PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437502

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437502

Middle-East And Africa Smart Airport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

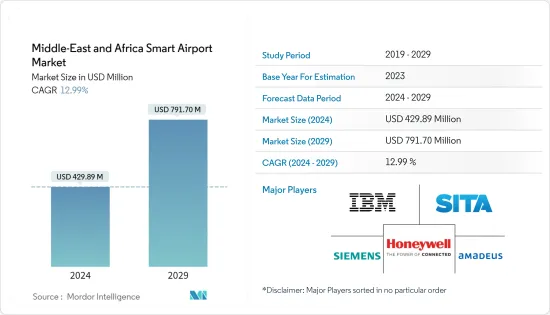

The Middle-East And Africa Smart Airport Market size is estimated at USD 429.89 million in 2024, and is expected to reach USD 791.70 million by 2029, growing at a CAGR of 12.99% during the forecast period (2024-2029).

The construction of several new airports in the Middle East is expected to generate significant demand for smart technologies in the coming years. Also, countries in Africa have plans to enhance the passenger handling capacity of airports. This may propel the growth of the market during the forecast period.

The increase in passenger traffic resulted in mounting pressure on airports and airlines, primarily to opt for advanced systems that can enhance their ground operations and support their motive of reducing aircraft turnaround time. Correspondingly, airports are using an array of automated technologies to facilitate the smooth flow of passengers and reduce turnaround times of the aircraft, thereby increasing the efficiency of the airports and the overall passenger experience.

The growing emphasis on the adoption of technologies, like automation, artificial intelligence (AI), and predictive analysis for a wide range of airport applications, to enhance the operational efficiency of the airports, is expected to drive the market in the years to come. Implementing smart solutions, such as advanced passenger processing systems, IoT devices, and data analytics platforms, demands considerable capital. Airports need to invest in upgrading their physical infrastructure, including IT networks, sensors, and communication systems. Moreover, they must allocate funds for software development, training, and maintenance. These investments can be a barrier, particularly for smaller airports or those in regions with limited financial resources.

MEA Smart Airport Market Trends

Security Systems to Dominate Market Share

The security systems segment is projected to dominate the smart airport industry. Security is paramount in the aviation industry, given the high-stakes nature of air travel. Smart airports heavily invest in cutting-edge security technologies to ensure the safety of passengers and assets. Technological advancements such as biometric authentication, video analytics, and AI-driven threat detection systems have revolutionized airport security. Biometrics, for example, enhances authentication processes by using unique physical attributes like fingerprints and facial recognition. This not only bolsters security but also expedites passenger processing. Additionally, advanced surveillance and video analytics enable airports to monitor and respond to security threats in real time. Machine learning algorithms can detect unusual behavior patterns and potential risks, improving overall safety. The growth of air travel and the increasing complexity of threats make security systems indispensable. These technologies not only keep passengers safe but also streamline operations by reducing false alarms and enhancing overall efficiency. For instance, DataDirect Networks was selected by Hamad International Airport in May 2023 to provide advanced data storage solutions to enhance security measures. The DDN solutions were selected due to their singular combination of performance, scale, and cost-effectiveness. In order to meet both primary and secondary recordings of more than 100 Petabytes, DDN has implemented a high-performance EXAScaler 7990 system with IntelliFlash 6200 systems.

Saudi Arabia is Expected to Witness Significant Growth in the Middle East and African Smart Airport Market

Saudi Arabia witnessed a surge of 26% in air traffic and flight movements from airports in 2023, the country witnessed 403,000 flights by June 2023. The country has been making investments to promote tourism and attract visitors, including the "Vision 2030" plan. As tourism and business travel increase, the demand for efficient, secure, and technologically advanced airport services rises. Saudi Arabia's strategic location as a major connecting hub between Europe, Asia, and Africa makes it a vital region for aviation. This naturally leads to a need for advanced airport technologies and infrastructure. Saudi Arabia has undertaken an airport privatization program. This move is expected to increase the adoption of smart technologies in the country's airports. In 2018, Saudi Arabia's General Authority of Civil Aviation collaborated with SITA to modernize the country's 26 airports by installing self-service-based procedures with kiosks, automated bag drops, and biometric single-token travel and payment systems. As a part of the technology upgrade, SITA is deploying its AirportConnect Open platform, which can be used by airlines to work seamlessly at airports. It also offers a self-service experience from check-in to boarding. Additionally, the platform delivers future-proof infrastructure and will support the implementation of new solutions, such as biometric single-token travel and common-use payment systems in the country's airports. Such developments are expected to bolster the market prospects in the country during the forecast period.

MEA Smart Airport Industry Overview

The Middle East and African smart airport market is consolidated, with only a handful of players accounting for a major share of the market revenues. SITA, Honeywell International Inc., IBM, Siemens AG, and Amadeus IT Group, S.A. are some of the major players in the market. Mergers and acquisitions between the players, in the recent past, have helped the companies strengthen their market presence. Players are expected to adopt new technologies, like AI, automation, robotics, etc., into their products and solutions, which will help them gain new contracts with the airports. For instance, SITA offers advanced passenger processing and baggage tracking systems. Meanwhile, Honeywell specializes in cutting-edge security technologies, encompassing biometrics and surveillance. IBM offers comprehensive data analytics and AI solutions, enhancing operational efficiency. Competition fosters continuous technological advancement, resulting in increasingly sophisticated and interconnected smart airport ecosystems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Security Systems

- 5.1.2 Communication Systems

- 5.1.3 Air/Ground Traffic Control

- 5.1.4 Passenger, Cargo, and Baggage Control

- 5.1.5 Ground Handling Systems

- 5.1.6 Other Technologies

- 5.2 Geography

- 5.2.1 Middle-East and Africa

- 5.2.1.1 Saudi Arabia

- 5.2.1.2 United Arab Emirates

- 5.2.1.3 Turkey

- 5.2.1.4 Egypt

- 5.2.1.5 South Africa

- 5.2.1.6 Rest of Middle-East and Africa

- 5.2.1 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International Inc.

- 6.1.2 Cisco Systems, Inc.

- 6.1.3 Amadeus IT Group, S.A.

- 6.1.4 Siemens AG

- 6.1.5 Indra Sistemas, S.A.

- 6.1.6 Thales

- 6.1.7 SITA

- 6.1.8 Collins Aerospace (RTX Corporation)

- 6.1.9 NATS Holdings Limited

- 6.1.10 Sabre GLBL Inc.

- 6.1.11 IBM

- 6.1.12 L3Harris Technologies, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS