PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690088

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690088

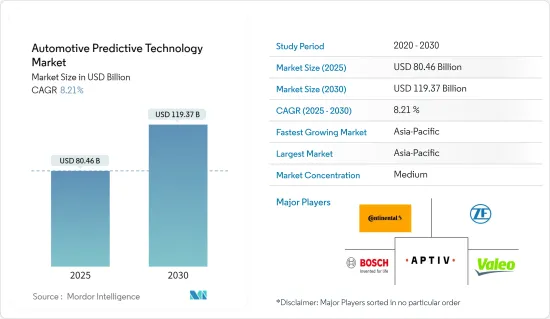

Automotive Predictive Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Predictive Technology Market size is estimated at USD 80.46 billion in 2025, and is expected to reach USD 119.37 billion by 2030, at a CAGR of 8.21% during the forecast period (2025-2030).

COVID-19's outbreak dealt a blow to the automotive predictive technology market. Temporary shutdowns of vehicle and component manufacturing facilities worldwide led to significant supply chain disruptions. Yet, the automotive industry has shown signs of recovery and is poised to continue this trend during the forecast period.

The market is being propelled by a rising demand for advanced technological features in vehicles. Innovations like artificial intelligence and machine learning are enhancing safety measures, notably through advanced driver-assistance systems (ADAS). Additionally, there's a focus on predictive maintenance, aiming to reduce vehicle downtime and boost performance in a cost-effective manner.

Predictive features play a crucial role in autonomous vehicles and self-driving technologies, alerting drivers to obstacles and other driving cues. Major OEMs are pouring investments into the development of autonomous vehicles, signaling promising opportunities for market players.

Asia-Pacific is set to lead the automotive predictive technology market, driven by a surging demand for luxury vehicles in India, China, and Japan. Furthermore, the rising adoption of ADAS in the region is anticipated to amplify the demand for predictive technologies in the coming years.

Automotive Predictive Technology Market Trends

ADAS Segment Likley to Dominate the Market During the Forecast Period

In recent years, the automobile industry has ramped up its R&D efforts to bolster Advanced Driver-Assistance Systems (ADAS). This intensified focus has not only refined ADAS technologies but also ignited a heightened demand for systems like night-time pedestrian detection, lane departure warnings, and an array of sensors including cameras and RADAR. These technologies are swiftly being embedded into vehicles, with automotive players actively pushing these advanced features to stimulate market demand.

Leading the charge, OEMs like Audi, BMW, Daimler, and Volvo have begun integrating night-time pedestrian detection systems into their offerings. These systems serve a dual purpose: they either alert the driver or autonomously engage the brakes when a pedestrian is detected within the vehicle's speed threshold. Such innovations underscore the evolving safety standards becoming commonplace in today's vehicles.

In a bid to capture a larger slice of the market, numerous major service providers are pouring substantial investments into R&D for cutting-edge ADAS technologies. This landscape isn't solely dominated by industry giants; a plethora of startups, often buoyed by funding from these major entities, are injecting fresh ideas and technologies. This synergy between established players and emerging startups is catalyzing swift progress in ADAS technology.

Given the relentless advancements and investments, the ADAS segment is poised to spearhead the predictive technology market within the automotive realm. With a concerted emphasis on bolstering safety, amplifying driving comfort, and adhering to rigorous regulatory standards, the adoption of ADAS is surging, solidifying its position as a market leader in the coming years.

Asia-Pacific Expected to Hold Significant Market Share

During the forecast period, the Asia-Pacific region is poised to emerge as the fastest-growing market. The surge in demand can be attributed primarily to the hybridization and electrification of vehicles, coupled with a rising production of electric vehicles. Nations such as India, China, and Japan are gradually embracing predictive technology in passenger cars. However, the adoption has been tempered by the higher price segment of these tech-equipped vehicles and challenges like inadequate infrastructure and regulatory hurdles.

In the Asia-Pacific, automobile manufacturers are not just adopting predictive technology but are also rolling out new products featuring it. For instance,

- In January 2024, Yuchai Group unveiled the Guangxi Low-carbon and Intelligent Powertrain Laboratory. The lab, spotlighting predictive control technology and the integration of big data, aims to refine powertrain systems. Its focus spans intelligent powertrains, new energy systems, and high-efficiency internal combustion engines. Moreover, it explores powertrains harnessing low- and zero-carbon fuels like methanol, hydrogen, and ammonia. The lab's predictive control technology is designed to enhance performance and curtail emissions, championing the cause of sustainable and intelligent automotive solutions.

- In May 2023, Bengaluru's Continental Technology Centre India made notable advancements in crafting ADAS solutions tailored for Indian roads. Their innovative modular ADAS can be effortlessly adapted across diverse vehicle platforms, ensuring broad compatibility.

These developments signal a burgeoning opportunity for predictive technology in the Asia-Pacific, with demand set to escalate in the coming years.

Automotive Predictive Technology Industry Overview

The automotive predictive technology market is witnessing a blend of established giants and emerging players, all competing for a slice of the market share. Key players making waves in this arena include Continental AG, ZF Friedrichshafen AG, Robert Bosch, Aptiv PLC, and Valeo SA.

Recent trends underscore a pronounced shift towards embedding advanced predictive and AI technologies in vehicles. This move not only aims to bolster safety and efficiency but also underscores the industry's unwavering commitment to innovation and an enriched user experience. By forging partnerships and tapping into each other's technological prowess, these companies are carving out a leading position in the automotive innovation landscape. For Instance,

- In January 2024, at CES 2024, HERE Technologies, in collaboration with Bosch and Daimler Truck AG, unveiled an advanced driver-assistance system (ADAS) tailored for commercial vehicles. This system marries HERE's ADAS Map with Bosch's Electronic Horizon software, seamlessly integrating into Daimler Truck's Predictive Powertrain Control (PPC). The results in enhanced driver comfort and optimized fuel and battery efficiency, all thanks to real-time considerations of road intricacies, traffic signs, and speed regulations.

- In January 2024, also at CES 2024, Infineon and Aurora Labs rolled out cutting-edge AI-driven automotive maintenance solutions. Harnessing Aurora Labs' Line-of-Code Intelligence (LOCI) AI on Infineon's TriCore AURIX TC4x microcontrollers, these solutions aim to bolster the reliability and safety of pivotal automotive components like steering and braking, thereby elevating overall vehicle performance and safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Connected Cars

- 4.1.2 Advancements In Data Analytics And Machine Learning

- 4.2 Market Restraints

- 4.2.1 High Implementation And Maintenance Costs

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 End-User

- 5.2.1 Fleet Owners

- 5.2.2 Insurers

- 5.2.3 Other End-Users

- 5.3 By Component

- 5.3.1 Software

- 5.3.2 Hardware

- 5.3.2.1 ADAS

- 5.3.2.2 On-board Diagnosis

- 5.3.2.3 Other Hardware Types

- 5.4 By Application

- 5.4.1 Safety & Security

- 5.4.2 Vehicle Maintenance

- 5.4.3 Predictive Smart Parking

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Aptiv PLC

- 6.2.3 Garrett Motion Inc.

- 6.2.4 Harman International Industries Incorporated

- 6.2.5 Visteon Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Valeo SA

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Verizon

- 6.2.10 Infineon Technologies AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration With Advanced Driver Assistance Systems (ADAS)