Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640675

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640675

North America Waste to Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

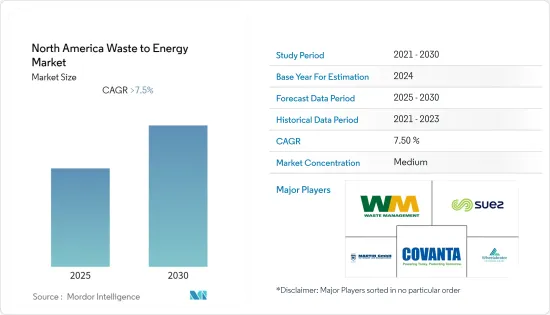

The North America Waste to Energy Market is expected to register a CAGR of greater than 7.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the increasing amount of waste generation, growing concern for waste management to meet the need for sustainable urban living, and increasing focus on non-fossil fuel sources of energy are driving the demand for the region's waste-to-energy market.

- On the other note, the countries still need more suitable policies and regulations concerning WTE, and factors such as high capital investment and increasing the recycling rate of waste have been restraining the growth in the WTE market.

- Nevertheless, technological advancements in the waste-to-energy sector are expected to create significant opportunities for plant operators in the near future.

- The United States is expected to dominate the market during the forecast period, with the growing demand for renewable-based electricity generation.

North America Waste to Energy Market Trends

Thermal Based Waste to Energy Conversion to Dominate the Market

- Thermal technology is expected to account for the highest market share in the global waste-to-energy market during the forecast period, owing to the increasing development of waste incineration facilities worldwide.

- It is estimated that plants, which utilize cogeneration of thermal power (heating and cooling), together with electricity generation, can reach optimum efficiencies of 80%.

- In the present scenario, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing. However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks. In order to reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in environmental sustainability.

- In 2021, nearly 431 trillion British thermal units of energy derived from waste were consumed in the United States. In order to reduce particulate and gas-phase emissions, the owners of incineration plants have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in terms of environmental sustainability.

- In May 2022, New Jersey-based waste management company Covanta Holding Corporation announced that it is making enough electricity to power 18,000 homes from the waste collected from American Airlines, Quest Diagnostics, Sunny Delight, and Subaru through thermal-based technology.

- Hence, owing to the above points and the recent developments, thermal-based waste-to-energy is expected to dominate the United States waste-to-energy market during the forecast period.

The United States to Dominate the Market

- The waste-to-energy market in the United States has been growing recently due to the increase in population and growing waste across the country. Solid waste is usually burned at special waste-to-energy plants that use the heat from the fire to make steam for generating electricity or to heat buildings.

- In 2021, 64 US power plants generated about 13.6 billion kilowatt-hours of electricity from burning about 28 million tonnes of combustible MSW for electricity generation. Biomass materials accounted for about 61% of the weight of the combustible MSW and about 45% of the electricity generated.

- In 2021, the US industrial sector consumed about 160 trillion British thermal units of energy derived from waste. The Americans discarded 51 million ton of wrappers, bottles, bags, and about 309 lb of plastic per person. Almost 95% ended up in landfills and oceans or scattered in the atmosphere in tiny toxic particles.

- The new government policies are aimed at restricting high carbon emissions. This factor is hindering the growth of the incineration process. In addition, the increase in municipal solid waste recycling to 60% by 2035 is expected to affect the incineration market.

- Also, in June 2022, Florida Gov. Ron DeSantis signed a law to establish a financial assistance program for power purchase agreements at municipally-owned solid waste combustion facilities and grants to incentivize capacity expansion potentially.

- Owing to the above points, the United States is expected to dominate the North American waste-to-energy market during the forecast period.

North America Waste to Energy Industry Overview

The North American waste to energy market is moderately fragmented. Some of the key players (in no particular order) include Covanta Holding Corp, Waste Management Inc., Suez SA, Martin GmbH, and Wheelabrator Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56748

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Physical Technology

- 5.1.2 Thermal Technology

- 5.1.3 Biological Technology

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Covanta Holding Corp

- 6.3.2 Waste Management Inc.

- 6.3.3 Suez SA

- 6.3.4 Martin GmbH

- 6.3.5 Wheelabrator Technologies Inc.

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Veolia Environnement SA

- 6.3.8 Babcock & Wilcox Volund AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.