PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687329

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687329

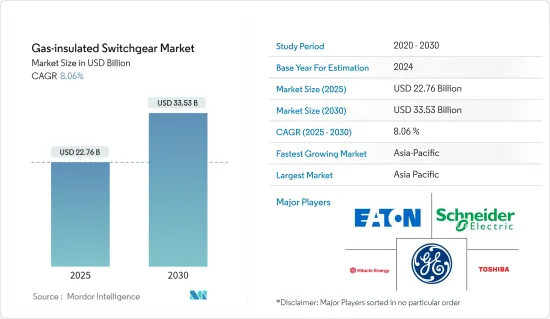

Gas-insulated Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Gas-insulated Switchgear Market size is estimated at USD 22.76 billion in 2025, and is expected to reach USD 33.53 billion by 2030, at a CAGR of 8.06% during the forecast period (2025-2030).

The outbreak of the COVID-19 led to a series of lockdowns leading to the global economic slowdown, which, in turn, led to a slowdown in industrial and commercial activities due to less discretionary spending, hampering the gas-insulated switchgear(GIS) market. In terms of the growth of the market, factors such as the transformation of the power industry in terms of upgrading transmission and distribution networks, rising adoption of renewable energy-based power plants, etc., are expected to drive the market during the forecast period. However, high equipment cost when compared to air-insulated switchgear, along with stringent environmental and safety regulations related to GIS, is likely to restrain the market growth during the forecast period.

Key Highlights

- The high voltage level segment due to most applications being in utility sectors, is anticipated to dominate the market during forecast period.

- Growing investments in smart grids and energy systems and the extension or replacement of old switchgear at substations in developed regions are expected to create ample opportunities in the GIS market soon.

- Asia-Pacific is expected to dominate the market, with the majority of the demand coming from the countries such as India and China.

Gas Insulated Switchgear Market Trends

High Voltage Level Segment Expected to Dominate the Market

- The power system that deals with voltage above 36kV is referred as high voltage switchgear. As the voltage level is high the arcing produced during switching operation is also very high. So, special care is to be taken during the designing of high voltage switchgear. High voltage circuit breaker, is the main component of HV switchgear, hence high voltage circuit breaker (CB) should have special features for safe and reliable operation.

- These switchgear have multiple usages across varied industries such as wind turbines, electrical motors, generators, solar power generation, residential power distribution, power supply systems, environmentally sensitive installation, underground stations, steel, paper, and mining industry, and growing number of marine applications. But the main application of the segment comes from large transmission and distribution networks being modernized and being built across the globe with especially high rates countries in the Asia-Pacific region.

- However, the segment has been plagued with downtime and maintenance issues. For this companies such as ACTOM High Voltage (HVE), in May 2022, in conjunction with its technology partners are developing asset performance management solutions to help customers with condition-based maintenance strategies. Such endeavors in the industry are expected to aid the growth of the market by providing a more feasible alternative to the market especially when compared to its peers.

- Also, the growing HVDC market is expected to aid the growth of the market with large projects, in December 2021, in the United Arab Emirates, such as the anticipated direct current subsea transmission system, which is expected to power Abu Dhabi National Oil Company's offshore production operations with cleaner and more efficient energy, delivered through the Abu Dhabi onshore power grid, owned and operated by the country's transmission and distribution companies.

- Further, in a major development in 2021, Siemens Energy and Mitsubishi Electric signed a Memorandum of Understanding to conduct a feasibility study on the joint development of high-voltage switching solutions with the prospect of zero global-warming potential (GWP). The study is expected to work on the substitution of greenhouse gases with clean air for insulation. Both companies are expected to research methods for scaling up the application of clean-air insulation technology to higher voltages. However, both partners are expected to continue to manufacture, sell, and service switchgear solutions independently and only the transfer of technology is expected to take.

- Hence, high-voltage switchgear are expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is one of the most populated regions, and due to rapid growth in industrialization and urbanization, power demand surged substantially over the past few years. Thus, investments in transmission and distribution (T&D) infrastructure also grew significantly. Additionally, long-distance T&D projects become more eco-friendly by developing underground networks and smaller substations, for which gas-insulated switch gears are increasingly suitable.

- The region is also the fastest-growing market in renewable energy deployment, led by China and India. With the rapid rise in renewable power generation, grid stability is a significant issue in countries with high levels of renewable integration in their grids, which also needs the modernization of older T&D infrastructure. As renewable power generated from sources, such as solar and wind, provide variable power output, traditional T&D systems may not be suitable for renewable energy transmission and distribution and would require upgradation or retrofitting.

- Additionally, most utility-scale renewable energy generation facilities, such as solar and wind farms, are situated far from population centers. Hence, they need to be connected to demand centers via large-scale transmission projects to use the power generated. Such projects are expected to create a massive demand for gas-insulated switchgear (GIS) over the forecast period.

- According to China's largest state-owned utility corporation, State Grid Corporation of China (SGCC), the country's energy demand in 2030, is expected to exceed 10 Petawatt hours (PWH). As a result, there is a need for the expansion of the existing power transmission network, which is expected to drive the demand for gas-insulated high voltage switchgear in the country.

- In January 2022, the Indian government, the West Bengal government along with the World Bank signed a project worth USD 135 million to improve the efficiency and reliability of electricity supply in selected areas of West Bengal. This project will see the adoption of GIS along with other equipment in the modernization of the electricity grid.

- As the demand for power increases, a majority of the emerging countries are unable to fulfill the domestic electricity demand. Therefore, new power plants are being built in this region.

- The region is also seeing rapid adoption of renewable energy-based power generation, which requires a transmission and distribution network of its own and revamping of existing grid infrastructure to integrate such power plants, which, in turn, is driving the demand for gas-insulated switchgear.

- Therefore, the trend is expected to continue during the forecast period as well, which, in turn, is expected to drive the gas-insulated switchgear market in the region.

Gas Insulated Switchgear Industry Overview

The gas-insulated switchgear market is moderately fragmented. Some of the key companies in the market include Hitachi Energy Ltd, Schneider Electric SE, General Electric Company, Eaton Corporation PLC, and Toshiba Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voltage Level

- 5.1.1 Low Voltage

- 5.1.2 Medium Voltage

- 5.1.3 High Voltage

- 5.2 End User

- 5.2.1 Power Utilities

- 5.2.2 Industrial Sector

- 5.2.3 Commercial and Residential

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Hitachi Energy Ltd

- 6.3.2 Schneider Electric SE

- 6.3.3 General Electric Company

- 6.3.4 Powell Industries Inc.

- 6.3.5 Eaton Corporation PLC

- 6.3.6 Toshiba Corp.

- 6.3.7 Mitsubishi Electric Corporation

- 6.3.8 Siemens Energy AG

- 6.3.9 Hyosung Heavy Industries Corp.

- 6.3.10 Bharat Heavy Electricals Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS