PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406060

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406060

Spain Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

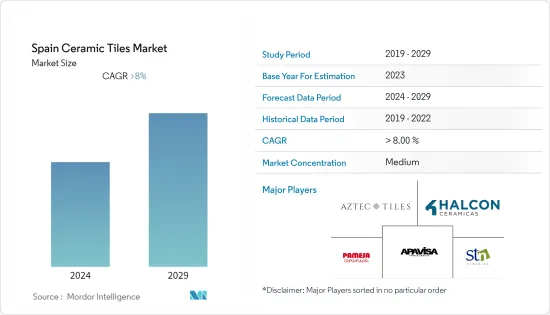

The market has generated a revenue of more than USD 10 million in the current year and is poised to achieve a CAGR of more than 8.0% during the forecast period.

The COVID-19 pandemic affected the construction and manufacturing industry across Europe. But it is seeing a steady recovery and now is showing pre-COVID recovery. Ceramic tiles are one of the largest segments in the flooring solutions industry.

The Spanish ceramic tiles market is expected to witness strong growth during the forecast period. Some of the major factors fueling this demand include increasing construction activity, rising demand for residential and commercial infrastructure, and increasing urbanization. Ceramic tiles are widely used in residential and commercial buildings, owing to their durability and crack-resistance nature. The protective coatings on ceramic tiles offer properties such as high-water resistance and stain protection. Spain is one of the top ceramic tile producers in Europe. The country also exports ceramic tiles to countries such as France, the United States, the United Kingdom, Saudi Arabia, Italy, and Israel. Product innovations, such as laser ablation technology that has emerged as a valid process for obtaining profiles or embossings on ceramic tiles, are increasing in the market.

Spain Ceramic Tiles Market Trends

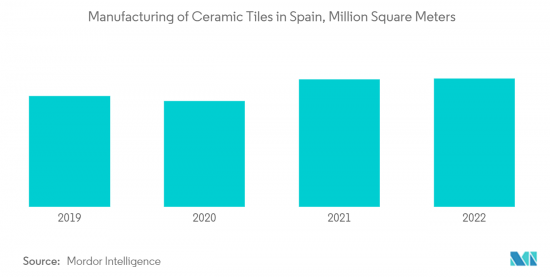

Increasing Production of Ceramic Tiles in Spain

Spain is one of the leading ceramic tiles producers in Europe. Nearly 90% of the Spanish ceramic tiles are produced in the Castellon cluster, which comprises nearly 81% of Spanish ceramic companies, with the majority of these being small and medium-sized enterprises (SMEs). In order to meet its domestic requirements and also due to the increasing global export requirements, the production of ceramic tiles in Spain is increasing significantly. Due to the intensifying competition and rising demand for ceramic tiles, the producers are focusing on new functional properties of ceramic tiles, such as decoration, mechanical features, health and hygiene, air cleaning, visual and smart signaling, heating, and energy-saving features.

Rising Exports of Spanish Ceramic Tiles

The Spanish ceramic tiles industry is one of the largest European exporters of tiles in volume and the second largest in the world. The country's tile industry's exports have grown significantly in the past few years, with the main export destinations being France, the United States, and the United Kingdom. Exports account for nearly 80% of the total industry revenue in Spain.

Spain Ceramic Tiles Industry Overview

The Spanish ceramic tiles market is fragmented. Spanish companies are also making significant investments in new technologies, with the dual aim of producing innovative materials and improving efficiency in the process and production cost management. Some of the key players in the market are Pamesa, STN Ceramica, Group Halcon, Aztec, and Alcor Tiles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Construction and Renovation Activities

- 4.2.2 Rising Export of Spanish Ceramic Tiles

- 4.3 Market Restraints

- 4.3.1 High Competitiveness in Players of Ceramic Tiles Market

- 4.3.2 Substitution by Other Products

- 4.4 Market Opprtunities

- 4.4.1 Rapidly Evolving Design Trends can be seen as Opportunity in the Market

- 4.4.2 Increase in Online Distribution

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on technology innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Applications

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Construction

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Pamesa

- 6.2.2 STN Ceramica

- 6.2.3 Group Halcon

- 6.2.4 Aztec

- 6.2.5 Apavisa Porcelanico

- 6.2.6 Ceramica Da Vinci SL

- 6.2.7 Ceramica Mayor SA

- 6.2.8 Ceramicas Vilar Albaro SL

- 6.2.9 Ceramicas Calaf SA

- 6.2.10 Ceramicas Belcaire SA (ROCA Group)

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US