PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690194

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690194

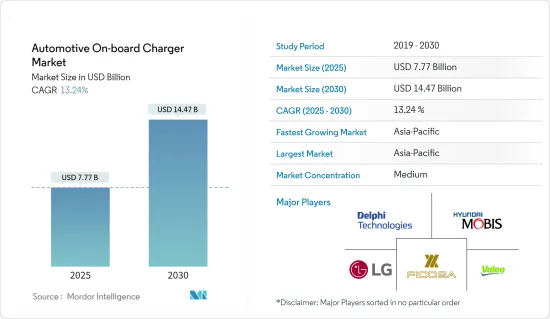

Automotive On-board Charger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive On-board Charger Market size is estimated at USD 7.77 billion in 2025, and is expected to reach USD 14.47 billion by 2030, at a CAGR of 13.24% during the forecast period (2025-2030).

Over the long term, rapid sales of electric vehicles, advancements in battery technology, improving charging infrastructure, and stringent emission regulations are expected to fuel the demand for automotive on board chargers. The market has been witnessing the adaptation of electric passenger vehicles in developed countries. Major players and new start-ups in the EV industry plan to introduce new electric models in the coming years.

As per the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 30.3% between 2021 and 2022.

The US government committed to reducing greenhouse gas emissions 50-52% below 2005 levels in 2030. The government announced its target to achieve a net-zero economy by 2050.

With the introduction of high-power commercial vehicles in the market, there is a massive demand for advanced on board chargers suitable for integration into these vehicles. Thus, several manufacturers are strategizing to incorporate dual on board chargers that improve the efficiency of these vehicles and help reduce the cost of the on board chargers. With the growing electric vehicle propulsion technology penetration in the coming years, the demand for on board chargers worldwide will increase.

However, the high cost of on board chargers imposes a significant challenge for players in the market. To tackle the issue of high costs, various players in the market are developing advanced technologies to reduce the cost of these chargers. To keep up with the high demand from buyers for electric vehicles, several OEMs are introducing cars with fast charging technologies to reduce the charging time, which will positively impact the demand for on board chargers during the forecast period. In the coming years, Asia-Pacific is expected to showcase surging growth owing to the rapid urbanization rate, increasing per capita disposable income, and the consumer preference shifting toward the adoption of new-energy vehicles.

Automotive On-board Charger Market Trends

The Passenger Cars Segment is Leading the On Board Charger Market

The penetration of electric passenger cars rapidly increased in recent years, owing to the government's aggressive push toward decarbonizing the transportation sector and consumers' shifting preference toward the adoption of new-energy vehicles. As more consumers are inclined to adopting passenger cars, the demand for components integrated into these cars, such as advanced on board chargers, to improve the charging efficiency of these cars will significantly increase.

As per the Society of Manufacturers of Electric Vehicles (SMEV), the electric four-wheeler sales in India touched 88,114 units in FY 2024 compared to 47,499 units in FY 2023, representing a Y-o-Y growth of 85.5% between FY 2023 and FY 2024.

The battery electric vehicle sales in the United States touched 258.8 thousand units in Q1 2023 compared to 226.7 thousand units in Q4 2022, recording a Q-o-Q growth of 14.1% between Q4 2022 and Q1 2023.

The rising investments in developing EV charging infrastructure globally are assisting the smooth transition from gasoline/diesel cars to electric cars. Consumers need to deploy many public EV charging stations so that their travel is not impacted due to the lack of charge in their vehicles. Hence, governments worldwide are investing in funding to develop the EV charging network, which, in turn, will contribute to the surging growth of on board chargers for passenger cars in the coming years.

In January 2024, the US government announced its plan to invest USD 623 million to foster the deployment of various electric vehicle charging points across the country, complementing its effort to decarbonize the transportation sector. The government stated that this funding will be disbursed through grants to 22 states nationwide to improve charging infrastructure, such as the deployment of rapid chargers in Oregon and hydrogen fuel chargers for freight trucks in Texas.

Globally, governments of many countries plan to promote green mobility by banning diesel vehicles and providing incentives to EV buyers; for instance, the United Kingdom plans to ban sales of all types of gasoline and diesel engine cars by 2040. The Government of India plans to consider a proposal to ban diesel vehicles from all Indian cities by 2027. Other European countries, such as Norway, are already establishing a framework to sell only zero-combustion cars by 2025. The comprehensive strategies being established by the governments to promote the reduction of carbon emissions are leading to increasing sales of electric passenger cars, which, in turn, is positively contributing to the demand for on board chargers in the market.

Asia-Pacific Is Expected to Lead the Automotive On Board Charger Market

Asia-Pacific is expected to lead the automotive on board charger market as it is the hub of the electric vehicle industry owing to the availability of lower-priced raw materials,

numerous electric vehicle manufacturers, growing population, and government participation. Therefore, with the expanding electric passenger cars and commercial vehicles industry in countries such as China, India, and Japan, the market for on board chargers is expected to showcase a rapid surge in the coming years across the Asia-Pacific.

As per the China Association of Automobile Manufacturers (CAAM), the monthly sales of commercial battery electric vehicles (BEVs) touched 38.000 in July 2023 compared to 33,000 units in June 2023, representing an M-o-M growth of 15.1% between June and July 2023.

According to the Japanese Automobile Inspection & Registration Information Association, the number of battery electric cars in use in Japan stood at 162.39 thousand units in 2023 compared to 138.33 thousand units in 2022, recording a Y-o-Y growth of 17.3% between 2022 and 2023.

The presence of several auto manufacturers in the region, such as BYD and Tata Motors, among others, involved in offering compatible electric vehicles is also leading in expanding the EV market, thereby fuelling the demand for on board chargers. Commercial fleet operators in the region, such as logistics and last-mile delivery service companies, are increasingly preferring to deploy electric vans and trucks in their fleet to complement the government's effort in reducing carbon emissions. With the deployment of a large number of trucks and vans expected in the coming years, the demand for on board chargers across the Asia-Pacific will increase during the forest period.

China is expected to dominate the on board chargers market in Asia-Pacific, owing to its growing electric vehicle parc and favorable policies toward establishing an EV manufacturing hub. The country's optional EV charging infrastructure is also expected to contribute to a greater adoption of EVs, which, in turn, will positively impact the demand for on board chargers in the coming years.

Automotive On-board Charger Industry Overview

The on board charger market is fragmented and highly competitive due to the presence of various international manufacturers operating in the ecosystem. Some of the major players include Delphi Technologies (BorgWarner Inc.), Hyundai Mobis, LG Corporation, STMicroelectronics, Ficosa International S.A., Valeo SE, Toyota Industries Corporation, and Bel Fuse Inc., among others. With the entry of various new electric models in the market, on board charger companies are expanding their presence by forming strategic alliances with other players and launching new automotive on board chargers.

In November 2023, BorgWarner announced its partnership with a North American-based original equipment manufacturer (OEM) to supply its bi-directional 800V Onboard Charger (OBC) for the passenger vehicle models manufactured by the OEM. The company stated that its on board chargers are equipped with silicon carbide power switches to enhance the efficiency of the vehicle and improve power conversion and safety compliance.

In June 2023, Renault and Mobilize announced its partnership to incorporate the R5's bi-directional onboard chargers into the model 5 manufactured by Renault. Mobilize stated that its bi-directional chargers, bidirectional charging station, and V2G service will assist customers reduce their charging costs since this technology helps send back electricity to the power grid.

The on board charger market is anticipated to witness massive investments in research and development to integrate advanced technology to improve the efficiency of electric vehicles and reduce the time to charge electric passenger cars or commercial vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 High Cost of On Board Chargers Hampers the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD and Volume - Units)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Powertrain Type

- 5.2.1 Battery Electric Vehicles (BEVs)

- 5.2.2 Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.3 By Power Rating

- 5.3.1 Less than 3.3 kW

- 5.3.2 3.3-11 kW

- 5.3.3 More than 11 kW

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Technologies (BorgWarner Inc.)

- 6.2.2 Hyundai Mobis

- 6.2.3 LG Corporation

- 6.2.4 STMicroelectronics

- 6.2.5 Ficosa International S.A.

- 6.2.6 Valeo SE

- 6.2.7 Delta Energy Systems AG

- 6.2.8 Toyota Industries Corporation

- 6.2.9 Brusa Elektronik AG

- 6.2.10 VisIC Technologies Ltd

- 6.2.11 Bel Fuse Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Enhancement in On Board Charger Technology to Fuel the Market Demand

8 SUPPLIER INFORMATION