PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437607

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437607

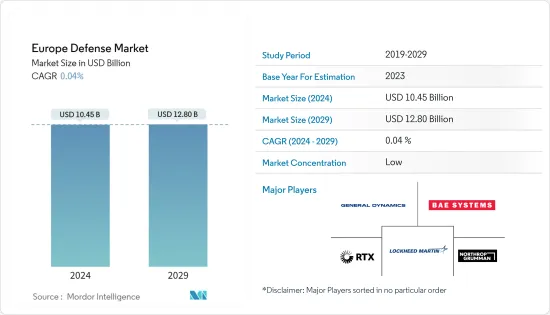

Europe Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Defense Market size is estimated at USD 10.45 billion in 2024, and is expected to reach USD 12.80 billion by 2029, growing at a CAGR of 0.04% during the forecast period (2024-2029).

The increase in the defense expenditure coupled with the growing need for procurement of advanced defense weapons and ammunition by countries within the European region in an effort to improve defense capabilities are some of the factors which is expected to lead to the growth of the market during the forecast period.

The ongoing Russia-Ukraine conflict has created a tense scenario in the region, with the countries increasing its investments in R&D in order to develop advanced capabilities that can counter the modern weapon technologies deployed by the Russian forces. Moreover, the European countries, especially the NATO members, are also diverting significant monetary resources in support of Ukraine, which is driving the defense market in the region.

On the other hand, the growth in regulations is hampering the procurement and production of advanced weapons for some countries in Europe and this will lead to the market growth witnessing restraint during the forecast period. Moreover, technological advancements for defense weapons such as the usage of artificial intelligence is expected to increase market growth opportunities in the near future.

Europe Defense Market Trends

The Naval Segment Will Showcase Remarkable Growth During the Forecast Period

The naval segment is expected to show significant growth during the forecast period. The growth is attributed to the increasing defense expenditure within the European countries and the growth in various conflicts, and this has led to various countries in Europe modernizing their defense forces. These factors are anticipated to lead to the market to witness significant growth in the near future.

The naval defense industry is a strategic asset for Europe. Moreover, naval yards in Europe have proven to be world leaders in terms of functionality. According to European Defense Matters, the manufacturers of military vessels and submarines are witnessing significant growth in Europe, especially in international markets where exports are booming. Despite difficult conditions in a growingly turbulent global naval market which is mainly caused by rising exports from Chinese, Russian, and South Korean shipyards, Europe's naval industry has managed to maintain its position as a highly competitive global player if not a world leader, owing to its technological edge and strong exports. On the other hand, although the European naval forces suffered a dramatic downsizing in the past three decades, technological investments by various countries in Europe will help push the market to witness significant growth during the forecast period.

With increased power competition and new challenges to European security, the ability to wield naval power is becoming increasingly relevant in modern space. This has led to governments across Europe formulating security and defense policies that are effective in the long run. Various European countries, in the current time, are looking towards improving their naval capabilities and are also entering into contracts with various market players in order to manufacture advanced naval defense machines. For instance, in July 2022, the European Union (EU) announced that they are ready to accelerate various naval projects under huge defense investment budget. Moreover, the commission announced that it will support 61 joint defense research and development projects with a total of almost USD 1.30 billion. In February 2022, the Greek government has approved a multibillion-dollar proposal to modernize the country's naval forces. Moreover, Greece will spend USD 2.53 billion to purchase three Belharra frigates from French defense contractor Naval Group over the next four years. In addition, Athens may also exercise an option to purchase another Belharra frigate and four corvettes next year. Thus, an increase in technological advancements and the need for modernizing of the naval forces of various European countries will lead to the naval segment witnessing significant developments in the near future thereby leading to market growth.

Russia Will Showcase Remarkable Growth During the Forecast Period

Russia is projected to show the highest growth during the forecast period. Growing military spending coupled with the need for the development of advanced defense products will lead to the country witnessing significant growth in recent years.

Russia is the fifth largest country that spends highly on defense. The defense industry of Russia is a strategically important sector and creates high employment. It is also a significant player in the global arms market. According to the Stockholm International Peace Research Institute (SIPRI), Russia is the second largest conventional arms exporter after the US, with USD 14.6 billion worth of exports in FY 2021. The Russian government revised its defense budget in September 2022 and has now spent USD 69 billion in its defense expenditure in 2022 which exceeded the originally proposed budget by 54%.

The ongoing war between Russia and Ukraine led to Russia making use of various weapon systems the country had in its inventory for a long time. Moreover, the Russian military has a variety of conventionally armed cruise and quasi-ballistic missiles at its disposal, including the islander-M system, Bastion-P, Kinzhal, Kh-101, and Kh-22/32, along with Kalibr, Kh-101, and other similar methods. Depleting inventory of such missiles due to the war has led to higher investments being made by Russia to restock the country's weapons arsenal and this will lead to a higher growth potential for the market during the forecast period.

European Defense Industry Overview

The European defense industry is fragmented with various players vying to increase their market share. Some prominent market players include Lockheed Martin Corporation, Northrop Grumman Corporation, General Dynamics Corporation, BAE Systems plc, and RTX Corporation amongst others.

The key players in the market are focusing on developing advanced defense systems for different countries in the European region. Growth in terms of defense expenditure as well as the collaboration between defense companies as well the governments of countries in the region will help formulate new business opportunities which will in turn lead to significant growth in the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment Type

- 5.1.1 Personnel Training and Protection

- 5.1.2 Communication

- 5.1.3 Armament

- 5.1.4 Transport

- 5.2 Platform

- 5.2.1 Terrestrial

- 5.2.2 Aerial

- 5.2.3 Naval

- 5.3 Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Russia

- 5.3.5 Italy

- 5.3.6 Spain

- 5.3.7 Greece

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Airbus SE

- 6.2.2 BAE Systems plc

- 6.2.3 General Dynamics Corporation

- 6.2.4 Indra Sistemas, S.A.

- 6.2.5 Leonardo S.p.A.

- 6.2.6 Northrop Grumman Corporation

- 6.2.7 Lockheed Martin Corporation

- 6.2.8 United Aircraft Corporation (PJSC UAC)

- 6.2.9 RTX Corporation

- 6.2.10 Rheinmetall AG

- 6.2.11 Rostec State Corporation

- 6.2.12 UkrOboronProm

- 6.2.13 Saab AB

- 6.2.14 THALES

7 MARKET OPPORTUNITIES AND FUTURE TRENDS