PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689866

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689866

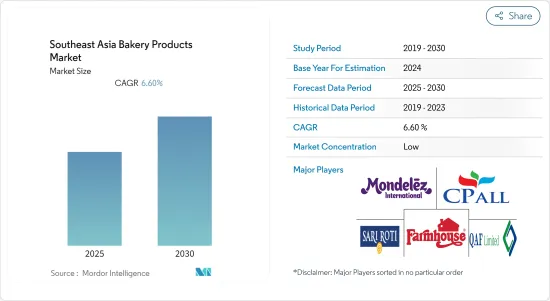

Southeast Asia Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Southeast Asia Bakery Products Market is expected to register a CAGR of 6.6% during the forecast period.

Key Highlights

- The South East Asian bakery products market is seeing an increasing demand for value-added products, particularly those that offer health benefits, specific certifications such as halal and kosher, freshness, and innovative flavors. In response to rising concerns about obesity, many companies in the region have begun to offer healthier baked goods, including high-fiber bread, gluten-free ranges, and low-fat flatbreads. Additionally, busy lifestyles and rising incomes, particularly among millennials, have led to increased demand for on-the-go snack sizes, prompting companies to offer products in convenient sizes and packaging.

- Consumers are increasingly becoming more conscious of the ingredients in their food and are seeking high-quality, better-for-you options. Many consumers also prefer simple and plain meals for snacks, which has driven demand for healthy bakery products with minimal flavors. As a result, products such as digestive biscuits, plain crackers, and other similar items are perceived as healthier alternatives, further driving the market growth. Many companies are launching healthier products in response to this trend, such as Nextar's new wheat digestive biscuits, which contain nutritional fiber and come in two varieties: chocolate and cheese.

- The growth of urbanization and the working population has significantly increased the importance of bakery products as a significant portion of the diet, particularly among the middle and lower segments of the population. The trend towards out-of-the-home consumption and the demand for instant and nutritious products are driving the need for bakery products across the South Asia bakery products market.

Southeast Asia Bakery Products Market Trends

Surge in Demand for Specialty and Healthy Bakery Products

- There has been a significant increase in the demand for natural and organic food products as consumers become more aware of the adverse health effects of consuming synthetic food ingredients that do not comply with governmental standards. In Southeast Asia, consumers are adopting Western-style diets that contain wheat and high protein content.

- Thai consumers, in particular, are seeking healthier diets, which has prompted companies to produce gluten-free baked goods and natural bakery products. Mondelez launched its gluten-free Oreo chocolate sandwich cookies in 2021, and this increased consumer demand for nutritious products and clean-label claims has accelerated market growth in the region.

- Consumers perceive their food as an opportunity to experience various tastes and textures, and they are more inclined to products that position themselves as natural and healthy. Market players are responding to this trend by incorporating "superfood" seeds into their offerings, such as chia seeds, which are rich in proteins and calcium. Oat Krunch, a brand of Munchy's group, offers healthy crackers made using oats and chia seeds. Oat Krunch is a source of fiber, is trans-fat-free, has no preservatives, and is available in dark chocolate, strawberry, and blackcurrant variants.

- The bakery industry has recently witnessed the establishment of a combination of bakeries, restaurants, cafes, and catering services. These bakery cafes or cake houses offer various products in different flavors, and the increasing demand for artisanal and healthy bakery products is further driving the bakery products in the market.

Indonesia as the Dominant Region in the Market

- The demand for bakery products in Indonesia is steadily increasing as consumers recognize them as a meal rather than just a snack. This rising consumption can be attributed to changing lifestyles, improving incomes, urbanization, and westernization.

- Consumers are now seeking unique offerings that fulfill halal requirements and offer authentic Indonesian flavors. Despite various factors affecting purchase decisions, such as cost, healthfulness, convenience, and sustainability, taste remains the primary motivator for food and beverage purchases across different baked product categories, according to the International Food Information Council Foundation.

- The German-Indonesian Chamber of Industry and Commerce reported that as of 2021, there were more than 640 registered bakery product companies operating in Indonesia, which includes both small and large enterprises. This highlights the significant growth of the bakery industry in Indonesia and the increasing competition in the market.

- Additionally, the increasing popularity of online food delivery services is contributing significantly to the growth of bakery product sales in the country. This has led to the emergence of new players in the e-commerce bakery market. One such example is Paris Baguette, a bakery company owned by SPC Group, which entered Indonesia in October 2021 and opened its first franchise location in Jakarta. The South Korean bakery and food manufacturer established a joint venture with Erajaya Group in Indonesia to tap into this market trend.

Southeast Asia Bakery Products Industry Overview

The Southeast Asia bakery products market is characterized by a high degree of fragmentation, with many organized and unorganized players offering a variety of products. Among the key players in the market are QAF Limited, President Bakery Public Company Limited, PT Nippon Indosari Corpindo TBK, CP All Public Company Limited, and Mondelez International, Inc.

One of the primary strategies adopted by these leading bakeries and companies operating in the bakery products market is product innovation. They focus on developing new flavors, attractive cakes, artisanal product designs, and eye-catching packaging to increase brand sales and attract target consumers.

To maintain their position in the market, companies are increasing their investments in research and development (R&D) and marketing and expanding their distribution channels. They are also adopting competitive strategies by investing in the development of low-calorie and low-sugar bakery goods to attract consumers with health issues.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Bread

- 5.1.2 Sweet Biscuit

- 5.1.3 Crackers and Savory Biscuits

- 5.1.4 Cakes, Pastries and Sweet Pies

- 5.1.5 Morning Goods

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/ Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Convenience/Grocery Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Vietnam

- 5.3.4 Thailand

- 5.3.5 Philippines

- 5.3.6 Myanmar

- 5.3.7 Singapore

- 5.3.8 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 PT Nippon Indosari Corpindo TBK

- 6.3.2 President Bakery Public Company Limited

- 6.3.3 Mighty Bakery SDN BHD

- 6.3.4 Mondelez International, Inc.

- 6.3.5 QAF Limited (Gardenia Bakery KL SDN BHD)

- 6.3.6 Variety Foods International Company Limited

- 6.3.7 Lotte Confectionery Co. Ltd

- 6.3.8 JG Summit Holdings (Universal Robina Corporation)

- 6.3.9 PPB Group Bhd

- 6.3.10 CP All Public Company Limited

- 6.3.11 SPC Samlip Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS