PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690707

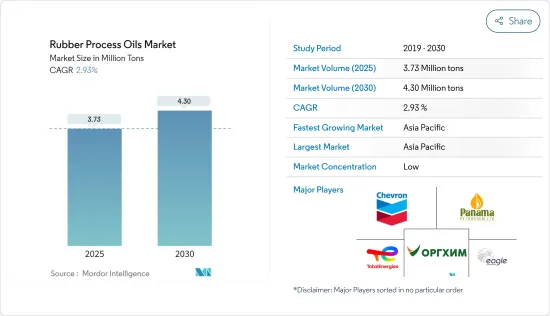

Rubber Process Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Rubber Process Oils Market size is estimated at 3.73 million tons in 2025, and is expected to reach 4.30 million tons by 2030, at a CAGR of 2.93% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand for tire and automotive components from the automobile industry is one of the major factors driving the growth of the market studied.

- On the flip side, volatility in raw material prices is expected to hinder the growth of the market.

- However, the increasing demand for bio-based rubber process oil is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Rubber Process Oil Market Trends

Growing Demand of Rubber Process Oil from Tire and Automobile Components

- Rubber process oils are used while mixing the rubber compounds. These products improve the dispersion of fillers and the flow property of the compound. Hence, it is considered to be the most important ingredient for the rubber-based industry.

- Due to enhanced mechanical properties, rubber process oils are used in the tire and other automotive components. In addition, improved braking efficiency and fuel consumption of the product are likely to further benefit its usage in the tire and automotive components.

- The rubber process oils enhance the rubber properties used in the production of tires. Rising population improved living standards and increased spending power are factors likely to boost the demand for automobiles globally. For instance, according to OICA, in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for the rubber process oil market in the forecast period.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars.

- However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for the rubber process oils market.

- Furthermore, the United States is the second-largest market for vehicle sales and production globally. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create an upside demand for rubber process oils market.

- Therefore, all such favorable trends and investments in the region are expected to drive the demand for rubber process oils market during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for rubber process oil during the forecast period. The rising demand for rubber process oil from tire and automobile components in developing countries like China, Japan, and India is expected to drive the demand for rubber process oil in this region.

- The largest producers of rubber process oil are located in the Asia-Pacific region. Some of the leading companies in the production of rubber process oil are Total, Chevron Intellectual Property LLC, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and Eagle Petrochem among others.

- The automobile industry in China is experiencing shifting trends as consumer preference for battery-powered electric vehicles rises. The expansion of China's automotive sector is expected to benefit the rubber process oil market. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the world's largest automobile producer, accounting for nearly 34% of global volume. In 2022, the country produced 2,70,20,615 units of automobiles, registering an increase of 24% compared to 2,61,21,712 units in 2021. Therefore, increasing in the production of automobiles is expected to create an upside demand for the rubber process oil market.

- In India, increasing regulations on vehicle emissions, advancement in vehicle safety, the introduction of driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors, have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, accroding to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, which showen an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India is expected to increase the consumption of rubber process oil market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This expansion is expected to have a positive impact on the rubber process oils market in the country.

- Rising awareness about the worker's safety from injuries due to electrical contacts, falling objects, spilling of harmful chemicals and oils, moving machinery, and others during industrial or construction work is likely to benefit the demand for rubber footwear. Rubber process oil is increasingly used in manufacturing footwear using rubber. Hence, the rising demand for rubber footwear further fuels the rubber process oils market.

- Owing to the above-mentioned factors, the market for rubber process oil in the Asia-Pacific region is projected to grow significantly during the study period.

Rubber Process Oil Industry Overview

The Rubber Process Oil Market is fragmented in nature. The major players in this market (not in a particular order) include TotalEnergies, Chevron Corporation, Panama Petrochem Ltd, ORGKHIM Biochemical Holding, and EaglePetrochem, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Tire and Automotive Components

- 4.1.2 Growing Demand for Footwear

- 4.1.3 Others

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Price

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aromatic

- 5.1.2 Paraffinic

- 5.1.3 Naphthenic

- 5.2 Application

- 5.2.1 Tire and Automobile Components

- 5.2.2 Footwear

- 5.2.3 Consumer Goods

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 APAR Industries

- 6.4.2 Chevron Corporation

- 6.4.3 CPC Corporation

- 6.4.4 EaglePetrochem

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 HF Sinclair Corporation

- 6.4.7 LODHA Petro

- 6.4.8 ORGKHIM Biochemical Holding

- 6.4.9 Panama Petrochem Ltd

- 6.4.10 Repsol

- 6.4.11 Sterlite Lubricants

- 6.4.12 TotalEnergies

- 6.4.13 Witmans Industries Pvt. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand of Bio Based Rubber Processing Oil

- 7.2 Other Opportunities