PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685681

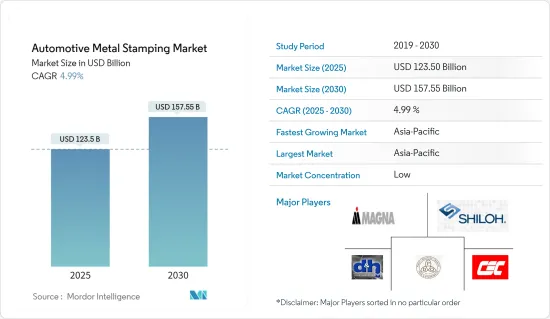

Automotive Metal Stamping - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Metal Stamping Market size is estimated at USD 123.50 billion in 2025, and is expected to reach USD 157.55 billion by 2030, at a CAGR of 4.99% during the forecast period (2025-2030).

Rising vehicle production and an increase in demand for passenger vehicle across the globe is likely to witness major growth in the automotive metal stamping market. However, with the growing trend toward engine downsizing in order to enhance fuel efficiency and lighter vehicles, lightweight metals such as aluminum are expected to witness huge demand among automotive metal stamping companies. This is likely to witness significant growth in the automotive metal stamping market.

Growing technology advancements such as laser metal stamping and hydraulic metal stamping, which help to reduce manufacturing cost, is likely to fuel the automotive metal stamping market. The rapid expansion of manufacturing industries is also fuelling the automotive metal stamping market across the globe.

Metals are widely used in the automotive industry. Key original equipment manufacturers have established manufacturing contracts with automotive stamping companies, which are an important source of business expansion for the latter. As a result, automotive production trends and policy frameworks aimed at automobile composition have a significant impact on the automotive metal stamping industry.

Automotive Metal Stamping Market Trends

Blanking Process Segment to Hold Significant Market Share -

The growing use of metal stamping in the automotive industry is witnessing major growth in the market. The blanking process can perform long production runs which require minor changes to the machinery or base material. Major automotive industries prefer the blanking process as the process commonly used to produce mass components. The rising demand for efficient vehicles has led to the design of innovative and unique outer body structures, with aerodynamic efficiency in consideration. Blanking metal stamping offers the technology to fabricate metal into smaller and more manageable pieces to be more tightly packaged in and around vehicles.

Several players are introducing business partnerships with the original equipment manufacturers which is witnessing major growth in the metal stamping market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

Advancements in laser technology, such as the usage of laser blanking technology supported sheet metal stamping machines, are positively affecting the market. The rise in automation in the blanking process in major automotive component manufacturing is a key factor for the blanking process. Owing to such factors is anticipated to boost the metal stamping market over the forecast period.

Asia-Pacific Region is Expected to Dominate the Target Market -

The Asia-Pacific region is expected to have a majority share in the automotive stamping market. Rising disposable income and an increase in global domestic product in the region are driving the market. Ease of manufacturing auto parts, vehicle sales, and growing government regulations improving electric vehicles adoption and robust expansion adopted by original equipment manufacturers and suppliers in the region to accommodate rising demand from the automotive industry across the Asia-Pacific region is expected to create a positive outlook for market growth during the forecast period.

China continues to be the world's largest automobile vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. Based on data from the China Association of Automobile Manufacturers, over 26.9 million vehicles were sold in 2022, an increase of 3.46% from 2021. India finished 2022 with annual sales of 3.8 million units, up more than 25% from 2021's 3.7 million units. The passenger vehicle industry in India experienced several record-breaking years in 2022.

Several manufacturers in the region are introducing different business strategies to cater to the metal stamping market offerings. For instance, In January 2023, Auto Expo 2023- Components, Gestamp announced its fourth hot stamping production line in India. This new addition joins the existing hot stamping lines in Pune, India. The company emphasizes that this move aligns with its strategy for India and worldwide. It aims to foster proximity to customers and collaborate on solutions near manufacturers.

Owing to these aforementioned factors, the sector is expected to grow at a reasonable rate, enhancing the demand in the automotive metal stamping market during the forecast period.

Automotive Metal Stamping Industry Overview

The automotive metal stamping market has the presence of several players, such as Clow Stamping Company., D&H Industries Inc., Shiloh Industries Inc., PDQ Tool & Stamping Co., Magna International Inc., and Integrity Manufacturing. Several companies are expanding their footprints with new innovative technologies so that they can have an edge over their competitors. However, the market is fragmented with several local players operating in the market. For instance,

- In February 2023, Fischer Group achieved a milestone in its partnership with TRUMPF by introducing the cutting-edge TruLaser 8000 Coil Edition blanking at its Achern headquarters. This innovative system autonomously processes up to 25 tons of coiled sheet metal, revolutionizing sheet metal production with enhanced material utilization and resource efficiency. Initially focused on aluminum blanking for Fischer's hot-forming products in the automotive industry, this technology marks a significant leap forward.

- In September 2022, General Motors Co. announced an investment of USD 491 million to boost the production of steel and aluminum stamped parts for future products, including electric vehicles, at its Marion metal stamping facility in Indiana, United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Automobile Production is Anticipated to Boosts the Market

- 4.2 Market Restraints

- 4.2.1 Fluctuating Raw Material Prices May Hinder the Market Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 Technology

- 5.1.1 Blanking

- 5.1.2 Embossing

- 5.1.3 Coining

- 5.1.4 Flanging

- 5.1.5 Bending

- 5.1.6 Other Technologies

- 5.2 Process

- 5.2.1 Roll Forming

- 5.2.2 Hot Stamping

- 5.2.3 Sheet Metal Forming

- 5.2.4 Metal Fabrication

- 5.2.5 Other Processes

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Clow Stamping Company

- 6.2.2 D&H Industries

- 6.2.3 Magna International Inc.

- 6.2.4 PDQ Tool & Stamping Co.

- 6.2.5 Alcoa Inc.

- 6.2.6 Shiloh Industries Inc.

- 6.2.7 Manor Tool & Manufacturing Company

- 6.2.8 Lindy Manufacturing

- 6.2.9 American Industrial Company

- 6.2.10 Tempco Manufacturing

- 6.2.11 Wisconsin Metal Parts Inc.

- 6.2.12 Goshen Stamping Co. Inc.

- 6.2.13 Interplex Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS