PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690694

Europe Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

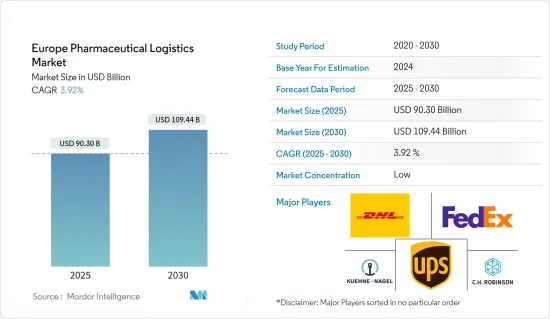

The Europe Pharmaceutical Logistics Market size is estimated at USD 90.30 billion in 2025, and is expected to reach USD 109.44 billion by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

The demand for pharmaceutical logistics in Europe is mainly driven by the increasing demand for drugs and vaccines, fueled by the COVID-19 pandemic and increasing investments by leading pharmaceutical firms. In order to restore economic growth in Europe and ensure the continued competitiveness of an increasingly competitive world economy, the R&D pharmaceutical sector plays a vital role. Europe invested EUR 44,500 million (USD 48,434 million) in research and development in 2022. It also directly employs about 865,000 people and indirectly generates about three times as many jobs as it now does, upstream and downstream.

Increasing demand for cellular therapies, vaccines, and blood products in the pharmaceutical industry is driving the growth of the region's pharmaceutical logistics market. The increase in demand for reverse logistics in the pharmaceutical sector, the rise in demand for temperature-sensitive pharmaceutical drugs, and the increase in the use of RFID technologies for pharmaceutical logistics are upcoming trends in the European pharmaceutical logistics market.

The growing pharmaceutical sales are expected to propel the growth of the healthcare logistics market. Increasing sales of pharmaceuticals are expected to boost the demand for logistics as the pharmaceutical products or drugs should be stored and transported to pharmacies, drug stores, and others, thus increasing the demand for transportation or healthcare logistics.

Europe Pharmaceutical Logistics Market Trends

Biopharma Sales in Europe is Increasing

Europe is the second-biggest biopharmaceuticals market in the world. The increasing populace and persistent sicknesses are boosting market development. The reception and openness, accessibility of biopharmaceuticals for treating and concluding illnesses, and mindfulness connected with medication have boosted the European market. To ensure the availability of secure and affordable medicines throughout the region for patients and to support the European pharmaceutical industry's ability to remain an innovator and a world leader, the European Commission established a public consultation on its proposed European drug strategy.

Pharmaceutical manufacturers increasingly focus on product quality and sensitivity. Factors such as the development of complex biological-based medicines and shipments of hormone treatments, vaccines, and complex proteins require specific results that require specialized transportation and warehousing. Temperature-controlled logistics of pharmaceutical products and medical devices is a part of the healthcare logistics industry. Moreover, the increase in the need for effective cold-chain logistics services to maintain the quality of goods fuels the growth of the pharmaceutical logistics market.

Cold chain supply chains and logistics for the pharmaceutical industry are evolving to be more strategic and reliable. High-value pharmaceutical products are mainly shipped via cold chain solutions across the entire distribution network, thus driving the market's growth.

Pharmaceutical Exports From Germany Are Increasing

Germany is the largest pharmaceutical market in Europe and the fourth-biggest in the world, as per Germany Trade and Invest (GTAI). The country is considered one of the global driving points for pharmaceutical production, and its large skilled labor force allows pharmaceutical companies to focus on other complex and challenging products, such as biosimilars, while keeping up with good manufacturing quality.

The population of Germany in 2023 was almost 84.5 million inhabitants, making it the most populated country in the European Union. The German market is ahead of the Italian, French, and Great Britain markets. Germany's total global pharmaceutical value allocation accounted for 5.9% of the global pharmaceutical industry. Germany has more than 510 pharmaceutical companies and more than 670 biotech companies. The manufactured medicines and pharma equipment were valued at EUR 31.1 billion (USD 33.1 billion) at the beginning of the pandemic.

Exports increased from EUR 50 billion (USD 53.5 billion) in 2002 to EUR 287 billion (USD 30.7 billion) in 2022. Compared to 2021 (EUR 235 billion), the 2022 total represented an increase of 22%. Imports rose from EUR 32 billion (USD 34 billion) to EUR 112 billion (USD 11.9 billion) between 2002 and 2022, rising by almost 12% from 2021 (EUR 100 billion) to 2022.

Europe Pharmaceutical Logistics Industry Overview

The European pharmaceutical logistics market is highly competitive and fragmented and consists of regional and international market players. A few existing significant players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. Some major domestic players include Eurotranspharma, Centre Specialties Pharmaceutiques, PostNL Pharma & Care, and Trans-o-Flex Schnell-Lieferdienst GmbH. These companies are implementing next-generation logistics solutions in their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends in the Industry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Value Chain / Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Over the Counter Drugs Across the European Region

- 5.1.2 Growing Manufacture Activity from Pharmaceutical Companies

- 5.2 Market Restraints

- 5.2.1 High Cost Associated with the Transportation Ordered

- 5.3 Market Opportunities

- 5.3.1 Increasing Demand for Home Healthcare Devices and Fast Track Assistance in the Healthcare Sector

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Generic Drugs

- 6.1.2 Branded Drugs

- 6.2 By Operation

- 6.2.1 Cold Chain Transport

- 6.2.2 Non-cold Chain Transport

- 6.3 By Application

- 6.3.1 Biopharma

- 6.3.2 Chemical Pharma

- 6.4 By Transportation

- 6.4.1 Airways

- 6.4.2 Railways

- 6.4.3 Roadways

- 6.4.4 Seaways

- 6.5 By Geography

- 6.5.1 Germany

- 6.5.2 United Kingdom

- 6.5.3 The Netherlands

- 6.5.4 France

- 6.5.5 Italy

- 6.5.6 Spain

- 6.5.7 Poland

- 6.5.8 Belgium

- 6.5.9 Sweden

- 6.5.10 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 FedEx

- 7.2.3 Kuehne+Nagel International AG

- 7.2.4 United Parcel Service

- 7.2.5 C.H. Robinson

- 7.2.6 CEVA Logistics

- 7.2.7 DB Schenker

- 7.2.8 Agility Logistics

- 7.2.9 Eurotranspharma

- 7.2.10 CSP*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX