PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906950

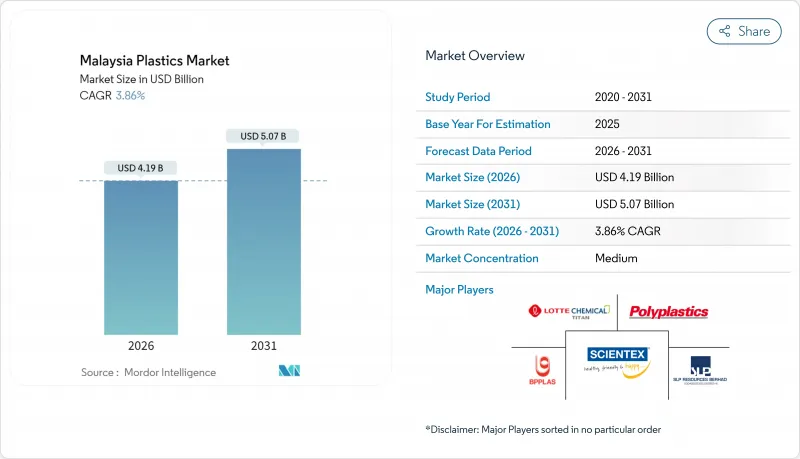

Malaysia Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia Plastics Market size in 2026 is estimated at USD 4.19 billion, growing from 2025 value of USD 4.04 billion with 2031 projections showing USD 5.07 billion, growing at 3.86% CAGR over 2026-2031.

This steady expansion is anchored by Malaysia's dual role as a regional petrochemical feedstock hub and a downstream manufacturing base that supplies the electronics, automotive, and packaging value chains across Southeast Asia. Stable feedstock from PETRONAS's integrated complexes, export-oriented manufacturing clusters in Selangor, Johor, and Penang, and policy-driven incentives for downstream petro-chemicals together reinforce supply security and cost competitiveness. Momentum is further supported by global brands demanding recycled or bio-based content, Malaysia's zero single-use plastics roadmap, and investments in automated processing that counter skills shortages. Meanwhile, environmental regulation and feedstock price volatility continue to temper margins but also catalyze upgrades into higher-value applications where specialty grades and precision molding command premium pricing.

Malaysia Plastics Market Trends and Insights

Rising Demand From Food and Beverage Packaging

Food and beverage manufacturers rely on plastic barrier films and multilayer structures to meet higher food-safety standards in export markets. PETRONAS's decision to embed a biorefinery inside the Pengerang Integrated Complex signals an upcoming local supply of bio-based packaging resins. Halal certification rules, prevalent in Malaysia's export food trade, necessitate specialized packaging that maintains product integrity during long transit times. Rising urban income levels and a preference for ready-to-eat formats amplify the consumption of convenience packaging. As a result, converters supplying stand-up pouches, retort pouches, and PET beverage bottles are securing premium margins tied to performance and sustainability credentials.

Growth of Electronics Manufacturing Ecosystem

Malaysia's National Semiconductor Strategy has attracted fresh investments from global players such as Infineon to expand back-end packaging, testing, and IC design activities. Semiconductor modules for 5G infrastructure and electric vehicles increasingly specify engineering plastics with high thermal stability and flame-retardant performance. Injection molding lines capable of micron-level tolerances are therefore proliferating within Penang's Bayan Lepas and Kulim High-Tech parks. Automated vision inspection and closed-loop molding systems allow manufacturers to meet tight defect-rate requirements while offsetting the local skills gap in precision polymer processing.

Environmental Concerns and Single-Use Bans

Malaysia's 2025-2030 zero single-use plastics roadmap imposes phased restrictions on disposable bags, straws, and EPS foodware. Import controls on plastic scrap, tightened in July 2025, have removed low-cost feedstock streams but improved public perception of domestic waste handling. Converters that cannot pivot to recyclable or compostable formats face higher excise levies and tighter enforcement in Greater Kuala Lumpur, Johor Bahru, and George Town. Conversely, firms with compostable film lines and reusable food-service models are capturing the shift toward regulatory-compliant alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Downstream Petro-Chemicals

- Circular-Economy Commitments by Global Brands

- Feedstock Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional polymers such as polyethylene and polypropylene retained 78.84% Malaysia plastics market share in 2025, buoyed by Pengerang's integrated cracker and polymer lines that anchor low-cost output. Bioplastics, however, are forecast to grow fastest at a 4.86% CAGR, aided by brand targets for compostable packaging and the country's single-use ban trajectory. Engineering resins addressing electrical insulation and under-hood automotive parts achieved mid-single-digit growth, supported by imported semifinished compounds rewired for localized finishing.

Producers associated with the Malaysia plastics market leverage existing cracker-to-film logistics to supply high-volume FMCG applications, yet face mounting EPR levies that narrow margins. The upcoming biorefinery within Johor's complex will enable drop-in replacements for fossil-based PET and PE, positioning local converters to claim advanced recycling credit in export tenders. Specialty compounders catering to the Malaysia plastics industry gain premium prices by offering flame-retardant, glass-fiber, and halogen-free grades, particularly for smart-device connectors. A widening skills gap in materials science underscores the value of technical service teams able to qualify new bio-based grades for food-contact and electronic-component certification.

The Malaysia Plastics Market Report is Segmented by Type (Traditional Plastics, Engineering Plastics, and Bioplastics), Technology (Blow Molding, Extrusion, Injection Molding, and Other Technologies), and Application (Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Houseware, Furniture and Bedding, and Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Behn Meyer

- BP Plastics Holding Bhd

- Commercial Plastic Industries Sdn Bhd

- CYL Corporation

- Ee-Lian Enterprise (M) Sdn. Bhd.

- Fu Fong Plastic Industries Sdn Bhd

- Guppy Group

- HICOM-Teck See

- Lam Seng Plastics Industries Sdn Bhd

- LOTTE CHEMICAL TITAN HOLDING BERHAD.

- Malayan Electro-Chemical Industry Co. Sdn Bhd

- Meditop International

- Megafoam Containers Enterprise Sdn Bhd (MEGAFOAM)

- Metro Plastic Manufacturer Sdn. Bhd.

- Polyplastics Co., Ltd.

- Sanko Plastics (M) Sdn Bhd

- Scientex Berhad

- SLP RESOURCES BERHAD

- Teck See Plastic Sdn Bhd (TSP)

- TORAY INDUSTRIES, INC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from food and beverage packaging

- 4.2.2 Growth of electronics manufacturing ecosystem

- 4.2.3 Government incentives for downstream petro-chemicals

- 4.2.4 Circular-economy commitments by global brands

- 4.2.5 Expansion of medical-device clusters

- 4.3 Market Restraints

- 4.3.1 Environmental concerns and single-use bans

- 4.3.2 Feed-stock price volatility

- 4.3.3 Skills gap in advanced polymer processing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Trend Analysis

- 4.7 Imports and Exports

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 By Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Houseware

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Behn Meyer

- 6.4.2 BP Plastics Holding Bhd

- 6.4.3 Commercial Plastic Industries Sdn Bhd

- 6.4.4 CYL Corporation

- 6.4.5 Ee-Lian Enterprise (M) Sdn. Bhd.

- 6.4.6 Fu Fong Plastic Industries Sdn Bhd

- 6.4.7 Guppy Group

- 6.4.8 HICOM-Teck See

- 6.4.9 Lam Seng Plastics Industries Sdn Bhd

- 6.4.10 LOTTE CHEMICAL TITAN HOLDING BERHAD.

- 6.4.11 Malayan Electro-Chemical Industry Co. Sdn Bhd

- 6.4.12 Meditop International

- 6.4.13 Megafoam Containers Enterprise Sdn Bhd (MEGAFOAM)

- 6.4.14 Metro Plastic Manufacturer Sdn. Bhd.

- 6.4.15 Polyplastics Co., Ltd.

- 6.4.16 Sanko Plastics (M) Sdn Bhd

- 6.4.17 Scientex Berhad

- 6.4.18 SLP RESOURCES BERHAD

- 6.4.19 Teck See Plastic Sdn Bhd (TSP)

- 6.4.20 TORAY INDUSTRIES, INC.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment