PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644303

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644303

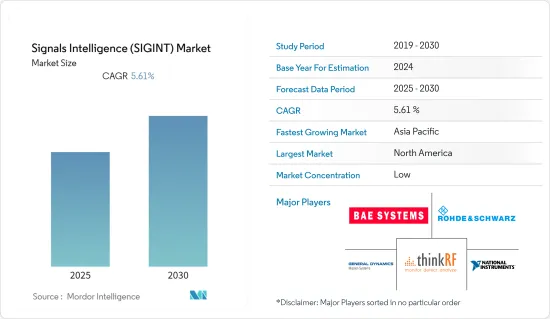

Signals Intelligence (SIGINT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Signals Intelligence Market is expected to register a CAGR of 5.61% during the forecast period.

Key Highlights

- Due to technological advancements, signal intelligence is increasingly gathered using unmanned aerial vehicles such as drones. With the growth in shifting velocities and frequency signals used for intelligence techniques, this information serves as the foundation for aerial surveillance, military and defense systems, safety measures, and security control. These systems help collect critical information on international terrorist organizations and their activities.

- Along with the rise of global terrorism, these signals serve as powerful deterrents for military officials and national governments. The signals assist in identifying potential dangers that national security forces could encounter shortly. This intelligence aids in the development of insights into opponent goals, dispute areas, threat capabilities, and necessary countermeasures. The technology suite includes a variety of sensors, radars, sonars, a command and control center, and quick interception boats outfitted with a specific suite of sensors.

- The companies are conducting significant research activities to provide innovative solutions. The companies are taking initiatives to integrate technology into their existing solutions to gain maximum market traction.

- Due to budgetary constraints and a shortage of competent staff, armies are challenged to adopt advanced and innovative technology and products. Budget restrictions frequently impede the implementation of modern communication systems.

- COVID-19 has further accelerated the need for cybersecurity as enterprises plan to execute months-long business continuity plans (BCP), including information security monitoring and response while operating under quarantine conditions focused on enhancing cybersecurity.

Signals Intelligence (SIGINT) Market Trends

Demand for Cyber Intelligence Expected to Grow Significantly

- The aerospace and defense industry is gracefully embracing technological advancements like IoT, AI, ML, and Industry 4.0, amongst other technologies, which are digitizing the operations of the defense industry significantly. The defense sector is venturing into analytics and the adoption of cloud services, which would likely help them drastically enhance productivity.

- The increasing digitization of this industry is likely to create new avenues for cybercriminal activities, and the risk can be high compared to any other sector. Compromising existing cyber defense strategies within a country can gradually lead to substantial monetary and resource loss.

- According to the US Office of Management and Budget, the United States government proposed a USD 10.89 billion budget for cyber security for the present year, and an increase from the previous fiscal year. These federal cyber security resources are intended to support a broad-based cyber security policy aimed at safeguarding the government and improving the security of key infrastructure and essential technology.

- An increase in defense expenditure for improving the government's effectiveness, efficiency, and cybersecurity capabilities is also anticipated to be a critical factor driving the implementation of these solutions. Private vendors such as Signal AI raised USD 50 million to build on their AI platform and retrieve from more diversified data sources to extract insights across an ever-wider range of business queries.

North America is Expected to Dominate the Market

- North America is the highest spending region in terms of military and defense activities, and the expenditure of the United States primarily drives it. According to the US Department of Defense, The US Navy would spend around USD 58.48 billion on military personnel in the current year, accounting for almost 25% of its entire budget plan. In the same fiscal year, the US Army would spend around USD 69.07 billion on military personnel.

- Rising incidences of terrorist attacks in recent years have compelled the region's government to implement robust physical security strategies. Hence, the companies in the country are actively focused on their product innovation strategies to offer enhanced security solutions catering to the defense industry.

- According to HackerOne, a US-based cybersecurity company, ethical hackers found almost 460 vulnerabilities in an Air Force platform during the recent iteration of the "Hack the Air Force" program. The ethical hackers have discovered approximately 12,000 vulnerabilities through the Department of defense's Hack the Pentagon initiative. The data provides a significant need for cybersecurity solutions in the aerospace sector in the form of infrastructure protection.

- The defense industry has witnessed a considerable change over the past decade. The rising advancements in information technology, upgradation of existing weapons with surveillance, intelligence, and increasing volume of classified data gathered from various systems have demanded the use of enhanced and reliable cybersecurity solutions for the defense industry. Further, the frequency and sophistication of cyberattacks are rising with the rising dependency of military organizations on the internet network. There is a considerable focus on adopting cybersecurity solutions in the defense sector to counter all these vulnerabilities.

Signals Intelligence (SIGINT) Industry Overview

The Signals Intelligence (SIGINT) Market is highly competitive owing to the presence of several global market players, such as BAE Systems, National Instruments Corporation, General Dynamics, Lockheed Martin, Northrop Grumman, and many more. The substantial increase in government spending on military and defense and the provision of government funding to the market players are factors helping the market players innovate and improvise their offerings, which in turn expands their market share and global presence. Players in the market are adopting strategies such as partnerships, mergers and acquisitions.

- July 2022 - Embraer SA, a Brazilian planemaker, announced a partnership with BAE Systems PLC to increase their presence in the global military industry, including a joint venture to create an electric aircraft defense variant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Cases of Terrorism Across the World

- 5.1.2 Growth in Defense Budgets by Several Governments

- 5.1.3 Modernization & Technological Adoption in the Defense Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Deployment Coupled and the Inability of the Technology to Eliminate Threats Completely

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Cyber Intelligence

- 6.1.2 Ground-based Intelligence

- 6.1.3 Naval Intelligence

- 6.1.4 Space Intelligence

- 6.1.5 Airborne Intelligence

- 6.2 By Type

- 6.2.1 Electronic Intelligence (ELINT)

- 6.2.2 Communications Intelligence (COMINT)

- 6.2.3 Other Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Dynamics Mission Systems, Inc.

- 7.1.2 BAE Systems PLC

- 7.1.3 National Instruments Corporation

- 7.1.4 Rohde & Schwarz GmbH & Co KG

- 7.1.5 ThinkRF Corp.

- 7.1.6 Lockheed Martin Corporation

- 7.1.7 Northrop Grumman Corporation

- 7.1.8 Thales Group

- 7.1.9 Elbit Systems Ltd.

- 7.1.10 SaaB AB

- 7.1.11 L3 Harris Corporation

- 7.1.12 Cobham PLC

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS