PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644321

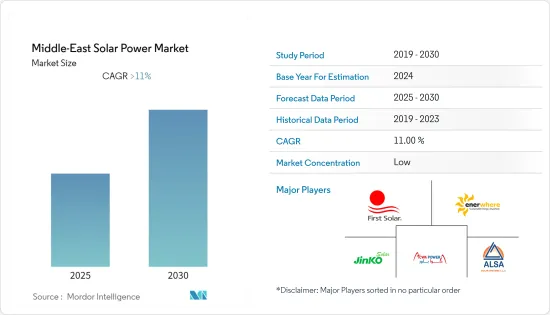

Middle-East Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle-East Solar Power Market is expected to register a CAGR of greater than 11% during the forecast period.

With the COVID-19 outbreak in Q1 2020, the Middle Eastern solar power market was moderately impacted. Few countries like Saudi Arabia, Kuwait, and Qatar had significantly less number of new installations in 2020 due to delays in the shipping of solar modules. The market rebounded in 2021.

Key Highlights

- Factors such as supportive government policies and increasing efforts to meet power demand using renewable energy sources, and decreased dependency on fossils are expected to be significant contributors to driving the market. Besides, many ambitious photovoltaic projects are lined up in the forecast period and are expected to drive the solar market in the coming years.

- However, factors such as delays in large-scale solar projects and increasing focus on alternative energy sources are expected to hinder the market's growth.

- The upcoming solar power projects, along with the use of hybrid power solutions in this region, can create immense opportunities for the solar power market in the near future.

- Saudi Arabia is expected to witness significant demand due to the number of ongoing and upcoming projects over the forecast period.

Middle East Solar Power Market Trends

Solar Photovoltaic (PV) Projects to Drive the Market

- Photovoltaic (PV) cells are arrays of cells containing a solar photovoltaic material that converts solar radiation or energy from the sun into direct current electricity. Photovoltaic (PV) solar panels held a share of more than 96.57% of the total Middle Eastern solar energy installed in 2022.

- The solar PV installed capacity of the Middle East grew to 12.440 GW in 2022, which is higher compared to the 9.239 GW installed in 2021. Upcoming projects are expected to increase capacity during the forecast period even further.

- In October 2022, the Water Procurement Company (OPWP) and Oman Power initiated bidding for the second large-scale solar photovoltaic (PV) project at Ibri in northwest Oman. The new Ibri III Solar Independent Power Project (IPP) has a solar PV capacity of 500 MW. The new facility is anticipated to begin commercial operations in the fourth quarter of 2026.

- In February 2023, Mobarakeh Steel Company was anticipated to finance the solar photovoltaic power plant in Kouhpayeh County, Isfahan Province, with a capacity of 600 MW. The project is expected to receive an investment of USD 500 million. The first phase will likely add nearly 100 MW to the nation's power grid by July 2023.

- With several projects under construction or in the tender phase in countries like Saudi Arabia and the United Arab Emirates, considerable growth in solar PV is expected to drive the solar power market in the Middle Eastern region over the forecast period.

Saudi Arabia to Dominate the Market

- In Saudi Arabia, the solar energy installed capacity growth can be attributed to the National Renewable Energy Program, which had a target of installing 35 renewable projects with 58.7 GW of installed capacity by 2030.

- The installed solar power capacity for Saudi Arabia in 2022 was 440 MW, which is expected to increase in the coming years. Also, the solar PV installed capacity for Saudi Arabia increased to 390 MW in 2022, which was higher compared to 59 MW in 2020.

- In November 2022, ACWA Power signed an agreement with Water and Electricity Holding Company (Badeel) to develop the world's largest single-site solar-power plant in Al Shuaibah, Mecca province. With a 2,060 MW generation capability, the solar power plant is anticipated to begin operations by the end of 2025.

- Moreover, in March 2022, according to the Ministry of Industry and Mineral Resources, Saudi Arabia launched a new plan to support green energy initiatives and reduce its reliance on crude oil. Additionally, the ministry would provide tax breaks and other benefits to businesses that generate renewable energy.

- Therefore, based on the aforementioned facts, Saudi Arabia is expected to witness significant demand for the solar power market in the Middle Eastern region over the forecast period.

Middle East Solar Power Industry Overview

The Middle Eastern solar power market is moderately fragmented. Some of the key players in this market include (not in particular order) JinkoSolar Holding Co. Ltd, First Solar Inc., Enerwhere Sustainable Energy DMCC, ACWA POWER BARKA SAOG, and Alsa Solar Systems LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Oman

- 5.2.4 Rest of the Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JinkoSolar Holding Co. Ltd.

- 6.3.2 First Solar Inc

- 6.3.3 Enerwhere Sustainable Energy DMCC

- 6.3.4 ACWA POWER BARKA SAOG

- 6.3.5 Alsa Solar Systems LLC

- 6.3.6 Enviromena Power Systems

- 6.3.7 Trina Solar Ltd.

- 6.3.8 JA SOLAR Co. Ltd.

- 6.3.9 Sungrow Power Supply Co. Ltd.

- 6.3.10 Hitachi Energy Ltd.

- 6.3.11 Canadian Solar Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS