PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445957

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445957

Asia-Pacific Medium And Large Caliber Ammunition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

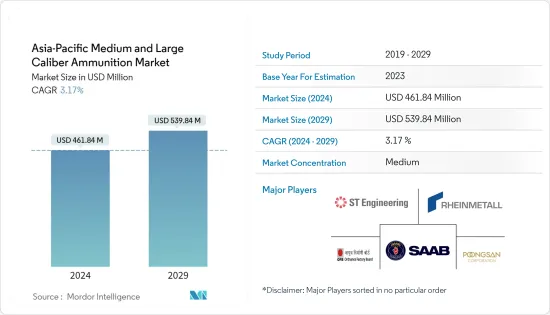

The Asia-Pacific Medium And Large Caliber Ammunition Market size is estimated at USD 461.84 million in 2024, and is expected to reach USD 539.84 million by 2029, growing at a CAGR of 3.17% during the forecast period (2024-2029).

The increasing geopolitical conflicts and border tension of neighboring countries in the region are fueling the rise in military expenditure of various countries. This increase in military expenditure is propelling investments into the procurement of new land, air, and sea platforms, which in turn is generating demand for medium and large caliber ammunition market.

The medium and large caliber ammunition market is expected to grow primarily due to the procurement and upgrade activities undertaken by armed forces to counter emerging threats. Several contracts for naval vessels, military aircraft, helicopters, infantry fighting vehicles (IFVs), and armored personnel carriers (APCs) mounted with medium caliber turret guns are currently underway and many new contracts are anticipated to be dispersed during the forecast period, creating a parallel demand for medium caliber ammunition.

High costs of procurement and issues like arms trafficking might hinder the market potential. The cost of new technologies, especially new concepts, is expected to be high and economically infeasible unless the mass adoption of such technologies takes place.

Programmable ammunition and loitering munitions are some of the emerging technologies with a potential to radically change the market dynamics in future.

Asia-Pacific Medium And Large Caliber Ammunition Market Trends

Large Caliber Segment is Expected Witness Highest Growth During the Forecast Period

In 2022, Asia-Pacific spent a total of USD 569 billion on military expenditure. Over the past few years, terrorist operations have increased in nations like Afghanistan, Pakistan, India, and the Philippines. As a result, more anti-terrorism funding is being made available to combat terrorism at the domestic and international levels.

The large caliber segment of the market is expected to witness growth primarily due to the procurement of howitzers, artilleries, etc., which in turn is propelling the investments of governments towards the procurement of large caliber ammunition. Countries in the Asia-Pacific region have collaborated with major ammunition manufacturers to support their indigenous defense capabilities. In June 2022, Thales Australia entered into a collaboration agreement with EXPAL Systems S.A. The new agreement aims to establish solutions in Australia for large caliber Naval munitions and fuzes in support of the Australian defense force. Such developments and procurements of advanced systems are anticipated to boost the growth of the segment during the forecast period.

China to Continue Market Dominance During the Forecast Period

China currently dominates the market and is expected to continue its dominance during the forecast period. This is mainly due to growing military spending and subsequent investments into the development and procurement of advanced armaments. The country plans to complete military modernization by 2035 and emerge as a supreme military power by the second centenary goal of 2049.

China has multiple state-owned and home-grown defense manufacturers that cater to the country's defense needs. Aviation Industry Corporation of China (AVIC), China Electronics Technology Group Corporation (CETC), China North Industries Group Corporation (NORINCO), and China South Industries Group Corporation (CSGC), are some of the major domestic defense companies that provide China with the weapons and munitions that are required to carry out the country's military activities.

China has been prioritizing its military and economic interests, due to which, multiple security expansions have taken place in recent times. As part of these expansions, the country is venturing into geographical areas that are causing international unrest and leading to military conflicts. China recently announced that Taiwan needs to be part of mainland China and has launched some fighter jets near the separately governed Taiwan. China is also expanding its military security, to tackle the border conflict with India. These moves sparked a large conflict with the countries in Asia-Pacific. Such tensions and deployment of advanced weaponry are expected to accelerate the growth of the country in the coming years.

Asia-Pacific Medium And Large Caliber Ammunition Industry Overview

The Asia-Pacific medium and large caliber ammunition market is highly fragmented with many regional players in the market that support various armed forces in the region. Some of the prominent players in the market are Munitions India Limited, Poongsan Corporation, Rheinmetall AG, Saab AB, and Singapore Technologies Engineering Ltd.

The international players in the market are forming partnerships with the governments, constructing new production facilities, and increasing their presence in the region. The growth is subjective to several associative factors, such as allocating funds to procure new equipment. It may be adversely affected due to the rapid technological advances resulting in the effective life of a newly developed technology.

Over the years, the local players have mastered technology and product design, and they are offering similar quality ammunition at a relatively cheaper price, thereby posing a threat to the growth of the established players in the region. This is expected to further intensify the competition in the market during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Caliber Type

- 5.1.1 Medium Caliber

- 5.1.2 Large Caliber

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Munitions India Limited

- 6.1.2 Kalyani Strategic Systems Limited

- 6.1.3 Poongsan Corporation

- 6.1.4 Rheinmetall AG

- 6.1.5 Saab AB

- 6.1.6 Rostec State Corporation

- 6.1.7 China South Industries Group Co.,Ltd.

- 6.1.8 Hanwha Group.

- 6.1.9 Singapore Technologies Engineering Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS