PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910639

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910639

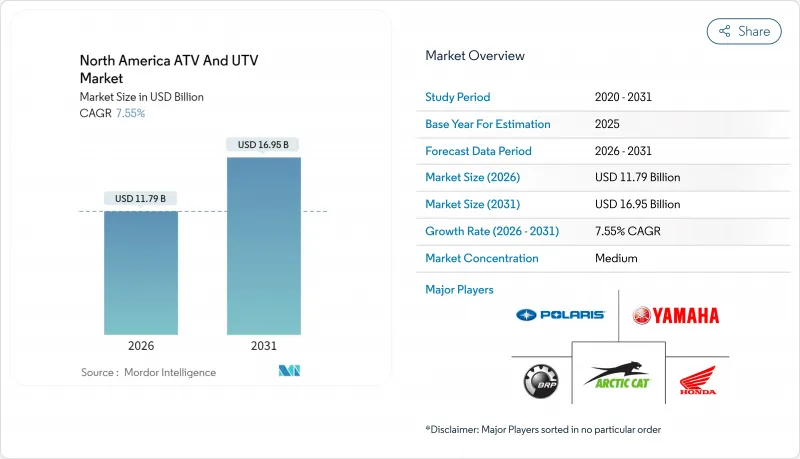

North America ATV And UTV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America ATV and UTV market size in 2026 is estimated at USD 11.79 billion, growing from 2025 value of USD 10.96 billion with 2031 projections showing USD 16.95 billion, growing at 7.55% CAGR over 2026-2031.

Robust demand is rooted in recreational trail expansion, precision-farming uptake, and ongoing military procurement, while OEM design roadmaps emphasize electrified drivetrains and digitally controlled safety systems. Persistent growth of utility terrain vehicles (UTVs) safeguards revenue stability as these platforms now integrate factory-installed telematics, autonomous-ready wire-harnesses, and modular cargo solutions that lower the total cost of ownership for farms and public agencies. Electric side-by-sides gain traction in noise-sensitive tourism zones and conservation areas. Yet, gasoline powertrains remain dominant among price-sensitive segments because of their lower upfront cost and established refueling infrastructure. Competitive intensity has heightened after Textron divested Arctic Cat and Polaris confronted retail decline in Q3 2024, prompting aggressive model refreshes, dealer incentive programs, and localization of component supply chains.

North America ATV And UTV Market Trends and Insights

Growing Agricultural Mechanization Needs

Machine-learning-based crop-scouting attachments mounted on UTVs deliver 15-20% yield gains by combining multispectral imaging and AI vision analytics that flag nutrient deficiencies in real time. Farmers cite durability as their prime purchase criterion, pushing OEMs to reinforce cargo beds to withstand 450 kg hay bale loads. Precision guidance kits with sub-meter GPS accuracy now ship as dealer-installed options, automating spraying and soil sampling on irregular fields. Safety enhancements remain critical because agriculture accounts for three-fifth of work-related ATV fatalities, prompting roll-over detection systems that cut engine power within 200 ms of sensor activation. Autonomous prototypes undergoing pilot trials in Iowa operate follow-me modes behind combines, reducing hired-hand costs during peak harvest. Such innovations position UTVs as integral field assets rather than discretionary purchases, supporting long-run demand for the North America ATV and UTV market.

Rising Recreational & Motorsports Activities

ATV trail mileage funded by state tourism boards keeps expanding, exemplified by Pennsylvania's Regional Trail Connector that now links 1,200 miles of mixed-use routes to local lodging hubs. Rental fleets report annual profits topping USD 85,000 as guided tour operators bundle equipment hire, trail permits, and safety gear in weekend packages. Wisconsin's statutory update allowing ATVs and UTVs on designated county roads bolsters ride-in/ride-out tourism, lifting rural hospitality revenue. Equipment OEMs co-sponsor festivals such as Utah's 2025 Paiute Trail Jamboree to showcase new models and collect real-time performance data through telematics. As a result, the North America ATV and UTV market captures significant global ATV demand, underpinning sustained aftermarket parts and apparel sales.

High Purchase & Maintenance Costs

Premium UTV stickers now eclipse USD 30,000 with the 2025 Polaris RANGER XP Kinetic topping USD 37,499 in fully optioned trim. For commercial fleet owners, high insurance costs and parts inventory tie up working capital because driveline, suspension, and battery modules remain brand-specific. Electric models promise more than one-fifth lower running costs over five years, yet limited dealership service capability prolongs downtime when high-voltage components fail. Financing complexities emerge for small farms that manage seasonal cash flows; lenders often require 20% down payments and collateral beyond the vehicle. Price pressure delays replacement cycles, muting short-term unit sales despite robust long-term fundamentals for the North America ATV and UTV market.

Other drivers and restraints analyzed in the detailed report include:

- Silent Electric SxS Demand in Conservation & Hunting

- Technological Advances in Suspension & Safety

- Lithium Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Utility terrain vehicles commanded 71.18% of the North America ATV and UTV market share in 2025 and growing at a 7.66% CAGR, underscoring their multi-purpose appeal across construction, emergency response, and back-country tourism. This dominance-reinforcing scale advantages for cargo-bed liners, cab enclosures, and hydraulic lift kits suppliers. The North America ATV and UTV market size allocated to multi-purpose UTV configurations is set to grow exponentially by 2031, supported by dealer-installed telematics that standardize fleet monitoring for municipalities. Sport-oriented UTV models such as Yamaha's Wolverine RMAX4 1000 help manufacturers defend high-margin niches while showcasing suspension technology transferable to work-focused trims.

All-terrain vehicles maintain niche relevance where single-rider agility, lower curb weight, and narrower track widths matter, particularly on trail systems mandating sub-50-inch vehicles. OEM roadmaps reveal six new ATV variants for 2025, integrating ride-by-wire throttles, blind-spot radar, and factory-installed winches to protect share against rapidly advancing UTVs. Regulatory alignment of ATV rollover standards with UTV occupant-protection protocols could blur historic category boundaries, with future models sharing chassis components and power electronics. Consequently, platform modularity is poised to reduce development cycles, sustaining innovation cadence while tempering bill-of-materials inflation across the North America ATV and UTV market.

Gasoline engines held 62.67% of the North America ATV and UTV market share in 2025. Yet, electrified drivetrains are advancing at a 7.62% CAGR, reflecting tightening emission caps and user preference for low-noise operation. Honda's expansion in North Carolina earmarks battery packs and final vehicle assembly capacity, signaling mainstream adoption. The North America ATV and UTV market size attributable to electric units is projected to grow drastically by 2031, assuming pack prices decline. Meanwhile, diesel remains confined to heavy-duty ranch and forestry applications where high-torque hauling supersedes energy-density constraints.

Hybrid range-extended concepts such as HuntVe's Switchback illustrate transitional architectures: a 72-V lithium pack supplies 40 km silent range before a 708 cc gasoline engine engages. Policymakers in California already mandate stage-V-equivalent off-road emission limits, hastening fleet electrification among public agencies. Yet mass-market electric penetration awaits infrastructure build-out of 240-V Level-2 chargers across trailheads and farmsteads, a requirement now tackled by cooperative utility-dealer programs in Midwestern states. Until such grid upgrades materialize, gasoline will sustain its majority hold on unit volumes within the North America ATV and UTV market.

The North America ATV & UTV Market Report is Segmented by Vehicle Type (All-Terrain Vehicles and Utility Terrain Vehicles), Propulsion/Fuel Type (Gasoline, Diesel, and More), End-Use Industry (Hybrid, and More), Seating/Capacity (Single-Seat, 2-3 Seat, and 4-6 Seat), Drive Type (2-Wheel Drive and More), and Geography (United States and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Polaris Inc.

- BRP Inc. (Can-Am)

- American Honda Motor Co.

- Yamaha Motor Co.

- Kawasaki Heavy Industries

- Textron Inc. (Arctic Cat & Tracker Off-Road)

- Suzuki Motor Corp.

- CF Moto Powersports

- Kubota Corp.

- Deere & Company (Gator)

- Mahindra Automotive NA (ROXOR)

- Segway Powersports

- Hisun Motors Corp.

- DRR USA Inc.

- Intimidator/BAD BOY Off-Road

- ODES Powersports

- Club Car LLC

- Toro Co.

- Kioti (Daedong-USA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing agricultural mechanisation needs

- 4.2.2 Rising recreational & motorsports activities

- 4.2.3 Silent electric SxS demand in conservation & hunting

- 4.2.4 Technological advances in suspension & safety

- 4.2.5 Trail-tourism incentive programs

- 4.2.6 Rural broadband-enabled fleet connectivity

- 4.3 Market Restraints

- 4.3.1 High purchase & maintenance costs

- 4.3.2 Lithium supply-chain volatility

- 4.3.3 Emission & noise regulation tightening

- 4.3.4 Land-owner liability litigation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 All-Terrain Vehicles (ATVs)

- 5.1.1.1 Sport ATVs

- 5.1.1.2 Utility/Work ATVs

- 5.1.2 Utility Terrain Vehicles (UTVs/Side-by-Sides)

- 5.1.2.1 Sport UTVs

- 5.1.2.2 Multi-purpose UTVs

- 5.1.1 All-Terrain Vehicles (ATVs)

- 5.2 By Propulsion/Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Electric

- 5.3 By End-use Industry

- 5.3.1 Hybrid

- 5.3.2 Recreation & Sports

- 5.3.3 Agriculture & Forestry

- 5.3.4 Industrial & Construction

- 5.3.5 Military & Government

- 5.3.6 Search, Rescue & Emergency Services

- 5.4 By Seating/Capacity

- 5.4.1 Single-seat

- 5.4.2 2 - 3 seat

- 5.4.3 4 - 6 seat

- 5.5 By Drive Type

- 5.5.1 2-Wheel Drive

- 5.5.2 4-Wheel Drive

- 5.5.3 All-Wheel Drive

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Polaris Inc.

- 6.4.2 BRP Inc. (Can-Am)

- 6.4.3 American Honda Motor Co.

- 6.4.4 Yamaha Motor Co.

- 6.4.5 Kawasaki Heavy Industries

- 6.4.6 Textron Inc. (Arctic Cat & Tracker Off-Road)

- 6.4.7 Suzuki Motor Corp.

- 6.4.8 CF Moto Powersports

- 6.4.9 Kubota Corp.

- 6.4.10 Deere & Company (Gator)

- 6.4.11 Mahindra Automotive NA (ROXOR)

- 6.4.12 Segway Powersports

- 6.4.13 Hisun Motors Corp.

- 6.4.14 DRR USA Inc.

- 6.4.15 Intimidator/BAD BOY Off-Road

- 6.4.16 ODES Powersports

- 6.4.17 Club Car LLC

- 6.4.18 Toro Co.

- 6.4.19 Kioti (Daedong-USA)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment