PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642160

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642160

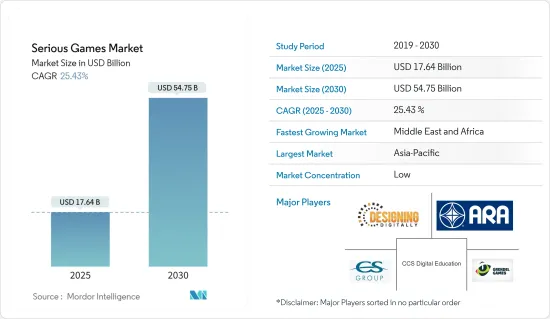

Serious Games - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Serious Games Market size is estimated at USD 17.64 billion in 2025, and is expected to reach USD 54.75 billion by 2030, at a CAGR of 25.43% during the forecast period (2025-2030).

The serious games market is evolving rapidly, driven by advancements in mobile technology and increasing demand for engaging learning tools across various industries. Serious games, which are designed for educational, training, or simulation purposes beyond entertainment, are gaining traction in sectors like education, healthcare, government, and corporate training. These games blend interactive experiences with practical learning outcomes, expanding their application in professional and educational environments. As the global focus shifts toward digital transformation and innovative training methods, serious games are becoming a critical tool for improving engagement, knowledge retention, and performance.

Key Highlights

- Technology Integration in Serious Games: The market is seeing a surge in mobile-based platforms, cloud-based infrastructure, and immersive technologies such as virtual and augmented reality (VR/AR). These technologies enhance the effectiveness of serious games by creating immersive and interactive learning environments that adapt to various educational needs. Artificial intelligence (AI) is also allowing for more personalized learning experiences, making serious games more impactful for users.

- Broad Industry Adoption: Serious games are being adopted across sectors. The healthcare industry uses them for simulation training and patient education, while educational institutions implement them for interactive learning. In industries like automotive and retail, serious games facilitate employee training and customer engagement, broadening their market appeal.

Mobile Educational Games Transform Learning

Key Highlights

- The increasing use of mobile-based educational games is a significant driver of the serious games market. Mobile devices make these games easily accessible to a broader audience. Educational games that run on smartphones and tablets are popular due to their portability and convenience, allowing users to learn anytime, anywhere. These games provide interactive content that enhances knowledge retention and learning efficiency.

- Integration into Education Systems: As education systems worldwide adapt to digital platforms, mobile games offering gamified experiences are being incorporated into curricula. Serious games promote critical thinking and problem-solving through engaging formats, fostering dynamic learning environments. Both students and professionals are increasingly relying on mobile applications for continuous learning.

- Corporate Training Benefits: In the corporate world, mobile-based serious games offer an engaging, cost-effective solution for employee training, particularly in industries like healthcare and aviation, where simulation and role-playing are key to training effectiveness. This trend aligns with the growing demand for serious games in corporate training as a modern training tool.

Improved Learning Outcomes Fuel Serious Games Adoption

Key Highlights

- The improved learning outcomes associated with serious games are driving adoption across various sectors. Research shows that serious games enhance user engagement and knowledge retention compared to traditional learning methods, proving particularly valuable in education and corporate training.

- Healthcare Applications: In healthcare, serious games simulate medical procedures, offering professionals hands-on experience in a risk-free environment. This leads to improved confidence and competency. Similarly, in education, serious games help students grasp complex concepts by allowing interactive experimentation.

- Data-Driven Personalization: The rise of data analytics in education and training has amplified the effectiveness of serious games. By tracking user progress, educators and trainers can personalize content to meet individual learning needs. This personalized learning not only increases user satisfaction but also delivers more efficient learning outcomes.

Serious Games Market Trends

Learning and Education Applications to Witness Significant Growth

The serious games market is experiencing rapid growth, especially in the education sector, as educational institutions adopt game-based learning to enhance student engagement. The immersive nature of serious games simplifies complex subjects, boosting cognitive skills and teamwork. This leads to better learning outcomes and increased student retention.

- Post-Pandemic Digital Shift: The rise of e-learning platforms and digital tools, accelerated by the COVID-19 pandemic, is driving demand for serious games in education. Virtual and augmented reality (VR/AR) technologies provide students with practical, hands-on learning environments that traditional methods often lack.

- Corporate Training Integration: The integration of serious games in corporate training is also on the rise. Companies are using simulations to develop leadership and decision-making skills. Organizations seek innovative ways to improve workforce skills, enhancing performance and competitiveness.

- Market Forecast: The global demand for serious games in education is projected to grow at a compound annual growth rate (CAGR) exceeding 20% over the next five years. Investments in educational technologies and game-based learning tools will continue to drive this growth, with serious games in healthcare and corporate training also contributing to the market expansion.

Asia Pacific is Expected to Hold Significant Market Share

The Asia Pacific region is poised for significant growth in the serious games market, driven by rising investments in digital learning technologies and the increasing focus on improving education systems. Countries like China, Japan, India, and South Korea are prioritizing digital infrastructure to enhance learning, particularly in underserved areas.

- Healthcare Sector Application: Serious games are being utilized in healthcare for medical training and patient care. Medical professionals are using simulations to practice procedures, while game-based interventions help patients manage chronic conditions, adding to the market's growth.

- Mobile Penetration: The growing use of mobile devices and high-speed internet across Asia Pacific is driving market expansion. Access to serious games via mobile platforms has surged, contributing to higher industry sales and market penetration. As mobile learning grows, serious games will play a pivotal role in providing accessible, engaging educational tools.

- Growth Forecast: Asia Pacific is expected to see the highest growth rate in the serious games market, with a projected CAGR of 25.38%. Government initiatives to improve education and healthcare outcomes, coupled with investments from global leaders, position the region as a hub for serious game development.

Serious Games Industry Overview

The serious games market is fragmented, featuring a mix of global and regional players across sectors such as education, corporate training, and healthcare. No single company dominates, fostering an environment of innovation and competition.

Key Market Players: Leading companies include Designing Digitally Inc., Diginext, CCS Digital Education Ltd., Applied Research Associates Inc., and Grendel Games. These firms specialize in creating serious games tailored to specific needs, such as educational simulations and corporate training modules, leveraging technologies like VR, AR, and AI.

Strategic Focus: Success in this market depends on the ability to integrate emerging technologies and offer customized solutions. Companies that prioritize user engagement, immersive experiences, and adaptability are well-positioned to thrive. Partnerships with educational institutions, corporations, and government agencies are crucial for market reach and success.

Innovation and Expansion: With e-learning and digital transformation on the rise, companies that can scale their serious game solutions globally will find ample opportunities. The serious games market outlook remains robust, with innovation driving future applications and growth across various industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Usage of Mobile-based Educational Games

- 5.1.2 Improved Learning Outcomes are Expected to Increase the Adoption of Serious Game Among End Users

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness about Serious Games among End-users

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Advertising and Marketing

- 6.1.2 Simulation Training

- 6.1.3 Learning and Education

- 6.1.4 Other Applications

- 6.2 By End-User Industry

- 6.2.1 Healthcare

- 6.2.2 Education

- 6.2.3 Retail

- 6.2.4 Media and Entertainment

- 6.2.5 Automotive

- 6.2.6 Government

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Designing Digitally Inc.

- 7.1.2 Diginext (CS Group)

- 7.1.3 CCS Digital Education Ltd

- 7.1.4 Applied Research Associate Inc.

- 7.1.5 Grendel Games

- 7.1.6 Cisco Systems

- 7.1.7 Revelian

- 7.1.8 MPS Interactive Systems

- 7.1.9 Can Studios Ltd

- 7.1.10 L.I.B. Businessgames BV

- 7.1.11 Tygron BV

- 7.1.12 Triseum LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET