PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437608

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437608

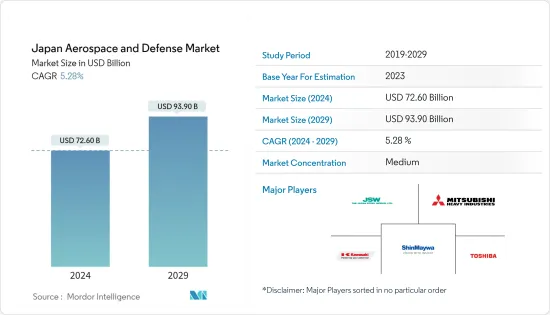

Japan Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Japan Aerospace And Defense Market size is estimated at USD 72.60 billion in 2024, and is expected to reach USD 93.90 billion by 2029, growing at a CAGR of 5.28% during the forecast period (2024-2029).

The Japanese aerospace sector is one of the largest in the world, with a strong international reputation, particularly in the field of research and development (R&D). Japanese companies have great potential in the research and development of dual-use aerospace defense technology, such as helicopters and light attack aircraft. In 2022, around 6.8 million passengers were carried on international flights via Japanese airlines, up from 1.4 million passengers in the previous year.

An increase in defense expenditure, rising procurement of next-generation weapons, and adoption of advanced technologies in military communication drive the growth of the market across Japan. According to the report published by Stockholm International Peace Research Institute (SIPRI) in 2022, Japan was the tenth largest defense spender in the world, with a defense budget of USD 46 billion. The country approved USD 51.4 billion in defense spending in FY2023.

The security environment in Japan has become increasingly stressed, with several international challenges and destabilizing factors becoming more acute. Hence, to adapt to the growing changes in the security environment, Japan has been strengthening its defense capabilities at a rapid pace. For the ninth consecutive year, the defense budget draft set a new record for Japan's national defense budget. For FY2023, the Japanese government approved 6.82 trillion yen (USD 51.4 billion), which showed an increase of 26.3% from the previous year. The growth in the defense budget and the ongoing military modernization are expected to be the major drivers for the growth of the market.

Japan Aerospace And Defense Market Trends

The Manufacturing Segment Accounted for a Major Share in 2023

The manufacturing service type segment stands out as the dominant force, holding the largest market share. Renowned companies such as Mitsubishi Heavy Industries, Ltd. and Kawasaki Heavy Industries, Ltd. play pivotal roles in shaping this sector. These industry giants leverage their expertise in precision engineering and cutting-edge technology to manufacture a wide array of aerospace and defense products, ranging from fighter jets and helicopters to sophisticated missile systems. The significance of the manufacturing service type is underscored by the intricate collaboration between these companies and the Japanese government, fostering a strategic partnership for national security. Additionally, emerging players like Subaru Corporation contribute to the sector's growth by diversifying their portfolios to include aerospace components. The emphasis on innovation, quality, and reliability positions Japan's manufacturing service type segment as a linchpin in the nation's aerospace and defense capabilities, reflecting a synergy between technological prowess and strategic foresight. Moreover, increasing orders from Japan government for indigenous manufactured products is also contributing to the growth of manufacturing sector. For instance, in November 2023, Mitsubishi Heavy Industries forecast its defense sales to double to 1 trillion yen (USD 6.7 billion) by 2026 and stay strong as geopolitical tensions boost business for MHI. The Japanese government's latest five-year strategy suggests a 56% increase in defense spending, through 2027, from the previous term as it strives to build up the Japan's defense capabilities. Major key focus of MHI is to develop a domestic capability to produce long-range missiles that can achieve distances of over 1,000 kilometers. The government is also offering manufacturers profit margins of up to 10% to encourage indigenous innovation and manufacturing and is prepared to offset up to 5% in cost increases to help with high inflation rates. Developments in such domains are expected to be a part of Japan's new multidimensional integrated defense force. Thus, such ongoing developments are expected to drive the Japanese defense market during the forecast period.

Aerospace Sector to Witness Significant Growth During the Forecast Period

The aerospace sector is poised to showcase remarkable growth during the forecast period. Japan continues to offer a lucrative market for imported aircraft, aircraft parts, and engines. Currently, Japan is playing a pivotal role in the development of several aircraft families, including the B777, B777X, and B787. In March 2023, Japan Airlines (JAL), Japan's national flag carrier, announced an order of 21 Boeing B737 MAX aircraft. The airline aims to bring advanced and fuel-efficient aircraft into its fleet starting in 2026. The value of the contract was approximately USD 2.5 billion. Haneda International Airport (HND), Narita International Airport (NRT), Kansai International Airport (KIX), and Fukoma International Airport (FUK) are the four major airports in Japan that together handle over 200 million passengers annually.

Furthermore, Japanese companies are also actively engaged in providing engineering services towards the development and MRO of aircraft engines, such as the V2500, Trent1000, GEnx, GE9X, PW1100G-JM, etc. Similarly, in January 2022, the US Department of Defense (DoD) announced a contract worth USD 471 million to the Boeing Company for the development of new systems for Japan Air Self-Defense Force's (JASDF) F-15 Eagle Super Interceptors fleet. The Japanese firms have also contributed to the development of various engineering test satellites, marine and terrestrial observation satellites, communications, broadcasting, global navigation satellites, etc., including weather satellites such as the HIMAWARI 8 and 9. In 2021, the Japanese government spent USD 4.14 billion on space activities. The Japanese space firms developed Launch vehicles such as the M-V, H-IIA/B, and Epsilon rockets. The Japanese satellite manufacturers are also using their advanced technical capabilities, high quality, and competitive costs to open the overseas market. Thus, growing expenditure on research and development and rising spending on enhancing aviation infrastructure drive market growth across the country.

Japan Aerospace And Defense Industry Overview

The Japan aerospace and defense market is semi-consolidated and several key players such as Mitsubishi Heavy Industries, Ltd., Toshiba Corporation, Kawasaki Heavy Industries, Ltd., ShinMaywa Industries, Ltd., and Japan Steel Works, Ltd. compete on product and services level to gain higher market share. Japan has adopted new principles and guidelines on arms exports and would permit arms exports to a country only if they serve the purpose of contributing to international cooperation and its security interests. According to the 2022 defense white paper, nearly 1,100 companies are involved in the manufacture of fighter aircraft, about 8,300 in building destroyers, and around 1,300 in the production of tanks. Thus, growing support for local aerospace and defense manufacturers and rising investment in research and development boost the market growth during the forecast period. For instance, The Japanese Ministry of Defense (MoD) secured USD 6.23 billion for ammunition-related spending, which is 330% higher than in 2022. It included USD 1.59 billion for the procurement of 500 US-made long-range Tomahawk cruise missiles. The Japanese MoD will deploy the Tomahawks in fiscal year 2026-27 as it aims to develop counterstrike capabilities. Tokyo will acquire the advanced model Tomahawk Block V to be equipped with Japan Maritime Self-Defense Force (JMSDF) Aegis-equipped destroyers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Aerospace

- 5.1.2 Defense

- 5.2 Service Type

- 5.2.1 Manufacturing

- 5.2.2 MRO

- 5.3 Platform

- 5.3.1 Terrestrial

- 5.3.2 Aerial

- 5.3.3 Naval

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BAE Systems plc

- 6.1.2 Kawasaki Heavy Industries, Ltd.

- 6.1.3 Komatsu Ltd.

- 6.1.4 Lockheed Martin Corporation

- 6.1.5 Mitsubishi Heavy Industries, Ltd.

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 RTX Corporation

- 6.1.8 ShinMaywa Industries Ltd.

- 6.1.9 THALES

- 6.1.10 The Boeing Company

- 6.1.11 Japan Steel Works, Ltd.

- 6.1.12 Toshiba Corporation

- 6.1.13 Toray Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS