Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640585

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640585

India Artificial Lift Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

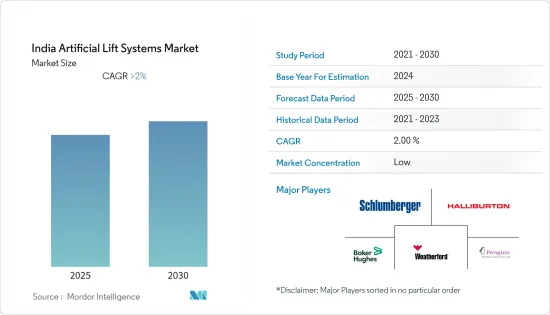

The India Artificial Lift Systems Market is expected to register a CAGR of greater than 2% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19, mainly due to delays and cancellations of projects and the crude oil price crash. However, the market rebounded in 2022.

Key Highlights

- Over the long term, the need for enhanced recovery rates, a growing number of wells that require pressure support for extraction, increasing demand for energy, petrochemicals, and technological advancements that are enabling companies to extract oil from challenging areas economically are some of the factors driving the growth of artificial lifts system market.

- On the other hand, factors such as advancements in smart water flooding and various IOR technology are restraining the market growth during the forecast period.

- However, most of the new fields, as well as the older fields, require an artificial lift of some form for production. Hence, all the major companies are regularly adopting artificial lifts in almost all wells. As the number of new exploration fields is increasing, these fields are expected to provide major opportunities for the artificial lift system market.

India Artificial Lift Systems Market Trends

Electric Submersible Pumps (ESP) to Witness Significant Demand

- India is highly dependent on crude oil imports to fulfill its energy needs. According to the latest government data, the country's dependence on crude oil imports reached nearly 82% in 2021.

- Additionally, the country witnessed a decline in domestic crude oil production from 937 thousand barrels per day in 2011 to 746 thousand barrels per day in 2021. ONGC, the country's major oil producer, is witnessing a decline due to technical issues in Mumbai and Neelam Heera fields and less-than-expected production in Santhal and Ball fields in Gujarat.

- The decline in production is also the result of aging fields, which leads to a fall in output. Such aging fields are expected to provide the potential for the usage of electric submersible pumps, thus driving the demand for artificial lift systems.

- The current usage of ESPs in India for oil and gas production is relatively low compared to other artificial lift systems. However, the upcoming investments in the oil and gas sector are expected to provide an opportunity for the electric submersible pumps market in the long run.

- Therefore, based on the above-mentioned factors, the electric submersible pumps segment is expected to witness significant demand for artificial lift systems in India during the forecast period.

Increasing Maturing and Matured Fields to Drive the Market

- Mature and maturing oil & gas fields and a rising number of aging production technologies are expected to have a huge impact on the growth of the artificial lift market. Natural gas production in the country declined from 4.15 billion cubic feet per day in 2011 to 2.76 billion cubic feet per day in 2021.

- Increasing competitiveness for access to new reserves has put pressure on the maturing reserves for maximizing the output. However, the costs incurred for producing from such maturing reserves are not always profitable and have to be a strategic decision of the companies involved. The operational demands of the matured fields are always unique, and the approach needs to be tailored for specific fields.

- The opportunities presented by the matured and maturing fields are large enough to take a calculated risk and employ technically complex processes for enhancing production.

- The limited budgets available, combined with the 'Lower for Longer' oil prices throw open an opportunity for the companies in the oil production landscape to employ artificial lift and maintain the performance of the assets.

- The investments also include directional drilling, where there exists a significant opportunity for finding hydrocarbons. The current scenario of low oil price is the right opportunity for strategically segmenting the wells and related infrastructure, and employing various oilfield services, such as wireline logging, coiled tubing, and artificial lift, to enhance production from maturing assets.

- Hence, owing to the presence of matured and maturing fields, along with the number of fields are constantly increasing, artificial lift market is expected to play a quintessential role in the drilling markets.

India Artificial Lift Systems Industry Overview

The Indian artificial lift systems market is moderately fragmented. Some of the major players include (in no particular order) Schlumberger NV, Halliburton Company, Weatherford International PLC, Baker Hughes Company, and Penguin Petroleum Services (P) Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55243

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION BY TYPE

- 5.1 Gas-Lift Systems

- 5.2 Sucker Rod Pumps

- 5.3 Electric Submersible Pumps

- 5.4 Progressive Cavity Pump Lifting Systems

- 5.5 Jet Pumps

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Weatherford International PLC

- 6.3.3 Schlumberger NV

- 6.3.4 Penguin Petroleum Services (P) Limited

- 6.3.5 Novomet Oilfield Services Company

- 6.3.6 Halliburton Company

- 6.3.7 United Drilling Tool Limited

- 6.3.8 Apergy Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.