PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851759

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851759

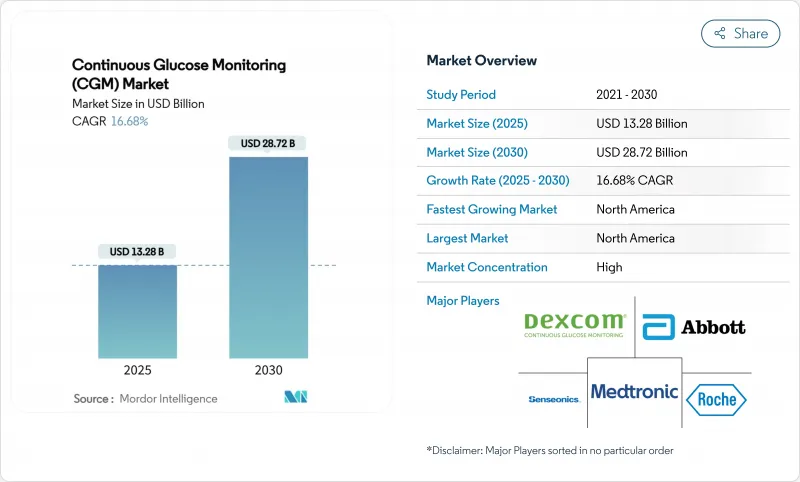

Continuous Glucose Monitoring (CGM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The continuous glucose monitoring market size stands at USD 13,275.19 million in 2025 and is set to reach USD 28,715.26 million by 2030, advancing at a 16.68% CAGR.

Robust growth stems from sensor miniaturization, supportive reimbursement, and the blending of consumer wellness with medical necessity. North America leads revenue generation, but Asia Pacific records the fastest uptake as smartphone penetration and diabetes prevalence converge. Ongoing device-software convergence creates recurring revenue streams that entice incumbents to bundle hardware with analytics subscriptions. Meanwhile, implantable and non-invasive prototypes foster expectations that the continuous glucose monitoring market will broaden into preventive and wellness-oriented use cases.

Global Continuous Glucose Monitoring (CGM) Market Trends and Insights

Rising Prevalence of Diabetes and Earlier Diagnosis

Accelerating incidence underpins structural demand because type 2 accounts for 96% of cases and is trending younger in Asia Pacific, where the median onset now falls below 45 years, creating decades-long monitoring horizons, IDF. Enhanced screening powered by artificial intelligence identifies at-risk cohorts earlier, prompting preventive sensor use. Medicare's 2024 policy opened access for type 2 patients with hypoglycemic episodes, instantly raising the insured base. Pediatric adoption, already growing at 18.41% CAGR, rides this wave as caregivers view continuous tracking as a safety net for school and sports environments.

Rapid Uptake of Remote Monitoring and Tele-Health Integration

Real-time data streams allow clinicians to manage more people without extra staff, and U.S. CPT-code reimbursements reward providers who deploy remote patient-monitoring kits. Rural patients in the United States and across Europe gain specialist oversight without long drives, improving adherence and glycemic control. Smartphone-native apps cut dedicated receiver costs, lifting barriers for younger, tech-savvy users.

High Device and Consumable Costs for Payers and Patients

Sensors that require replacement every 10-14 days cost USD 100-200 per month for U.S. Medicare beneficiaries after coinsurance, straining fixed incomes. In low- and middle-income countries, unsubsidized retail prices exceed average monthly wages. Although subscription models lower entry costs, they remain out of reach for many. Innovative pay-per-use or outcomes-based contracts could mitigate financial hurdles, yet broad implementation is still nascent.

Other drivers and restraints analyzed in the detailed report include:

- Sensor Miniaturization and Accuracy Breakthroughs

- Favorable Reimbursement Expansion in OECD & China

- GLP-1 Weight-Loss Drugs Reducing Glucose Testing Frequency

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors delivered 84.89% revenue in 2024, underpinning a 17.84% CAGR that reflects their role as the indispensable physiological touchpoint. Continuous material innovation increased wear life from 10 to 14 days on mainstream disposables, while implantable variants promise annual exchange intervals. Extended longevity directly lowers lifetime ownership costs, making the continuous glucose monitoring market size for sensors the primary engine of topline expansion. Transmitter hardware, by contrast, booked just a 6.19% CAGR as Bluetooth Low Energy modules and direct-to-phone architecture commoditize that layer. Platform vendors now bundle transmitter functions into sensor housings or smartphone apps, pressuring unit margins but captivating consumers through simplified setups.

Second-generation sensor chemistry leverages enzyme stabilization and polymer membranes to curtail drift, enabling more aggressive insulin dosing algorithms and automated insulin delivery integration. Implantable solutions from Glucotrack and Senseonics highlight a migration toward low-profile, maintenance-light devices that could open occupational and athletic niches previously underserved. As sensors evolve into semi-implantable assets, software analytics and cloud subscriptions accrue increasing wallet share, pivoting value creation away from hardware toward longitudinal data services.

The Continuous Glucose Monitoring (CGM) Market Report is Segmented by Component (Sensors, Transmitters, Receivers), End User (Hospitals/Clinics, Home/Personal), Demography (Adult, Paediatric), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 51.01% share in 2024, supported by entrenched insurance frameworks and high device literacy. The region is forecast to add USD 7.3 billion in incremental sales at an 18.24% CAGR to 2030. Medicare's April 2024 policy expanded eligibility to type 2 diabetics with documented hypoglycemia, unlocking a latent adult cohort and ensuring sustained unit growth. Canada's single-payer system aligns formularies nationally, smoothing provincial disparities, while Mexico's social-security reforms broaden device reimbursement in urban centers.

Asia Pacific, now at 18.18% share, records the steepest CAGR of 16.08%. China's National Reimbursement Drug List began piloting sensor inclusion in 2025, and domestic manufacturers are scaling to meet tier-2 city demand. India's high smartphone penetration, coupled with pay-as-you-go insurance apps, lowers household entry barriers. Japan and South Korea maintain high per-capita uptake because consumer-electronics majors embed glucose modules into multipurpose wearables, a trend likely to ripple across Southeast Asia.

Europe offers mid-single-digit growth underpinned by universal coverage and coordinated procurement. Germany champions CGM as the standard of care for type 1 patients, while the United Kingdom's NHS Long-Term Plan subsidizes hardware upgrades to factory-calibrated models. Eastern European markets emerge as white space; Czechia and Poland introduced pilot funding in 2025, leveraging EU structural funds to modernize diabetes care.

- Abbott Laboratories

- Medtronic

- Dexcom

- Senseonics

- Roche

- A. Menarini Diagnostics S.r.l.

- I-Sens

- Medtrum Technologies Inc.

- Nemaura Medical Inc.

- Zhejiang POCTech Co.,Ltd.

- MicroTech Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Diabetes and Earlier Diagnosis

- 4.2.2 Rapid Uptake of Remote Monitoring and Tele-Health Integration

- 4.2.3 Sensor Miniaturization and Accuracy Breakthroughs

- 4.2.4 Favorable Reimbursement Expansion in OECD & China

- 4.2.5 Consumer-Wellness Expansion Beyond Diagnosed Diabetes

- 4.2.6 Subscription Pricing Lowering LMIC Entry Barriers

- 4.3 Market Restraints

- 4.3.1 High Device and Consumable Costs for Payers And Patients

- 4.3.2 Calibration / Data-Overload Usability Concerns

- 4.3.3 GLP-1 Weight-Loss Drugs Reducing Glucose Testing Frequency

- 4.3.4 Cyber-Security and Data-Privacy Vulnerabilities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Disease-Prevalence Indicators

- 4.8.1 Type-1 Diabetes Population

- 4.8.2 Type-2 Diabetes Population

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Sensors

- 5.1.2 Transmitters

- 5.1.3 Receivers

- 5.2 By End User

- 5.2.1 Hospitals / Clinics

- 5.2.2 Home / Personal

- 5.3 By Demography

- 5.3.1 Adult

- 5.3.2 Paediatric

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 Japan

- 5.4.3.2 South Korea

- 5.4.3.3 China

- 5.4.3.4 India

- 5.4.3.5 Australia

- 5.4.3.6 Vietnam

- 5.4.3.7 Malaysia

- 5.4.3.8 Indonesia

- 5.4.3.9 Philippines

- 5.4.3.10 Thailand

- 5.4.3.11 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 Iran

- 5.4.4.3 Egypt

- 5.4.4.4 Oman

- 5.4.4.5 South Africa

- 5.4.4.6 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic plc

- 6.3.3 Dexcom Inc.

- 6.3.4 Senseonics Holdings Inc.

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 A. Menarini Diagnostics S.r.l.

- 6.3.7 i-SENS, Inc.

- 6.3.8 Medtrum Technologies Inc.

- 6.3.9 Nemaura Medical Inc.

- 6.3.10 Zhejiang POCTech Co.,Ltd.

- 6.3.11 MicroTech Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment