PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906962

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906962

Europe Veterinary Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

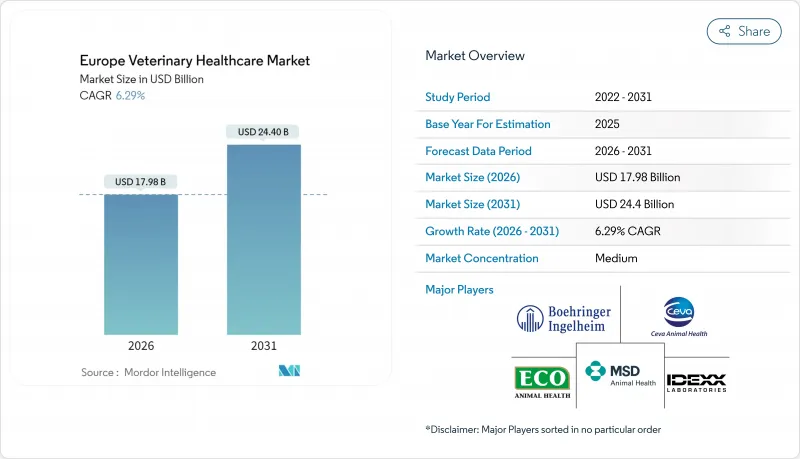

The Europe veterinary healthcare market is expected to grow from USD 16.92 billion in 2025 to USD 17.98 billion in 2026 and is forecast to reach USD 24.4 billion by 2031 at 6.29% CAGR over 2026-2031.

This expansion is propelled by widespread pet humanization, regulatory reforms that accelerate product approvals, and strong corporate investment in clinical infrastructure. Rising disposable incomes support higher out-of-pocket spending on routine and advanced treatments, while digital platforms enhance practice efficiency and client engagement. Consolidation among hospital chains unlocks purchasing power for diagnostics and biologics, and successful commercialization of monoclonal antibodies signals a shift toward precision therapeutics. Simultaneously, livestock producers adopt biosafe vaccines to curb antimicrobial resistance, sustaining demand across farm-animal lines.

Europe Veterinary Healthcare Market Trends and Insights

Rising Companion Animal Ownership

More than 90 million European households keep pets, anchoring long-run demand for veterinary care. Germany tops the region, with pets in 45% of homes and accelerating insurance uptake that reduces treatment price sensitivity. Italy follows with a 60.2 million animal population, translating into robust preventive-care spending. Urban owners channel discretionary income toward wellness plans, premium foods, and chronic-disease management. Nordic nations illustrate the linkage between ownership and insurance: Sweden insured 83% of dogs and 69% of cats in 2023. As pets live longer, companion-animal healthcare needs diversify into oncology, endocrinology, and geriatric pain control.

Growing Government and Institutional Animal-Welfare Support

Regulation (EU) 2019/6 standardizes product approval procedures, restricts prophylactic antibiotics, and improves medicine traceability. The forthcoming welfare package, expected in 2026, extends oversight to transport and slaughter, driving greater vaccine and analgesic uptake. Public spending supports new university programs that address rural veterinary shortages, especially in Germany, Spain, and the UK. The European Medicines Agency 2025 Strategy prioritizes One-Health measures against antimicrobial resistance, spurring demand for non-antibiotic therapies. These policies collectively nurture a growth-oriented operating climate for manufacturers and service providers.

Escalating Veterinary Service Costs

Median fees for common procedures rose 2-24% across Nordic markets between 2022 and 2023; corporate chains posted annual price hikes outpacing independents. Spain illustrates the trend, with spend climbing from EUR 2.613 billion in 2022 to a projected EUR 3.800 billion in 2030 while a 21% VAT compounds consumer burden. Technology upgrades, higher wage expectations, and private-equity return targets fuel inflation. Price comparison portals such as Sweden's Vetpris emerge but cannot offset the structural cost floor set by advanced equipment and biologics. Budget-constrained owners delay care, risking welfare setbacks and public-health repercussions.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Innovations in Veterinary Healthcare

- Expanding Pet-Insurance Penetration

- Shortage of Rural Veterinary Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutics represented 61.88% of Europe veterinary healthcare market share in 2025, anchored by vaccines, parasiticides, and anti-infectives. Europe veterinary healthcare market size for therapeutics grew steadily as corporates leveraged centralized buying to stock high-margin biologics. Vaccines such as VAXXITEK posted 15.2% expansion in early 2025, reflecting poultry producers' heightened biosecurity protocols. Parasiticides remained resilient through flagship brands like NEXGARD, although antibiotic stewardship capped systemic-antibacterial volumes. Diagnostics, while smaller, register a 7.18% CAGR as clinics adopt AI-driven imaging and reagent-free hematology devices that compress lab timelines and lift compliance. Immunodiagnostic kits retain the largest slice, yet molecular assays and digital radiography accelerate fastest, propelled by insurance reimbursement and corporate back-office integrations.

