PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689891

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689891

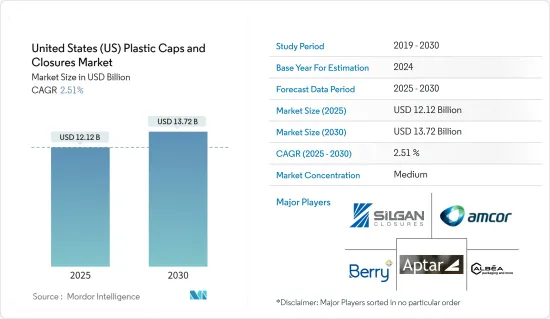

United States (US) Plastic Caps and Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Plastic Caps and Closures Market size is estimated at USD 12.12 billion in 2025, and is expected to reach USD 13.72 billion by 2030, at a CAGR of 2.51% during the forecast period (2025-2030).

Key Highlights

- Plastic caps and closures utilize PP and PE as primary raw materials for manufacturing. Industries heavily rely on these materials, providing a cost-effective sealing solution. The demand for packaged food and pharmaceutical drugs has been steadily increasing, consequently impacting the caps and closures market, which is expected to see a rise in demand during the forecast period.

- Similarly, amid a growing trend of health-consciousness among consumers, the demand for packaged beverages and pharmaceutical drugs is surging, propelling the caps and closures market. This rise is particularly pronounced in the plastic caps and closures segment, driven by the increasing accessibility of bottled water, which is a favored choice for health-conscious consumers.

- Notably, in 2023, the Beverage Marketing Corporation and the International Bottled Water Association reported that bottled water claimed the top spot as the most consumed beverage in the United States. While the growth rate in the sector has tapered, the leading beverage category, in terms of volume, marked record highs in both producer revenues and total gallons. Specifically, in 2023, the bottled water market saw a modest increase of 0.4%, a slowdown from the 1.1% growth in 2022 and a significant decline from the robust growth rates of 4.6% and 4.1% observed in 2021 and 2020, respectively.

- Also, the rise in bottled water demand among customers in the United States is propelling the plastic caps and closures market. These components are essential for sealing water bottles to prevent spills, facilitate transportation, and enhance shelf life. The growing awareness of water contamination and safety concerns is driving up the demand for bottled water, a trend expected to continue during the forecast period, potentially spiking the demand for plastic caps across the market.

- Raw material prices directly impact the cost of plastic caps and closures. When the price of plastic resins rises, manufacturers face increased costs in sourcing, processing, and transforming these materials into packaging products. The escalation in raw material costs can strain profit margins, particularly if manufacturers cannot pass on the increased costs to customers. Consequently, this may result in reduced investments in innovation, expansion, or even downsizing, thus restraining the market's growth.

United States (US) Plastic Caps and Closures Market Trends

Polyethylene (PE) is expected to be the Fastest Growing Raw Material Segment

- Polyethylene (PE) is one of the most durable plastics available, exhibiting resistance to chemicals and boasting a low cost. Derived from petroleum polymers, PE can withstand various environmental hazards, typically categorized as high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- HDPE and LDPE represent the primary materials used in caps and closures. HDPE variants find extensive use in water, dairy, and juice bottles, favored for their excellent organoleptic properties, particularly in water bottle closures, due to their longstanding preference. Renowned for strength and durability, HDPE plastics can be color-matched and commonly found in white. Its adaptability and durability position HDPE as a top choice for cosmetic bottles.

- Borealis notes that the growth in HDPE caps and closures is largely attributed to the replacement of metal caps on glass bottles (by PET) and shifting consumption patterns favoring smaller bottles for refreshments.

- According to the American Chemistry Council, in 2023, the United States produced 7.05 billion pounds of polyethylene, including HDPE, LDPE, and LLDPE. Injection molding technology, particularly influential in the LDPE segment, contributes to the production of medical devices, caps, and closures.

- Due to its strength and cost-effectiveness, many industries in the United States prefer HDPE over LDPE. HDPE's rigidity makes it an ideal packaging choice for impact-resistant goods. The chemical industry emerges as a major consumer, propelling the market's growth.

- The US plastic caps and closures market is experiencing a notable increase, driven by a strategic emphasis on the polyethylene industry's export initiatives. Asia has emerged as a critical market for these exports. According to data from the US Commerce Department, US PE export shipments in the first quarter of 2023 increased by 30% compared to the previous year, totaling 3,196,437 million metric tons (mt) or 7.05 billion pounds.

The Beverage Segment is expected to Hold Major Market Share

- Caps and closures are crucial in sealing containers, pouches, and bottles in the beverage industry, encompassing carbonated and non-carbonated drinks. They safeguard against foreign particles and preserve the flavor and taste of beverages. The beverage segment encompasses bottled water, fruit juices, ready-to-drink beverages, and energy drinks.

- The escalating demand for single-serve beverages, coupled with the hot fill process that extends the shelf life of packaged drinks, is set to propel growth in the US caps and closures market. Companies favor plastic bottles for hot fill processes as they eliminate the need for preservatives, enhancing the drink's health quotient. Notably, the advantages of hot-fill plastic bottles include extended product shelf life and preservative-free content, their lightweight composition, and their cost-effectiveness due to their plastic composition.

- Hot-fill plastic bottles are increasingly prevalent as various hot-fill processes become commonplace in the beverage industry. The rising prominence of hot-fill applications, particularly in the ready-to-drink segment, is anticipated to drive market growth.

- The market for sports caps is expanding alongside the increasing demand for bottled water and energy drinks. Despite their weight, sports closures offer tamper-evident features. Diverse sports closure designs vary in aesthetics, neck diameters, and tamper-evident solutions catering to cold, dry, or wet aseptic filling requirements. According to Beverage Digest, in 2023, Coca-Cola's retail volume share of the US carbonated soft drink (CSD) market exceeded 40%. North America accounted for nearly 37% of the Coca-Cola Company's total revenue during the same period. The company's global net operating revenue in 2023 was approximately USD 46 billion.

- Another influential trend impacting beverage closures is the rise of e-commerce. The convenience of online shopping presents an opportunity for companies to access new consumers and cater to the growing demand for at-home delivery. Consequently, more food and beverage sales are transitioning to direct-to-consumer e-commerce platforms.

United States (US) Plastic Caps and Closures Market Overview

The plastic caps and closures market maintains a semi-consolidated structure in the United States, a trend expected to continue during the forecast period. Key characteristics of this market include moderate exit barriers, a preference for established brands, and significant merger and acquisition activities. Noteworthy players in this market landscape are Silgan Closures (Silgan Holdings Inc.), Amcor Ltd, Aptargroup Inc., Berry Global Inc., and Albea Services SAS.

In March 2024 - Subway, a global restaurant brand, announced a 10-year agreement with PepsiCo to supply beverages in US restaurants beginning January 1, 2025. Subway's longstanding partnership with Frito-Lay will extend through 2030, bringing the brand's US snack and beverage portfolio together under one supplier and driving more efficiency across the system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Packaged Food and Pharmaceutical Drugs

- 5.1.2 Increasing Demand from Small and Medium-Scale End-user Industries

- 5.2 Market Challenges

- 5.2.1 Fluctuation in the Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Materials (Polystyrene and PVC)

- 6.2 By Type

- 6.2.1 Threaded

- 6.2.2 Dispensing

- 6.2.3 Unthreaded

- 6.2.4 Child-resistant

- 6.3 By Application

- 6.3.1 Food

- 6.3.2 Pharmaceutical and Healthcare

- 6.3.3 Beverage

- 6.3.4 Cosmetics and Toiletries

- 6.3.5 Household Chemicals

- 6.3.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silgan Closures (Silgan Holdings Inc.)

- 7.1.2 Amcor Ltd

- 7.1.3 Aptargroup Inc.

- 7.1.4 Berry Global Inc.

- 7.1.5 Albea Services SAS

- 7.1.6 Trimas Corporation

- 7.1.7 Tetra Pak International SA

- 7.1.8 Guala Closures Group (Guala Pack SPA)

- 7.1.9 MJS Packaging

- 7.1.10 O Berk Company LLC

- 7.1.11 Closure Systems International Inc.

- 7.1.12 Bericap Holding

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS