PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690748

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690748

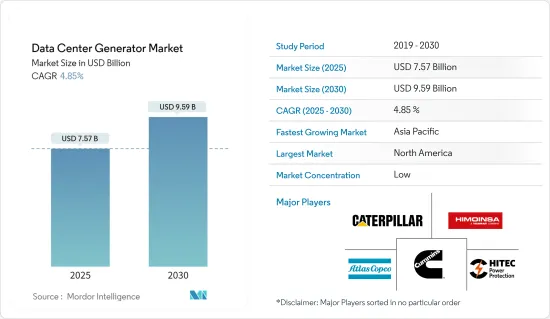

Data Center Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data Center Generator Market size is estimated at USD 7.57 billion in 2025, and is expected to reach USD 9.59 billion by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

Data centers are at significant risk of experiencing operational losses owing to power outages caused by utility grid failures, rolling blackouts, bad weather, natural or artificial calamities, or electrical breakdowns. Systems and components used in data centers are expected to operate nonstop. They require dependable, uninterrupted power seven days a week, creating a demand for the data center generator market.

The growth of digital data has significantly fueled the market studied. The need for data centers has increased as the population grows increasingly connected and dependent on digital infrastructure. The amount of digital data produced globally is growing rapidly.

Moreover, the emerging cloud technology in a wide range of data centers is one of the major factors driving the overall demand for data center systems and technologies, thereby fueling the studied market's growth. Continued high demand for data centers is expected to be driven by fast growth such as AI and other modern technologies, e.g., streaming gaming or autonomous car technology. As operators strive to provide the capacity that will allow them to meet increased power density requirements for HPC, innovation in data center design and technology may also be stimulated.

Due to an increase in data center construction and the increased number of hyperscale buildings by colocation and hyperscale operators, the global market for power generators has expanded. In several emerging countries, such as Brazil, Denmark, Singapore, Australia, Canada, India, Japan, Sweden, South Korea, and so on, several hyperscale data center projects have been identified. These projects in these countries are creating opportunities for suppliers of energy infrastructure.

The escalating growth of carbon emissions from data centers poses a significant restraint for data center operators and their generators. As the demand for digital services and storage continues to surge, the environmental impact of these facilities becomes an important concern. This issue necessitates comprehensively examining the challenges and potential solutions for mitigating carbon emissions from data centers.

With the outbreak of COVID-19, the cloud market gained significant traction as cloud-based services and tools are increasingly adopted due to organizations deploying remote work access amid lockdowns in various countries, as indicated in the graph. Most data centers worldwide witnessed a massive surge in demand owing to the growth of cloud adoption across all sizes of enterprises.

Data Center Generator Market Trends

Natural Gas Segment to Witness Major Growth

- The demand for natural gas generators in the data centers is expected to experience significant growth in the coming years owing to the benefits associated with natural gas, such as being cleaner, less expensive than other non-renewable fuels, and considerably efficient. Natural gas is also readily available in large cities since it is delivered directly through pipelines, thus positively driving the demand as the strong underground pipeline network is rarely impacted by weather. According to GGON, by October 2023, there was a total of 1,869 operational gas pipelines, and around 400 were newly proposed globally.

- Recent advances in generator technology make natural gas generators an attractive option to achieve continuous power and make strides toward corporate sustainability commitments. Natural gas is the cleanest burning of fossil fuels, is readily available in most locations, and is more cost-efficient than diesel. Built-in storage with a highly reliable natural gas grid avoids risks of limited run times and refueling, thus emerging as an attractive option for data center operators.

- Data centers are becoming more dynamic, reaching scale in size and complexity and achieving record power usage levels. As these data superusers approach zero tolerance for power outages, the demand for resilient and sustainable backup power solutions such as natural gas generators is becoming increasingly critical to maintaining today's standard for 100% uptime. Additionally, natural gas prices have remained relatively stable compared to traditional fuels, ensuring long-term cost-effectiveness for data center operators.

- Advancements in gas extraction technologies have increased availability and reduced prices, making natural gas an economically viable option for power backup in data centers. New launches of innovative natural gas engines may further positively influence the market's growth during the forecast period.

Asia-Pacific is Expected to Witness Significant Growth

- Rapid growth in the number of data centers in Asia-Pacific, supplemented with the government's initiatives, has made the region one of the fastest-expanding data center markets in the world, with fintech growth and digital transformation in the region.

- The increasing investments by global and regional facility operators and the rising adoption of public cloud and hybrid cloud services are the primary factors contributing to the growth of the APAC region's data center generator market.

- Moreover, the digital transformation across various sectors has intensified the demand for increasing data infrastructure. Due to this, many companies are launching data centers in the region. For instance, in December 2023, NTT Global Data Centers Japan, a subsidiary of NTT DATA Group Corporation, and TEPCO Power Grid, Inc. announced that both companies would launch a new company to jointly develop and operate data centers in the Inzai-Shiroi area of Greater Tokyo, Japan.

- These data centers are the backbone for the economic development of many Asian countries and require reliable power solutions to maintain continuous operations. The unpredictable nature of power supply in certain parts of the Asia-Pacific region has made data center generators indispensable for mitigating the risks associated with power fluctuations and outages.

Data Center Generator Industry Overview

The data center generator market is fragmented, with many large, technologically advanced players, such as Caterpillar, Cummins, Atlas Copco AB, HITEC Power Protection BV (Air Water Inc.), Himoinsa SL, etc. The rivalry is expected to be on the higher side. Market penetration is growing with the strong presence of major players in established markets. With the increasing focus on innovation, the demand for generators with different capacities is growing, which, in turn, is driving investments for further developments.

In December 2023, Cummins Inc. announced the launch of C1760D5, C1875D5, and C2000D5B generator models between 1700 kVA and 2000 kVA. The new models launched by the company are powered with the KTA50 engine series, designed and optimized for diverse power applications.

In October 2023, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), a part of Mitsubishi Heavy Industries (MHI) Group, approved its engine products for use with Hydrotreated Vegetable Oil (HVO). MHI Group is pursuing to achieve net zero CO2 emission by 2040 according to its declaration of "MISSION NET ZERO," and the approval of HVO aligns the effort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing Construction of Data Centers by Colocation Service Providers

- 4.2.1.2 Growing Construction of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Growing Carbon Emissions from Data Centers

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

- 4.5 Industry Value Chain Analysis

- 4.6 Environmental Impact of Diesel vs Natural Gas and Other Alternatives

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Diesel

- 5.1.2 Natural Gas

- 5.1.3 Other Product Types

- 5.2 By Capacity

- 5.2.1 Less than 1MW

- 5.2.2 1-2MW

- 5.2.3 Greater than 2MW

- 5.3 By Tier

- 5.3.1 Tier I and II

- 5.3.2 Tier III

- 5.3.3 Tier IV

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Caterpillar Inc.

- 6.1.2 Atlas Copco AB

- 6.1.3 Cummins Inc.

- 6.1.4 HITEC Power Protection BV (Air Water Inc.)

- 6.1.5 Himoinsa SL

- 6.1.6 Kohler Co.

- 6.1.7 Mitsubishi Heavy Industries Group (MHI)

- 6.1.8 Generac Power Systems Inc. (Generac Holdings Inc.)

- 6.1.9 Rolls-Royce Holdings PLC

- 6.1.10 Aksa Power Generation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET