PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435847

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435847

Europe Airport Baggage Handling Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

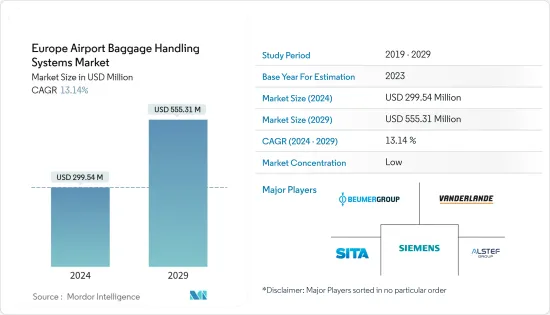

The Europe Airport Baggage Handling Systems Market size is estimated at USD 299.54 million in 2024, and is expected to reach USD 555.31 million by 2029, growing at a CAGR of 13.14% during the forecast period (2024-2029).

Key Highlights

- The airport construction industry in Europe is booming and there are major ongoing airport infrastructure development projects, such as Berling Brandenburg Airport (scheduled to open in October 2020, an extension of Terminal 2 of Manchester Airport (Main building construction completed in March 2020). These factors are propelling the growth of airport baggage handling systems in the European region.

- Worldwide air travel has grown at a historically sharp pace over the past two decades. Europe experienced an increase of 3.2% in the air passenger traffic in 2019. Airports in Europe are replacing their existing baggage handling systems with new BHS to enhance their operations and to cater to the increasing air passenger traffic in the region.

- The integration of Information Technology in logistics and baggage management has increased the service quality and efficiency of airport operations. Implementation of technologies such as Artificial Intelligence, RFID etc. will help in further decreasing the number of mishandled baggage.

Airport Baggage Handling Systems Market Trends

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- The above 40 million segment is expected to grow significantly during the forecast period. In recent years, there has been a significant increase in the number of airports entering the above 40 million passenger handling capacity segment.

- An increasing number of air passengers and rising expenditure on airport modernization programs drive the market's growth. For instance, Frankfurt International Airport, Germany's main airport hub, is undergoing expansion by operator Fraport with a significant investment of USD 5.7 billion. In 2022, the airport handled 48.9 million passengers, making it the sixth busiest airport in Europe in terms of passenger traffic. The expansion project includes the construction of Terminal 3, which is projected to be operational by 2026.

- The addition of Terminal 3 is expected to enhance the airport's capacity and improve the overall passenger experience. Similar projects are ongoing in several other countries in different regions. Such airport expansion projects are anticipated to generate demand for new baggage handling systems that will efficiently process passengers and baggage in the airport.

- Eastern and Southern Europe are expected to witness high growth in airport development, with many major projects under construction to cater to the need for growing passenger traffic. Also, Poland is planning to invest USD 10 billion to construct the new Warsaw Solidarity Airport, which is scheduled to be operational by 2027.

- Solidarity Transport Hub (STH) is a new greenfield airport prepared by the Polish government, and it has a passenger capacity of 40 million passengers annually in the first phase. The most important feature of the airport will be an integration of air, rail, and road transport. Such developments will create demand for new baggage handling systems, driving the market's growth.

France is Expected to Show Significant Growth During the Forecast Period

- France will showcase remarkable growth in the market during the forecast period. France recorded the highest rate of air passenger traffic in Europe, and the rate is constantly increasing, owing to the development of other medium and small-sized airports, work, and education opportunities, etc. Owing to the aforementioned factors, the airport baggage handling systems market will witness significant growth.

- Due to the growth in terrorism in the European region, France has invested in airport security solutions capable of efficiently scanning large amounts of baggage. Projects such as the terminal expansion of Marseille Provence International Airport, which is expected to be completed by 2023, will boost the passenger handling capacity from 8 million to 12 million and the total passenger handling capacity to 16 million passengers.

- Additionally, Charles de Gaulle Airport will receive a new terminal by 2024, owing to the scheduled Paris Olympics 2024. The terminal will serve more than 30 million passengers annually and will take the total annual passenger handling capacity of the airport to more than 120 million passengers.

- Several baggage-handling system players are operating in France and investing in customer service enhancement and technological developments. The aforementioned factors are propelling the growth of the airport baggage handling systems market in France.

Airport Baggage Handling Systems Industry Overview

The European airport baggage handling systems market is moderately fragmented in nature, with several global and local players catering to the need for large, medium, and small airports in the region. The market is dominated by a few major players, such as BEUMER Group, Vanderlande Industries B.V., SITA, Alstef Group SAS, and Siemens AG. The market is witnessing a lot of collaboration between technology companies and baggage handling system manufacturers for developing smart baggage management systems. Players also strive to win contracts with major airports to generate revenues.

For instance, in February 2023, Aena Group signed a contract with Siemens Logistics to operate and maintain the baggage handling systems at Adolfo Suarez Madrid-Barajas Airport in Spain (MAD). The service contract will run for five years and covers technical support for 140 kilometers of conveyor systems, tray, and belt technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Airport Capacity

- 5.1.1 Up to 15 million

- 5.1.2 15 - 25 million

- 5.1.3 25 - 40 million

- 5.1.4 Above 40 Million

- 5.2 Geography

- 5.2.1 Europe

- 5.2.1.1 United Kingdom

- 5.2.1.2 Germany

- 5.2.1.3 France

- 5.2.1.4 Italy

- 5.2.1.5 Rest of Europe

- 5.2.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alstef Group SAS

- 6.1.2 BEUMER Group

- 6.1.3 Vanderlande Industries B.V.

- 6.1.4 Siemens AG

- 6.1.5 Daifuku Co. Ltd

- 6.1.6 SITA

- 6.1.7 BB Computerteknikk AS

- 6.1.8 Ammega Group BV

- 6.1.9 PSI Logistics GmbH

- 6.1.10 Lift All AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS