PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435838

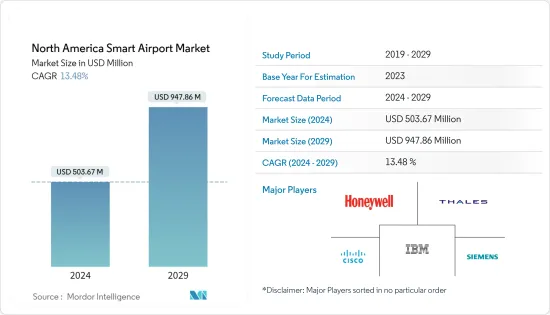

North America Smart Airport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Smart Airport Market size is estimated at USD 503.67 million in 2024, and is expected to reach USD 947.86 million by 2029, growing at a CAGR of 13.48% during the forecast period (2024-2029).

The COVID-19 pandemic has severely impacted the global aviation industry. The adverse impacts of the pandemic resulted in huge supply-demand issues and delayed activities of smart airport operations globally. The airlines faced unmatched challenges due to travel restrictions and a reduced number of air passengers which resulted in a decline in revenues. The market showcased a strong recovery post-COVID due to increased investment in the digitalization of airports.

The smart airport concept became the future of airport operations, and it can completely change the aviation sector toward adapting to modern technologies. The number of people opting for air travel has increased in the past few years which has resulted in increased pressure on airports and airlines to opt for advanced systems that can enhance their ground operations and support their motive to reduce aircraft turnaround time. Smart airport systems also provide numerous advantages such as they reduce physical human work, speeding up airport operations, and minimizes the environment's negative impact.

Increasing automation of the system is expected to revolutionize the entire process flow architecture in airports. Airports are using technologies such as artificial intelligence (AI) and predictive analysis for a wide range of applications, from customer service to operational efficiency.

North America Smart Airport Market Trends

Air and Ground Traffic Control Segment is Estimated to Show Remarkable Growth During the Forecast Period

- The air and ground traffic control segment will showcase significant growth during the forecast period. The growth is attributed to the increasing expenditure on the modernization of airports and the growing use of advanced systems for airport operations in the United States and Canada.

- The rapid growth of air traffic has necessitated airports to become highly adaptive, entrepreneurial, and proactive in addressing the ever-changing dynamics of the aviation industry in North America. With the airports developing into multi-nodal transportation hubs for passengers, efforts are being divested towards developing systems and processes that are digitally aware, interconnected, infused with intelligence, and easily accessed by all stakeholders.

- For instance, the US Department of Transportation's Federal Aviation Administration (FAA) started investing the first USD 1 billion in funding to modernize the country's air traffic control system in April 2022. The funding is part of a total of USD 5 billion invested to maintain and replace air traffic control buildings and equipment nationwide. Thus, growing expenditure on the enhancement of airports and emerging adoption patterns are anticipated to drive the development of smart airports in North America during the forecast period.

The United States is Projected to Dominate the Market During the Forecast Period

- The US held the highest shares in the North American smart airport market and is anticipated to continue its dominance in terms of market share during the forecast period. The growth is due to increased spending on the aviation sector and the presence of the highest number of airports across the United States. To efficiently handle increasing passenger traffic, ensure seamless operations, and enhance the customer satisfaction index, airports are revamping their operations to include several IoT-powered systems.

- For instance, in March 2023, The US Federal Aviation Administration (FAA) awarded USD 20 million from President Biden's Bipartisan Infrastructure Law to 29 airport-owned traffic control towers nationwide. The investment will be used to upgrade and build control towers in small towns and regional airports.

- Also, in May 2021, Raytheon Intelligence & Space signed a five-year contract worth USD 318 million with the Transportation Security Administration (TSA) to expand the deployment of checked baggage screening equipment to all federally managed airports nationwide. The construction of new airports and advancements in technology in the existing airports to enhance the experience of the passengers are expected to drive market growth across the US.

North America Smart Airport Industry Overview

The North American smart airport market is highly consolidated in nature, with few players holding significant shares in the market. The stringent safety and regulatory policies in the aviation sector are expected to restrict the entry of new players. Furthermore, the sales of technology-based platforms such as automated baggage handling systems and full-body scanners are primarily influenced by the prevalent economic conditions in dominant markets like the United States. Hence, during an economic downturn, purchases may be subjected to deferral or cancelation and lead to a relatively slower rate of adoption, which, in turn, can adversely affect the market dynamics.

Moreover, business uncertainty may be enhanced by failures or delays in obtaining licenses and certifications for export, which can have an adverse effect on the businesses and operating results of market players. Furthermore, the diversification of geographical markets, in tandem with the product offerings, will be a key criterion for ensuring profitability and survival in the long run.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Security Systems

- 5.1.2 Communication Systems

- 5.1.3 Air/Ground Traffic Control

- 5.1.4 Passenger, Cargo and Baggage Control, and Ground Handling Systems

- 5.2 Airport Location

- 5.2.1 Landside

- 5.2.2 Airside

- 5.2.3 Terminal Side

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Amadeus IT Group, S.A.

- 6.2.2 Cisco Systems, Inc.

- 6.2.3 Honeywell International Inc.

- 6.2.4 IBM Corporation

- 6.2.5 Raytheon Technologies Corporation

- 6.2.6 Sabre GLBL Inc.

- 6.2.7 Siemens AG

- 6.2.8 SITA

- 6.2.9 THALES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS