PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687371

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687371

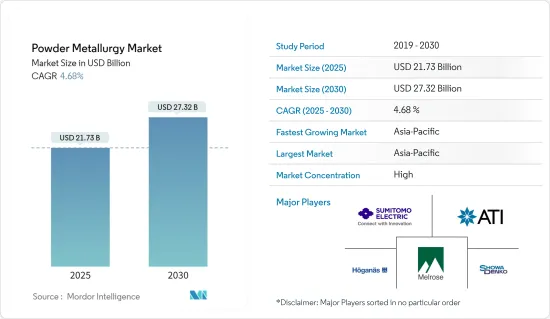

Powder Metallurgy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Powder Metallurgy Market size is estimated at USD 21.73 billion in 2025, and is expected to reach USD 27.32 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

In 2020, COVID-19 negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- Powder metallurgy is being used more and more by automotive OEMs, which is one of the main things driving the market. Moreover, the growing implementation of electrical and electromagnetic applications is also expected to provide market growth.

- On the other hand, rising costs of raw materials and tools are likely to slow the market's growth.

- The increasing adoption of powder metallurgy in the medical field along with the rapid growth in the aerospace and defense sector is expected to provide opportunities to the market.

- The Asia-Pacific region led the market for powder metallurgy, and it is expected to have the highest growth rate over the next few years.

Powder Metallurgy Market Trends

Automotive Applications to Dominate the Market

- Powder metal parts have great control over how porous they are and can lubricate themselves, which lets them filter gases and liquids.Because of this, powder metallurgy is a very good way to make parts that have complicated bends, depressions, and projections.

- This flexibility to develop mechanical parts with diverse compositions, such as metal-nonmetal and metal-metal combinations, enables the production of automotive parts with high dimensional accuracy and ensures consistent properties and dimensions with very little scrap and material waste.

- Bearings and gears are the most common vehicle parts made through the powder metallurgy process. The process is also used for a large number of parts in a vehicle, including the chassis, steering, exhaust, transmission, shock absorber parts, engine, battery, seats, air cleaners, brake discs, etc.

- Auto parts are made from a wide range of metals, such as ferrous (iron, steel, alloy steel, and stainless steel) and non-ferrous (copper, bronze, aluminum alloys, and titanium alloys).The focus of powder metallurgy is to improve the net shape, utilize heat treatment, provide special surface treatment, and improve precision.

- In the first three quarters of 2022, around 50 million passenger cars were manufactured worldwide, up nearly 9% compared to the same quarter in 2021, as per the report of the European Automobile Manufacturers' Association (ACEA).

- Also, the China Association of Automobile Manufacturing says that the number of New Energy Vehicles made in the country rose by 96.9% from December 2021 to December 2022.Thus, the expanding electric vehicle market is expected to increase market demand during the forecast period.

- Due to such factors, the demand for powder metallurgy in the automotive sector is increasing.

Asia-Pacific to Dominate the Market

- Asia-Pacific has become one of the most important powder metallurgy markets and a top destination for manufacturers because its economy is growing and people have more money to spend.

- The positive economic growth trends in countries such as China, India, and Japan have boosted the demand for powder metallurgy products and applications in recent years.

- China has the largest automotive production base in the world, according to the China Association of Automobile Manufacturers (CAAM). In 2022, 27 million vehicles were expected to be made in China, which is 3.4% more than the 26 million vehicles made in 2017.

- Further, in the first 7 months of 2022, the country produced 14.57 million units of cars, registering a growth rate of 31.5% year over year.

- Also, the Society of Indian Automobile Manufacturers (SIAM) said that India's automotive industry will make 22,933,230 vehicles in FY 2021-22 (April 2021-March 2022), compared to 22,655,609 units in FY 2020-21 (April 2020-March 2020).

- Furthermore, the aerospace industry is also growing significantly in the region. For instance, the Boeing Commercial Outlook 2022-2041 predicts that by 2041, 8,485 new deliveries with a market service value of USD 545 billion will take place in China.thus boosting market growth.

- Hence, due to the aforementioned factors, Asia-Pacific is likely to dominate the market during the forecast period.

Powder Metallurgy Industry Overview

The powder metallurgy market is consolidated in nature. Some of the major players in the market (not in any particular order) include Melrose Industries PLC, Sumitomo Electric Industries, Ltd., Hoganas AB, ATI, and Showa Denko Materials Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Preference for Powder Metallurgy by Automotive OEMs

- 4.1.2 Growing Implementation in Electrical and Electromagnetic Applications

- 4.2 Restraints

- 4.2.1 Increasing Raw Material and Tooling Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Ferrous

- 5.1.2 Non-ferrous

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Industrial Machinery

- 5.2.3 Electrical and Electronics

- 5.2.4 Aerospace

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ATI

- 6.4.2 Catalus Corporation

- 6.4.3 fine-sinter Co., Ltd.

- 6.4.4 H.C. Starck Tungsten GmbH

- 6.4.5 Showa Denko Materials Co., Ltd.

- 6.4.6 Hoganas AB

- 6.4.7 Horizon Technology

- 6.4.8 Melrose Industries PLC

- 6.4.9 Miba AG

- 6.4.10 Perry Tool & Research, Inc.

- 6.4.11 Phoenix Sintered Metals, LLC

- 6.4.12 Precision Sintered Parts

- 6.4.13 Sandvik AB

- 6.4.14 Sumitomo Electric Industries, Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Powder Metallurgy Techniques in Medical Sector

- 7.2 Rapid Growth in Aerospace and Defense Sector