PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439792

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1439792

India Hair Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

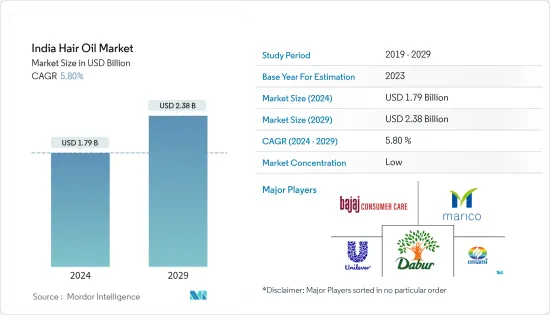

The India Hair Oil Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 2.38 billion by 2029, growing at a CAGR of 5.80% during the forecast period (2024-2029).

India has been a prominent market for hair oil over generations due to the practice of oiling the head regularly. With India taking a strong lead in hair oils due to its well-established hair-oiling rituals, numerous brands are offering differentiated products for different demographics of the country. The main categories of hair oil available in India are coconut hair oils, amla hair oils, light hair oils, and cooling hair oils. Among these, coconut oil is largely used across the country, especially in South India. The heat and humidity in the country are often associated with dry and greasy hair. Thereby changing climatic conditions are increasing the use of hair oil to prevent hair damage, positively impacting the market growth.

Hair gets dry and damaged due to pollution. Consumers are tremendously moving toward hair oils, as the massage of hair oils on the scalp can prevent dryness and increase hair volume. Hair oils are one of the best hair care products, and consumers prefer these products, which is driving the market. The rising demand for light hair oil among consumers also enables players to innovate new hair oil products and have consistency in innovation. Offering different hair oils to consumers is a significant factor in increasing the per capita spending in this market.

India Hair Oil Market Trends

Demand for Herbal Ingredients in Hair Oil

Consumers are shifting toward organic hair oil with the growing awareness about chemical products. Organic hair oil products are considered to provide nourishment and good results. Moreover, consumers prefer hair oil based on herbal ingredients because these oils are made up of natural elements and carry essential benefits. These hair oils are used to treat hair problems like thinning hair and dry or flaky scalp. Consumers use hair for moisturizing purposes and to promote hair growth. Some consumers also use these products to improve blood circulation in the scalp. For instance, aloe vera-based hair oil gives a better texture to the hair and helps to boost the hair density of the individual. Therefore, the rising demand for herbal ingredients in hair oil is promoting the hair oil market.

Hair Oil Massage Promotes Relaxation

The region has witnessed the growth of hair oil in recent years. This is because consumers prefer natural products over using complex chemicals on the body and hair. Hair oil is one of the purest and is available in natural form. Due to the changing lifestyle and busy schedules, consumers are leading a stressful lifestyle. They are using hair oils, as massage of these oils promotes a deeper relaxation of the mind and body.

Eventually, hair oil has a strong prevalence in the Indian market as applying oil to the hair has been a routine measure followed by several generations for ages. Hair oil massages provide consumers relief from their busy lifestyles and help in hair growth. The demand for hair oil is increasing and driving the market.

India Hair Oil Industry Overview

The market studied is highly competitive in nature due to the presence of numerous local and global level players in the country. Some major companies in the region are Unilever Company, Marico, Dabur, Emami, and Bajaj. Due to globalization, most companies are actively involved in product innovation and mergers and acquisitions, as leading global companies have a considerable share of the industry. The strategy behind mergers and acquisitions also enables these top players to sustain dominance over other regional players in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Coconut Oil

- 5.1.2 Almond Oil

- 5.1.3 Amla Oil

- 5.1.4 Castor Oil

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Marico Limited

- 6.3.2 Dabur India Ltd

- 6.3.3 Patanjali Ayurved Limited

- 6.3.4 Unilever PLC

- 6.3.5 Emami Group

- 6.3.6 Khadi Natural

- 6.3.7 Bajaj Consumer Care Ltd

- 6.3.8 Henkel AG & CO. KGAA

- 6.3.9 The Procter & Gamble Company

- 6.3.10 The Himalaya Wellness Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS