.01% through 2030. This market leadership position is driven by increasing mainstream acceptance, especially in urban transportation where electric assistance effectively addresses common cycling barriers like hills, distance, and physical effort. The integration of advanced battery technology and improved motor efficiency has made e-bikes more reliable and cost-effective for daily use. Consumer awareness of environmental benefits and government incentives for sustainable transportation solutions further accelerate e-bike adoption across various demographics.

Mountain/All-Terrain and Road/City bicycles maintain their established positions in recreational and traditional commuting segments respectively, though they increasingly compete with the rising e-bike category. Hybrid bicycles continue to appeal to consumers who prioritize versatility and balanced performance, offering multi-purpose functionality without the additional complexity and cost of electric systems. The enduring popularity of these conventional bicycle categories is supported by their lower maintenance requirements and appeal to fitness-oriented consumers. Additionally, improvements in lightweight materials and component technology enhance the riding experience across these traditional segments.

Regular bicycles maintain their market dominance with an 86.56% share in 2024, as consumers consistently choose traditional bicycle formats for their proven performance, long-term durability, and cost-effectiveness across most cycling applications. The widespread availability of spare parts and established service networks further reinforces the appeal of traditional bikes, particularly in regions with well-developed cycling infrastructure. While conventional bikes retain their strong market position, the folding bike segment demonstrates significant growth potential with a projected CAGR of 10.44% through 2030, driven by innovations in hinge mechanisms and advanced frame materials that successfully address historical performance limitations while minimizing weight concerns.

The rising urban population density and limited living spaces in major European cities continue to fuel the demand for folding bikes, as these versatile vehicles provide space-efficient transportation and convenient storage solutions for apartment dwellers, eliminating worries about theft and weather damage associated with outdoor parking. The successful integration of folding mechanisms with electric bike technology has established a premium market segment that particularly appeals to urban commuters seeking both compact storage capabilities and extended travel range, strengthening the growth trajectory of the folding bike category. This trend is further supported by municipal policies promoting sustainable transportation alternatives and the increasing adoption of mixed-mode commuting, where cyclists combine bike travel with public transit.

The Europe Bicycle Market Report is Segmented by Product Type (Road/City, Mountain/All-Terrain, Hybrid, E-Bicycle, and Other Types), Design (Regular and Folding), End User (Men, Women and Children), Distribution Channel (Offline Retail Stores and Online Retail Stores), and Geography (Germany, United Kingdom, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trek Bicycle Corporation

- Accell Group NV

- Giant Manufacturing Co. Ltd

- Pon Holdings BV

- Scott Sports SA

- Decathlon SA

- Merida Industry Co. Ltd

- Pending System GmbH & Co. KG

- Canyon Bicycles GmbH

- Riese & Muller GmbH

- Orbea S. Coop.

- ZEG Zweirad-Einkaufs-Genossenschaft eG)

- myStromer AG

- KTM Fahrrad GmbH

- Brompton Bicycle Ltd

- VanMoof

- Specialized Bicycle Components Inc.

- Cycles Follis

- Cycleurope AB

- Simplon Fahrrad GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Traffic Congestion in Cities Drives Adoption of Bicycles for Daily Commuting

- 4.2.2 Rising Health Consciousness and Fitness Trends Accelerate Cycling Activities

- 4.2.3 Increasing Government Initiatives Promote Adoption of Sustainable Transportation

- 4.2.4 Growing Environmental Awareness and Focus on Sustainability Boost Bicycle Adoption

- 4.2.5 Implementation Of Corporate Wellness Programs Promotes Bicycle Usage Among Employees

- 4.2.6 Escalating Fuel Costs Make Bicycles an Economical Transportation Choice

- 4.3 Market Restraints

- 4.3.1 Alternative Transportation Options Such as Motorcycles and Rapid Transit Systems Reduce Bicycle Adoption Rates

- 4.3.2 Proliferation of Fake Bicycle Products Negatively Impacts Market Expansion

- 4.3.3 Elevated Prices of Electric Bicycles Limit Widespread Consumer Acceptance Across Regions

- 4.3.4 Inadequate Road Infrastructure in Rural Regions Affects Bicycle Riding Experience

- 4.4 Regulatory Landscape

- 4.5 Technological Advancements

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End-User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Children

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Poland

- 5.5.8 Belgium

- 5.5.9 Sweden

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trek Bicycle Corporation

- 6.4.2 Accell Group NV

- 6.4.3 Giant Manufacturing Co. Ltd

- 6.4.4 Pon Holdings BV

- 6.4.5 Scott Sports SA

- 6.4.6 Decathlon SA

- 6.4.7 Merida Industry Co. Ltd

- 6.4.8 Pending System GmbH & Co. KG

- 6.4.9 Canyon Bicycles GmbH

- 6.4.10 Riese & Muller GmbH

- 6.4.11 Orbea S. Coop.

- 6.4.12 ZEG Zweirad-Einkaufs-Genossenschaft eG)

- 6.4.13 myStromer AG

- 6.4.14 KTM Fahrrad GmbH

- 6.4.15 Brompton Bicycle Ltd

- 6.4.16 VanMoof

- 6.4.17 Specialized Bicycle Components Inc.

- 6.4.18 Cycles Follis

- 6.4.19 Cycleurope AB

- 6.4.20 Simplon Fahrrad GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK