PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910803

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910803

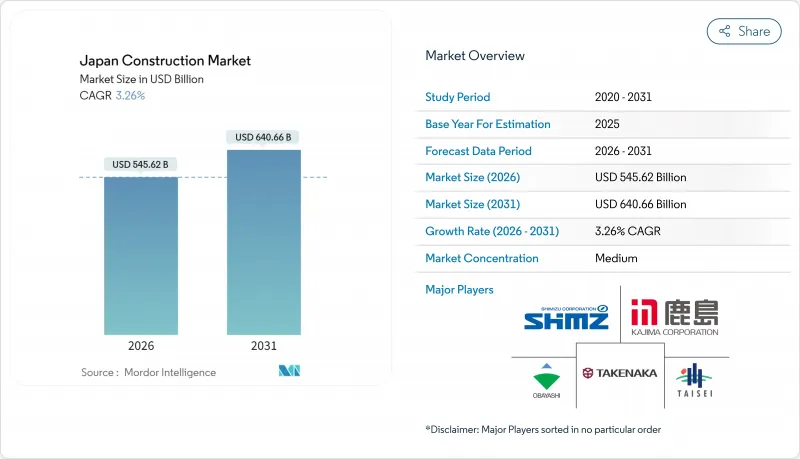

Japan Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Japan Construction market size in 2026 is estimated at USD 545.62 billion, growing from 2025 value of USD 528.4 billion with 2031 projections showing USD 640.66 billion, growing at 3.26% CAGR over 2026-2031.

The outlook reflects a stable demand base anchored in public-works spending, stringent seismic regulations, and sustained housing requirements in the Tokyo metropolitan area. Government commitment to long-range resilience, illustrated by the National Resilience Plan's JPY 20 trillion (USD 137.9 billion) allocation,n assures contractors of a predictable pipeline that spans water, sewage, and disaster-mitigation assets. Momentum is reinforced by a 10 GW offshore-wind target for 2030, a digital-twin procurement mandate due in 2026, and a fast-growing prefabrication ecosystem that alleviates labor constraints. Simultaneously, higher material costs arising from yen weakness and aging craft labor pools intensify the need for technology-enabled productivity gains.

Japan Construction Market Trends and Insights

Government Stimulus & Public-Works Spending

Japan's shift from reactive repairs to proactive infrastructure resilience provides a structural floor for the Japan construction market. The National Resilience Plan channels multi-year outlays into flood-control tunnels, bridge renewals, and quake-proof water pipelines, ensuring steady project flow across all prefectures. Contractors with expertise in advanced materials and seismic design benefit from specification-heavy tenders that favor specialized know-how. Smaller firms also gain entry points in niche applications such as pipe-lining and vibration-dampening devices. Overall, elevated public budgets cushion cyclical swings and support technology investments that lift sector productivity.

Seismic Retrofitting & Urban Redevelopment Wave

Compulsory bridge and building assessments have identified 92,000 structures requiring urgent reinforcement, stimulating a multiyear retrofitting wave. Unlike earlier quake repair cycles, projects now integrate energy efficiency, smart monitoring, and demographic adaptation elements, transforming single-purpose jobs into integrated urban renewal programs. Contractors must therefore pair structural engineering skills with sensor integration and data analytics capabilities. The emphasis on community-wide resilience fosters collaboration among builders, planners, and ICT providers, creating bundled service opportunities that expand revenue per project.

Skilled-Labor Shortage & Aging Workforce

More than one-third of craft workers are over 55, and retirements outpace new entrants, constraining project capacity. April 2024 overtime curbs further reduce available man-hours, compelling general contractors to deploy autonomous earth-moving fleets, remote-controlled cranes, and AI-driven scheduling. Leading firms have demonstrated multi-machine robotic control that keeps sites active during off-peak hours, preserving output with fewer tradespeople. Concurrently, digital training modules and exoskeletons extend veteran workers' careers, but labor scarcity remains the single biggest drag on the Japan construction market.

Other drivers and restraints analyzed in the detailed report include:

- Tokyo Metropolitan Housing Demand Pressure

- Renewable-Energy Project Pipeline (Offshore Wind, Solar)

- Imported Material Inflation & Weak Yen

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The residential arena captured the largest slice of Japan construction market share at 31.88% in 2025. Demand is concentrated in greater Tokyo, where vertical expansion and space-efficient floor plans sustain new-build activity. Prefabricated apartments shorten cycle times while meeting energy-code requirements slated for universal enforcement in 2025. In contrast, commercial construction rides e-commerce growth through logistics hubs, while infrastructure spending flows to rail capacity upgrades and coastal defenses.

The sector remains the fastest riser, charting a 4.38% CAGR. Modular high-rise systems, wood-based CLT towers, and integrated smart-home packages improve affordability and appeal to aging households seeking barrier-free environments. Commercial builders pivot toward flexible offices that combine retail and coworking zones, responding to hybrid work patterns. Infrastructure contractors integrate digital twins into bridges and tunnels, enabling predictive maintenance that lowers long-term ownership costs. Collectively, these shifts underpin a sustained expansion of the Japan construction market size for sector participants.

New construction dominated with 71.65% of Japan construction market size in 2025, yet renovation's 3.75% CAGR signals growing strategic weight. Adaptive reuse of office blocks into residential units trims carbon footprints and sidesteps land scarcity in dense cores. Municipal incentives for seismic upgrades unlock grants that make overhauls financially viable.

Renovation specialists excel in structural diagnostics, asbestos abatement, and integration of energy-conserving HVAC systems. Meanwhile, new-build projects advance through design-for-manufacture approaches that modularize pipelines, wall panels, and facade elements. The interplay between renovation and new construction diversifies revenue streams and cushions cyclical swings across the Japan construction market.

The Japan Construction Market Report is Segmented by Sector (Residential, Commercial, Infrastructure), by Construction Type (New Construction, Renovation), by Construction Method (Conventional On-Site, Modern Methods of Construction), by Investment Source (Public, Private), and by Geography (Hokkaido, Tohoku, Kanto, Chubu, Kansai, Rest of Japan). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Obayashi Corporation

- Kajima Corporation

- Shimizu Corporation

- Taisei Corporation

- Takenaka Corporation

- Sumitomo Mitsui Construction

- Maeda Corporation

- Penta-Ocean Construction

- Kumagai Gumi

- Hazama Ando Corporation

- Toda Corporation

- Daiwa House Industry

- Sekisui House

- Tokyu Construction

- Mori Building

- Zenitaka Corporation

- Nippon Concrete Industries

- Takada Corporation

- Mitsubishi Heavy Industries (Infrastructure & Plant)

- Toshiba Infrastructure Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government stimulus & public-works spending

- 4.2.2 Seismic retrofitting & urban redevelopment wave

- 4.2.3 Tokyo metropolitan housing demand pressure

- 4.2.4 Renewable-energy project pipeline (offshore wind, solar)

- 4.2.5 Wood-based high-rise subsidies (CLT, timber skyscrapers)

- 4.2.6 BIM & digital-twin procurement mandate (MLIT 2026)

- 4.3 Market Restraints

- 4.3.1 Skilled-labor shortage & aging workforce

- 4.3.2 Imported material inflation & weak yen

- 4.3.3 Carbon-footprint approval bottlenecks for cement-heavy builds

- 4.3.4 Zoning reforms favour renovation over new builds

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Industry Attractiveness - Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of the Japan with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 Hokkaido

- 5.5.2 Tohoku

- 5.5.3 Kanto (Tokyo)

- 5.5.4 Chubu (Nagoya)

- 5.5.5 Kansai (Osaka)

- 5.5.6 Rest Of Japan

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Obayashi Corporation

- 6.4.2 Kajima Corporation

- 6.4.3 Shimizu Corporation

- 6.4.4 Taisei Corporation

- 6.4.5 Takenaka Corporation

- 6.4.6 Sumitomo Mitsui Construction

- 6.4.7 Maeda Corporation

- 6.4.8 Penta-Ocean Construction

- 6.4.9 Kumagai Gumi

- 6.4.10 Hazama Ando Corporation

- 6.4.11 Toda Corporation

- 6.4.12 Daiwa House Industry

- 6.4.13 Sekisui House

- 6.4.14 Tokyu Construction

- 6.4.15 Mori Building

- 6.4.16 Zenitaka Corporation

- 6.4.17 Nippon Concrete Industries

- 6.4.18 Takada Corporation

- 6.4.19 Mitsubishi Heavy Industries (Infrastructure & Plant)

- 6.4.20 Toshiba Infrastructure Systems

7 Market Opportunities & Future Outlook