Diagnostic momentum elevates practice profitability and improves case-outcome transparency, reinforcing client trust. EMA's 2023 approval list, with nine new vaccines, signals sustained pipeline vitality that will sustain the Europe veterinary healthcare market long term. The line between therapy and diagnosis blurs as companion-animal monoclonal antibodies double as biomarkers, foreshadowing integrated care bundles. Product-life-cycle extensions through chewable formulations and combination parasiticide-vaccines create cross-selling opportunities within corporatized clinic networks.

Europe veterinary healthcare market size for dogs and cats equaled 46.10% of 2025 revenue, underpinned by expanding insurance, urban lifestyles, and longevity-linked morbidities. German households alone spent heavily on premium services, reinforcing the Europe veterinary healthcare market leadership of companion animals. Poultry edges ahead as fastest riser at 6.62% CAGR, mirroring the shift toward high-density, antibiotic-free production. Horses command niche but high-value consumption in equine cardiology and orthopedic interventions, particularly across France and Germany. Swine and ruminant segments adopt combination vaccines to satisfy regulatory curbs on metaphylaxis. Aquaculture emerges through DNA-based salmon vaccines following MSD's aqua acquisition, diversifying growth vectors.

The companion sector benefits from human-grade facility investments that mirror small-animal ICU standards. Cross-species product transfers accelerate pipeline efficiency, evidenced by feline diabetes solutions adapted from human endocrinology. Livestock categories confront margin compression from producer consolidation and retail price pressure, steering demand toward cost-effective broad-spectrum biologics and nutraceuticals.

The Europe Veterinary Healthcare Market Report is Segmented by Product (Therapeutics and Diagnostics), Animal Type (Dogs & Cats, Horses, Ruminants, Swine, Poultry, and Other Animal Types), Route of Administration (Oral, Parenteral, and More), End User (Veterinary Hospitals & Clinics, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Boehringer Ingelheim

- Ceva Sante Animale

- ECO Animal Health Group PLC

- Elanco

- IDEXX

- MSD Animal Health

- Vetoquinol

- Virbac

- Zoetis

- Hipra

- Dechra Pharmaceuticals

- Norbrook Laboratories Ltd

- Huvepharma

- Phibro Animal Health

- Neogen Corp.

- Mars Petcare (Mars Veterinary Health)

- Covetrus

- Bimeda Animal Health

- Orion Corporation (Animal Health)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Companion Animal Ownership

- 4.2.2 Growing Government and Institutional Animal Welfare Support

- 4.2.3 Continuous Technological Innovations in Veterinary Healthcare

- 4.2.4 Expanding Pet Insurance Penetration

- 4.2.5 Increasing Adoption of Digital Veterinary Solutions

- 4.2.6 Favorable European Union Regulatory Reforms

- 4.3 Market Restraints

- 4.3.1 Prevalence of Counterfeit Veterinary Products

- 4.3.2 Escalating Veterinary Service Costs

- 4.3.3 Regulatory Uncertainty Post-Brexit

- 4.3.4 Shortage of Rural Veterinary Professionals

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-Infectives

- 5.1.1.4 Medical Feed Additives

- 5.1.1.5 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Clinical Chemistry

- 5.1.2.5 Other Diagnostics

- 5.1.1 Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs & Cats

- 5.2.2 Horses

- 5.2.3 Ruminants

- 5.2.4 Swine

- 5.2.5 Poultry

- 5.2.6 Other Animal Types

- 5.3 By Route Of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.3.3 Topical

- 5.3.4 Other Route of Administrations

- 5.4 By End User

- 5.4.1 Veterinary Hospitals & Clinics

- 5.4.2 Reference Laboratories

- 5.4.3 Point-Of-Care / In-House Testing Settings

- 5.4.4 Academic & Research Institutes

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Boehringer Ingelheim International GmbH

- 6.3.2 Ceva Sante Animale

- 6.3.3 ECO Animal Health Group PLC

- 6.3.4 Elanco

- 6.3.5 IDEXX Laboratories Inc.

- 6.3.6 MSD Animal Health

- 6.3.7 Vetoquinol SA

- 6.3.8 Virbac

- 6.3.9 Zoetis Inc.

- 6.3.10 Hipra

- 6.3.11 Dechra Pharmaceuticals PLC

- 6.3.12 Norbrook Laboratories Ltd

- 6.3.13 Huvepharma

- 6.3.14 Phibro Animal Health Corp.

- 6.3.15 Neogen Corp.

- 6.3.16 Mars Petcare (Mars Veterinary Health)

- 6.3.17 Covetrus Inc.

- 6.3.18 Bimeda Animal Health

- 6.3.19 Orion Corporation (Animal Health)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment