PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404560

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404560

Graphics Processing Unit (GPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

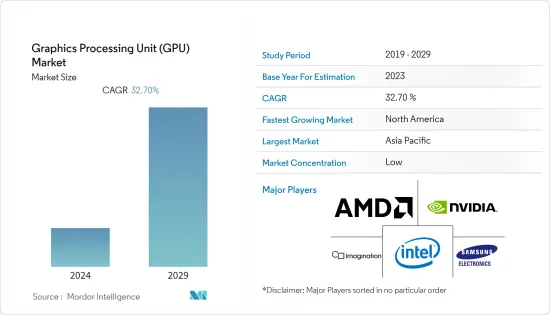

The Graphics Processing Unit (GPU) Market was valued at USD 37.9 billion the previous year and is expected to grow at a CAGR of 32.70%, reaching USD 206.95 billion by the next five years. The demand for high-end personal computing devices and gaming console effects has surged in recent years. Hence, investing in a graphics add-in board is helpful for micro-processing companies, as GPU forms a vital component of the finished product.

Key Highlights

- The high adoption of computing products, such as personal computers (PC) or laptops, globally and the increasing investment in the gaming industry have been major factors driving the studied market's growth in recent years. The growing demand for high graphics and computing applications and the expansion of technologies, like AI, along with the trend of real-time analysis, are mainly expanding the scope of GPU technology over the forecast period.

- The gaming industry is one of the significant driving forces for the GPU market. The growing investment in the global gaming sector and advancement in game development also fuel graphics growth. Features like real-time stimulators demand high graphics. Additionally, game developers mainly leverage competitive advantage by developing high-graphics games that match real-world scenarios. These features also require advanced graphics boards.

- The growing demand for advanced technologies, like AR, VR, and AI, is further fueling the GPU demand, as these technologies require high-speed analysis, for which GPU is an ideal option. AI chips have surpassed GPUs in performance and energy efficiency. However, GPUs are still an indispensable part of high-performance computing. Apart from AI, GPUs also have a solid general-purpose computing capability.

- GPU manufacturing, especially the standalone GPU chip, is costlier and requires high-end machines. Although the raw material is cost-effective, the companies need a high initial investment to build the lab for testing and manufacturing. For instance, Intel announced Intel Arc for consumer high-performance graphics solutions. The Arc brand would encompass hardware, software, and services over multiple generations of hardware, with the first discrete GPU (Alchemist) based on the Xe HPG microarchitecture delivered to OEMs in Q1 of the current year.

- COVID-19 impacted the industry by disrupting the supply chain in the initial phase. However, the market has reported increased consumer demand in a particular segment, mainly supporting GPU technology growth. In April this year, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres.

Graphics Processing Unit (GPU) Market Trends

Servers Application Segment is Expected to Hold Significant Market Share

- The server segment is witnessing significant growth owing to the proliferation of the cloud in various end-user sectors. For instance, in Japan, KDDI, one of the prominent telecom companies, partnered with NVIDIA to offer GeForce Now game-streaming service to customers. KDDI reportedly partnered with NVIDIA to deliver PC games over low-latency broadband and a 5G network to gamers in Japan. It would place NVIDIA's RTX gaming servers in a new data center in Tokyo.

- Additionally, GPUaaS may be utilized for various purposes, including training multilingual AI speech engines and identifying early indicators of diabetes-related blindness. Modern GPUaaS, which provides a compelling alternative to traditional general-purpose processors with variable pricing and no CAPEX, is one way to achieve the speed required for machine learning systems.

- Moreover, the Indian market is also witnessing investment by many vendors. For instance, Acer launched new NVIDIA Tesla GPU-powered servers in India. The server can host up to eight NVIDIA Tesla V100 32GB SXM2 GPU accelerators. GPU pair includes one Peripheral Component Interconnect (PCIe) slot for high-speed interconnect.

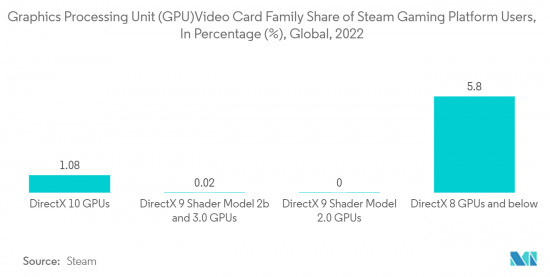

- Technological advancement in high-performing computing (HPC) may also develop an opportunity for GPU vendors. For instance, in April 2022, Nvidia stated that researchers discovered trends in Hubble data on 25 of them using a supercomputer with NVIDIA GPUs. To increase the understanding of all planets, high-performance computing is used with NVIDIA GPUs to analyze the torrid atmospheres. According to Steam, 91.22 percent of respondents used a DirectX 12 GPU graphics card as of August 2022.

Asia Pacific is Expected to Hold Significant Market Share

- In China, the Fenghua GPU achieved a significant milestone in terms of broad adoption. The GPU was announced in November last year by Xindong Technology and Innosilicon. The GPU was validated in March 2022 for stable operation and excellent Tongxin UOS operating system performance.

- Tongxin UOS is a significant operating system in China because it was created as a government-led effort to usurp Windows. It is built on Debian Linux and has been tweaked to work with the newest homemade hardware. As a result, alongside the development of support for Chinese-designed semiconductor devices such as Zhaoxin CPUs and GPUs, the Fenghua GPU certification represents a significant step.

- In April 2022, Moore Threads announced MTT S60 for PC desktops and workstations and the MTT S2000 for servers. Both are based on MUSA-based 12nm GPUs. Moving on to AI, MUSA-based graphics cards can support a variety of common AI frameworks, including those for visual processing, audio processing, natural language processing, and more.

- Many companies are also partnering or investing in Chinese start-ups or research laboratories, which are getting government support. This is also known as indirect penetration in the Chinese market. China-based popular AI start-up SenseTime has a portfolio of 700 clients and partners, including the Massachusetts Institute of Technology (MIT), and Qualcomm, among others.

- The company has become successful in very little time and has a valuation of USD 4.5 billion. One of the reasons SenseTime has been able to grow so quickly is that it has government support and direct access to China's vast databases. The company is also working with the Chinese government on Made in China in 2025. The company also revealed that its aggregate computing power is more than 160 petaflops, achieved with 54,000,000 GPU cores across 15,000 GPUs within 12 GPU clusters.

- The growth in the Chinese gaming industry is mainly due to increasing investment in enhancing R&D capability for GPU technology. Independent games developed by domestic firms have continued to dominate market sales in China.

Graphics Processing Unit (GPU) Industry Overview

The Graphics Processing Unit market is fragmented with the presence of major players like Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, Imagination Technologies Group, and Samsung Electronics Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - MediaTek partnered with NVIDIA to deliver a complete range of in-vehicle AI cabin solutions for the next generation of software-defined vehicles. MediaTek would develop automotive SoCs through this collaboration, integrating a new NVIDIA GPU chiplet with NVIDIA AI and graphics IP.

- August 2022: Intel Data Centre GPU Flex Series Arctic Sound-M was introduced for the Intelligent Visual Cloud. Flex Series GPU is designed to meet the requirements for intelligent visual cloud workloads, with 5x media transcode throughput performance and up to 68 simultaneous cloud gaming streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Graphics in Games

- 5.1.2 Growing Applications of AR, VR, and AI

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Discrete GPUs

- 6.1.2 Integrated GPUs

- 6.2 By Applications

- 6.2.1 Desktop

- 6.2.2 Mobile PC

- 6.2.3 Workstation

- 6.2.4 Server/Datacenter

- 6.2.5 Automotive/Self-driving Vehicles

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Advanced Micro Devices Inc.

- 7.1.3 Nvidia Corporation

- 7.1.4 Imagination Technologies Group

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Arm Limted (soft Bank Group)

- 7.1.7 EVGA Corporation

- 7.1.8 SAPPHIRE Technology Limited

- 7.1.9 Qualcomm Technologies Inc.

8 VENDOR MARKET SHARE

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET