PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406123

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406123

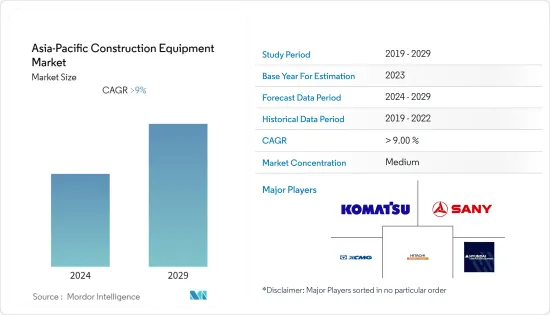

Asia-Pacific Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Asia-Pacific Construction Equipment Market was valued at USD 152.39 billion in 2024 and is expected to reach USD 239.86 billion by 2029, registering a CAGR of 9.50% during the forecast period (2024-2029).

The Asia-Pacific Construction Equipment Market registered a steep fall during Covid 19 pandemic in 2020 due to manufacturing shutdowns, lockdowns, and trade restrictions during the COVID-19 Furthermore, the slowing down of the construction sector and lack of labor significantly impacted the market. As construction and infrastructure companies have resumed operations due to steadily rising construction activities across major countries by the first half of 2021, the market regained its momentum.

Over the long term, increasing investments in production capacity by major industry players, massive government spending on infrastructure, electrification of the equipment, and growing urbanization as well as rising demand for construction equipment like excavators, backhoe loaders, and road machinery is creating demand in the automotive and transportation industry with a surge in sales of construction equipment.

Key players in the market are expanding their production capacity and launching new products to cater to the increased demand for construction equipment. For instance,In August 2022 Sany Heavy Industry started operations at their first manufacturing facility in Indonesia with the rollout of locally produced SY315CKD excavator. The factory is built in 100000 square meter area with an investment of USD 30 million.In May 2022, JCB launched 19C-1E India's first fully electric excavator at Excon 2022.

China expected to stand as the largest market followed by India, South Korea, and Japan over the forecast period due to the presence of large construction equipmnet OEMs, huge infratsructure spaending by the government , growing urbanisation and many global companies have joint ventures with the local players to manufacture construction equipment in China.

APAC Construction Equipment Market Trends

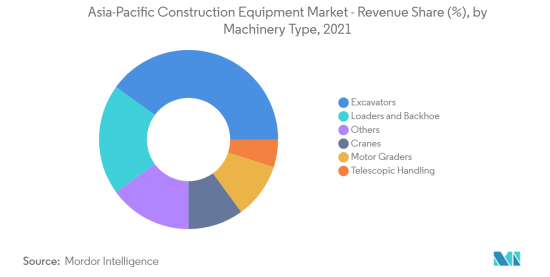

Growing Demand for Excavators to Drive Demand in the Market

Excavators are predicted to dominate the Asia Pacific Construction Equipment Market during the forecast period due to the ongoing infrastructure megaprojects. Excavators are the most widely used equipment for excavation work because the excavation of the land is the first step when any construction project is commenced. Excavators are available in capacities from 5 to 40 tons and use crawlers as well as wheels for their mobility thus making them one of the most versatile construction equipment.

Excavators are also widely used in major construction projects like Belt and Road Initiative (BRI), Asian Highway Network (AHN), Kunming-Singapore Railway, Sagarmala, and Bharatmala in the region. Excavators are also the best-selling type of construction equipment in major markets like China, Japan, South Korea, and Indonesia. For instance, In 2021, 274357 excavators were sold in China. This is a Year on Year increase of 4.6%. According to China Construction Machinery Association, there are about 25 excavator manufacturers in the country, more than any other country in the world.

In some markets like India backhoe loaders dominate the construction equipment market . However excavators have become the fastest selling type of constrcution equipment due to undertaking of large scale of infrastructure projects in the country. For instance, In 2021 about 34000 excavators were sold in India posting a Year on Year increase of 54.5%. Based on all the above factors excavators are forecasted to be the most dominant segment by the machinery type during the forecast period.

China to Play Key Role in Development of Asia-Pacific Construction Equipment Market

China is likely to emerge as the largest market followed by India, Indonesia, Japan, and South Korea. Ongoing mega projects in China need a lot of machinery and materials to be displaced from one part of the country to the other. Projects like the Zhongwei Ji'an Natural Gas Pipeline project, Liuzhou-Wuzhou Railway Line, Belt, and Road Initiative, and Zhengshen Foshan Expressway are some of the many projects that will require the deployment of many construction equipments. China announced investments of USD 1.1 trillion in infrastructure projects in 2021. Chinese construction equipment sales reached around USD 58 billion and accounted for 20% of the global construction equipment market in 2021.

India and Indonesia are also witnessing a rapid rise in construction equipment sales. In India, construction equipment sales are rising due to the large-scale undertaking of construction road projects and logistical corridors while in Indonesia construction equipment sales are driven by the construction of manufacturing zones and growth in the mining industry. Thus, with companies coming up with new launches to increase their market share in this segment, the market for construction equipment is expected to grow over the forecast period for the excavator market. For instance,

- In May 2022, Komatsu India launched three new B-20 biodiesel compatible excavators (Komatsu PC205-10MO Hydraulic Excavator, Komatsu PC500LC-10R Hydraulic Excavator,and Komatsu PC210LC-10M0 Super Long Front) in India during Excon 2022.

- In July 2022, Volvo CE launched EC550E excavator in India. The excavator is specifically designed for heavy duty digging and mass excavation.

Therefore, the aforementioned factors and instances anticipated to contribute for growth of countries like China, India, etc. over the forecasted period.

APAC Construction Equipment Industry Overview

The Asia Pacific Construction Equipment market is moderately consolidated. The market is characterized by the presence of considerably global players as well as some local players who have secured long-term supply contracts with major infrastructure companies. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

Some of the major players dominating the global market are Komatsu Corp., Sany Heavy Industry, XCMG, Hitachi Construction Machinery Ltd., and Hyundai Construction Equipment Ltd. . Key players are engaging in mergers and acquisitions as well as launching new products to secure their market position and stay ahead of the market curve. For instance,

- In May 2022 Caterpillar Inc. launched 303 CR mini excavators and 120 GC Motor Grader in India. These two products were displayed at the Confederation of Indian Industry (CII) EXCON 2022 in Bengaluru, along with Caterpillar's existing range of products, including excavators, motors, wheels, backhoes, and skid steer loaders.

- In January 2022 Hitachi Ltd. announced the selling of a 50% stake in Hitachi Construction Machinery Ltd. to a joint venture between Itochu Corporation and investment fund Japan Industrial Partners Inc. for JPY 182.4 billion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size Value in USD billion)

- 5.1 Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handling

- 5.1.3 Excavator

- 5.1.4 Loaders And Backhoe

- 5.1.5 Motor Grader

- 5.1.6 Others

- 5.2 Drive Type

- 5.2.1 IC Engine

- 5.2.2 Electric And Hybrid

- 5.3 By Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 XCMG Group

- 6.2.2 Sany Group

- 6.2.3 Lingong Machinery Group

- 6.2.4 Hitachi Construction Equipments Co. Ltd

- 6.2.5 Komatsu Limited

- 6.2.6 Kobelco Construction Machinery

- 6.2.7 Hyundai Heavy Industries

- 6.2.8 Doosan Group

- 6.2.9 Zoomlion Heavy Industry Science And Technology Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS