PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851829

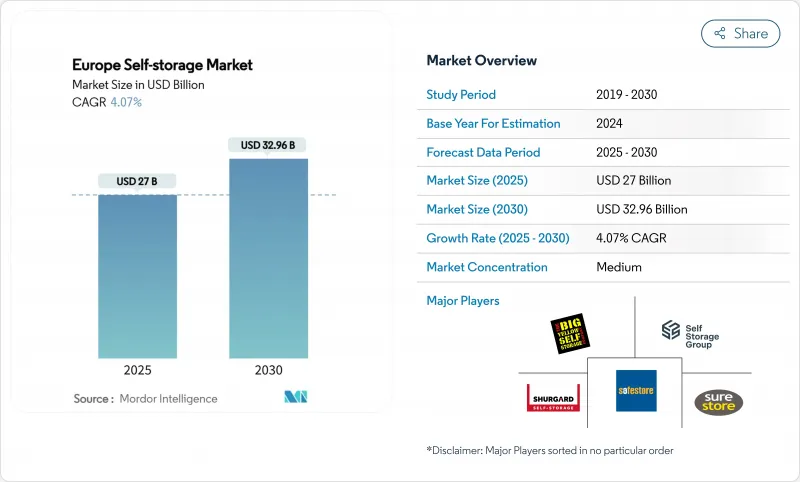

Europe Self-storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe self-storage market stands at USD 27 billion in 2025 and is forecast to reach USD 32.96 billion by 2030 at a 4.07% CAGR.

Expansion rests on steady urban population growth, rising residential mobility, and institutional capital inflows that treat storage assets as infrastructure rather than peripheral real-estate plays. Urban compression in London, Paris, Berlin, and similar Tier-1 cities, coupled with ageing populations downsizing, keeps occupancy and rental levels resilient across economic cycles. Small and medium e-commerce businesses increasingly adopt micro-warehousing strategies, while student and expatriate mobility supplies predictable seasonal demand. Climate-policy-driven retrofits, although costly, improve energy efficiency and create a premium segment that lifts yields for compliant facilities

Europe Self-storage Market Trends and Insights

Urban compression and micro-living

Intensifying land prices have shrunk average city dwellings, prompting residents to treat local storage facilities as an external "room." Over 100 new complexes opened in the UK in three years, earning operators GBP 1 billion annually as renters off-load furniture and seasonal goods. Hybrid leases and 24/7 digital access further embed the service into day-to-day urban living.

Ageing population downsizing from larger homes

Older homeowners in Germany, Italy, and the UK are shifting to smaller dwellings, creating interim storage demand for heirlooms and bulky furniture. OECD projections show the 65+ cohort reaching 25% of G7 city dwellers by 2050, locking in a durable, needs-based customer base

Stringent fire-safety codes

Nordic rules require advanced suppression systems and verified risk assessments, adding up to 25% to conversion budgets and delaying market entry

Other drivers and restraints analyzed in the detailed report include:

- E-commerce SMB boom driving flexible micro-warehousing

- Student & expat mobility

- Heightened energy-efficiency mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal users accounted for 70% of Europe self-storage market revenue in 2024. Household moves, micro-living, and retirement downsizing secure long-tenure contracts that stabilise occupancy during macro shocks. The business cohort, while smaller, is expanding at 7.5% annually as SMEs embrace pay-as-you-go inventory space. Operators now tailor dual-branding strategies-lifestyle messaging for individuals and turnkey logistics features for corporations-to monetise both streams effectively.

The Europe self-storage market size attached to personal tenancy is forecast to maintain a dominant share through 2030, helped by digital reservation platforms that simplify short-cycle booking. Meanwhile, cross-selling services such as courier pick-up, racking, and insurance lift average revenue per business customer as e-commerce penetration deepens in peripheral cities.

Non-climate units delivered 60% of Europe self-storage market share in 2024 thanks to lower fit-out costs. Yet climate-controlled stock, growing at 9% CAGR, underpins margin expansion because sensors, HVAC, and stricter access controls command fees 25-40% above standard rooms.

Regulatory upgrades accelerate the pivot: facilities that already meet class E standards recoup retrofit spending via higher rents and lower churn. The Europe self-storage market size for climate-controlled units is on track to surpass USD 10 billion by 2030, supporting specialised insurance offerings for electronics, art, and archival documents.

Europe Self Storage Market Report is Segmented by User Type (Personal and Business), Storage Type (Climate-Controlled, Non-Climate-Controlled), Space Size (Up To 90 Sq Ft, 91-150 Sq Ft, and More), Application (Household Goods, E-Commerce Micro-Fulfilment, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Big Yellow Group PLC

- Self Storage Group ASA

- Lok'nStore Group PLC

- SureStore Ltd

- Access Self Storage Ltd

- Lagerboks

- Nettolager

- Pelican Self Storage

- 24Storage AB

- Casaforte (SMC Self-Storage Management)

- W Wiedmer AG

- MyPlace SelfStorage GmbH

- BlueSpace Self-Storage S.L.

- Space Station Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Compression and Micro-Living Trends in Tier-1 European Cities

- 4.2.2 Aging Population Downsizing from Larger Homes in Germany, Italy and UK'

- 4.2.3 E-commerce SMB Boom Driving Need for Flexible Micro-Warehousing

- 4.2.4 Surging Student & Expat Mobility Within the Schengen Region

- 4.2.5 Rise of Hybrid Work Creating Home Office Clutter

- 4.2.6 Institutional Investor Appetite for Alternative Real-Estate Yields

- 4.3 Market Restraints

- 4.3.1 Stringent Fire-Safety Codes Limiting Facility Conversions in Nordics

- 4.3.2 Scarcity of Suitable Zoned Industrial Stock in Historic City Centres

- 4.3.3 Inflation-Linked Rental Index Caps in France and Spain

- 4.3.4 Heightened Energy-Efficiency Mandates Increasing Retrofit Costs

- 4.4 Consumer Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Storage Type

- 5.2.1 Climate-Controlled

- 5.2.2 Non-Climate-Controlled

- 5.3 By Space Size

- 5.3.1 Up to 90 sq ft

- 5.3.2 91-150 sq ft

- 5.3.3 151-300 sq ft

- 5.3.4 Above 300 sq ft

- 5.4 By Application

- 5.4.1 Household Goods

- 5.4.2 E-commerce Micro-Fulfilment

- 5.4.3 Document & Archive Storage

- 5.4.4 Vehicle Storage

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shurgard Self Storage SA

- 6.4.2 Safestore Holdings PLC

- 6.4.3 Big Yellow Group PLC

- 6.4.4 Self Storage Group ASA

- 6.4.5 Lok'nStore Group PLC

- 6.4.6 SureStore Ltd

- 6.4.7 Access Self Storage Ltd

- 6.4.8 Lagerboks

- 6.4.9 Nettolager

- 6.4.10 Pelican Self Storage

- 6.4.11 24Storage AB

- 6.4.12 Casaforte (SMC Self-Storage Management)

- 6.4.13 W Wiedmer AG

- 6.4.14 MyPlace SelfStorage GmbH

- 6.4.15 BlueSpace Self-Storage S.L.

- 6.4.16 Space Station Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment