PUBLISHER: Roots Analysis | PRODUCT CODE: 1721379

PUBLISHER: Roots Analysis | PRODUCT CODE: 1721379

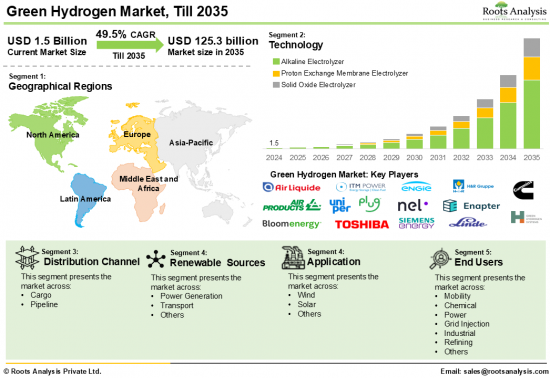

Green Hydrogen Market: Industry Trends and Global Forecasts, Till 2035: Distribution by Technology, Distribution Channel, Renewable Sources, Storage, Applications, Production Scale, Purity Level, End Users and Geography

Green Hydrogen Market Overview

As per Roots Analysis, the global green hydrogen market size is estimated to grow from USD 1.5 billion in the current year to USD 125.3 billion by 2035, at a CAGR of 49.5% during the forecast period, till 2035.

The opportunity for green hydrogen market has been distributed across the following segments:

Technology

- Alkaline Electrolyzer

- Proton Exchange Membrane Electrolyzer

- Solid Oxide Electrolyzer

Distribution Channel

- Cargo

- Pipeline

Renewable Sources

- Wind

- Solar

- Hydrothermal

- Power Thermal

- Others

Storage

- Compressed Gas

- Liquid Hydrogen

- Metal Hydrides

- Underground Storage

Application

- Fuel Cells

- Power-to-Gas

- Ammonia Production

- Methanol Production

- Refining

Production Scale

- Small-scale (< 1 MW)

- Medium-scale (1-10 MW)

- Large-scale (> 10 MW)

Purity Level

- Ultra-high Purity (99.999%+)

- High Purity (99.99%+)

- Standard Purity (99.9%+)

End Users

- Mobility

- Chemical

- Power

- Grid Injection

- Industrial

- Refining

- Others

Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

GREEN HYDROGEN MARKET: GROWTH AND TRENDS

Hydrogen is among the colorless chemical elements found on the planet, utilized across a variety of sectors, including vehicle propulsion, electricity generation for residential heating, and supporting businesses. However, traditional hydrogen production methods heavily rely on fossil fuels, which significantly contribute to climate change through greenhouse gas emissions and other environmental risks. In fact, hydrogen currently accounts for more than 2% of the total global CO2 emissions. These concerns have led to the emergence of cleaner hydrogen alternatives in the market, such as green and blue hydrogen.

Green hydrogen is generated through the electrolysis of water using renewable energy sources like wind, solar, and hydroelectric power. This process involves splitting a water molecule into hydrogen and oxygen, resulting in minimal to no greenhouse gas emissions, thus providing numerous advantages in achieving carbon neutrality and reducing ecological impact. In addition to serving as a fuel for transportation, powering fuel cell electric vehicles (FCEVs), green hydrogen can also act as an energy storage solution. Therefore, it offers industries an efficient and cleaner option to decrease their carbon emissions.

Moreover, the growth of the green hydrogen sector has been expedited by the Paris Agreement aimed at combating climate change. Countries that have signed this agreement are dedicated to lowering greenhouse gas emissions through the adoption of cleaner energy sources. Consequently, it establishes a more favorable regulatory landscape and market conditions that can support the application of green hydrogen and encourage the development of various green hydrogen initiatives globally. With the rising demand for clean energy options and nations' commitment to reducing emissions, the green hydrogen market is expected to witness significant growth during the upcoming forecast period.

GREEN HYDROGEN MARKET: KEY SEGMENTS

Market Share by Technology

Based on technology, the global green hydrogen market is segmented into alkaline electrolyzer, proton exchange membrane electrolyzer (PEM) and solid oxide electrolyzer (SOEC). According to our estimates, currently, proton exchange membrane electrolyzers segment captures the majority share of the market. This can be attributed to the multiple benefits provided by PEM electrolyzers, including enhanced electrical efficiency and a rapid response time, enabling swift adjustments during variations in renewable energy supply.

Market Share by Distribution Channel

Based on distribution channel, the green hydrogen market is segmented into cargo and pipeline. According to our estimates, currently, pipelines segment captures the majority share of the market. This can be attributed to their economical nature and capability to transport substantial amounts of hydrogen over long distances efficiently. Additionally, the availability of hydrogen in multiple forms, such as liquid, gas, or processed variations (like methanol or ammonia), makes pipelines the most viable transportation option.

Market Share by Renewable Sources

Based on renewable sources, the green hydrogen market is segmented into wind, solar and others. According to our estimates, currently, solar renewable source segment captures the majority share of the market. This can be attributed to the declining costs of solar photovoltaic (PV) technology, owing to advancements in the PV sector, making it a more appealing choice for hydrogen generation. This financial feasibility is essential for the progress of green hydrogen, as production costs pose a significant challenge.

Market Share by Storage

Based on storage, the green hydrogen market is segmented into compressed gas, liquid hydrogen, metal hydrides and underground storage. According to our estimates, currently, liquid hydrogen segment captures the majority share of the market. This can be attributed to its high density and greater stability compared to other forms, which facilitate handling and transportation. Moreover, it can be stored in cryogenic tanks and transported using tanker trucks or ships. Additionally, for long-distance transport, liquid hydrogen is more cost-effective than gaseous hydrogen, as a liquid transport truck can accommodate more hydrogen than a gaseous tube trailer.

Market Share by Application

Based on application, the green hydrogen market is segmented into fuel cells, power-to-gas, ammonia production, methanol production and refining. According to our estimates, currently, fuel cells segment captures the majority share of the market. This is primarily because green hydrogen serves as a fuel in the automotive and transportation industries, offering an alternative to traditional fossil fuel-powered vehicles. Additionally, it can power fuel cell electric vehicles (FCEVs), providing a longer range and quicker refueling times compared to battery electric vehicles.

Market Share by Production Scale

Based on production scale, the green hydrogen market is segmented into small-scale (< 1 MW), medium-scale (1-10 MW) and large-scale (> 10 MW). According to our estimates, currently, large-scale (> 10 MW) hydrogen plants capture the majority share of the market. This can be attributed to the fact that these plants can provide energy for several industries, including transportation, chemicals, and power, while small-scale and medium-scale facilities generally cater to small communities with the potential to supply power to local grids.

Market Share by Purity Level

Based on purity level, the green hydrogen market is segmented into ultra-high purity (99.999%+), high purity (99.99%+) and standard purity (99.9%+). According to our estimates, currently, ultra-high purity green hydrogen captures the majority share of the market. This can be attributed to fact that high purity hydrogen is crucial for making a variety of industries more environmentally sustainable.

Moreover, the demand for these green hydrogen sources is on the rise across multiple sectors such as electronics, the semiconductor industry, chemical manufacturing, and energy production, as a means to combat climate change by lowering greenhouse gas emissions released into the atmosphere.

Market Share by End User

Based on end users, the green hydrogen market is segmented mobility, chemical, power, grid injection, industrial, refining, others. According to our estimates, currently, industrial end users captures the majority share of the market. This can be attributed to the fact that industries are encouraged to implement sustainable practices. Produced from renewable energy sources like wind and solar power, green hydrogen and its derivatives are emerging as promising solutions.

This aligns with sustainability initiatives in agriculture-based economies, contributing to market expansion. Additionally, since industrial end users are significant sources of greenhouse gas emissions, governments have put strict regulations in place to promote the adoption of sustainable packaging materials.

Example Players in Green Hydrogen Market

- Air Liquide

- Air Products

- Bloom Energy

- Cummins

- Enapter

- ENGIE

- Green Hydrogen Systems

- H&R Olwerke Schindler

- ITM Power

- Linde

- Nel ASA

- Plug Power

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper

GREEN HYDROGEN MARKET: RESEARCH COVERAGE

The report on the green hydrogen market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the Green hydrogen market, focusing on key market segments, including [A] technology, [B] distribution channel, [C] renewable sources, [D] storage, [E] application, [F] production scale, [G] purity level, [H] end users [I] geography.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the Green hydrogen market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure, [E] technology, [F] distribution channel, [G] renewable sources, [H] applications, [I] production scale, [J] purity level, and [K] end users.

- Company Profiles: Elaborate profiles of prominent players engaged in the Green hydrogen market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] Green hydrogen portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in green hydrogen market?

- Which are the leading companies in this market?

- What is the significance of edge AI in the Green hydrogen market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- Which type of Green hydrogen is expected to dominate the market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PROJECT BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on Market

- 3.2.2.4. Strategies For Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1. Insights on Market Landscape of Leading Players in the Green Hydrogen Industry

- 4.2. Insights on Market Landscape of Startups in the Green Hydrogen Industry

- 4.3. Insights on Global Green Hydrogen Market

- 4.4. Insights on Global Green Hydrogen Market by Technology

- 4.5. Insights on Global Green Hydrogen Market by Distribution Channel

- 4.6. Insights on Global Green Hydrogen Market by Renewable Sources

- 4.7. Insights on Global Green Hydrogen Market by Applications

- 4.8. Insights on Global Green Hydrogen Market by Production Scale

- 4.9. Insights on Global Green Hydrogen Market by Purity Level

- 4.10. Insights on Global Green Hydrogen Market by End Users

- 4.11. Insights on Global Green Hydrogen Market by Geography

5. GREEN HYDROGEN MARKET: MEGATRENDS ANALYSIS

- 5.1 Megatrends in the Green Hydrogen Market

6. INTRODUCTION

- 6.1. Overview of the Green Hydrogen Industry

- 6.1.1. Technological Trends

- 6.2. COVID-19 impact on the Green Hydrogen Market

- 6.3. Challenges Prevailing in the Green Hydrogen Industry

- 6.4. Recent Developments in the Green Hydrogen Industry

- 6.5. Future Perspectives

7. GREEN HYDROGEN MARKET: VALUE CHAIN ANALYSIS

- 7.1. Brief Overview on Green Hydrogen Manufacturing Process and Stakeholders Involved

- 7.2. The Evolving Requirements of Stakeholders and Conclusion

8. COMPETITIVE LANDSCAPE: LEADING PLAYERS IN THE GREEN HYDROGEN MARKET

- 8.1. Green Hydrogen Market: Market Landscape of Leading Players

- 8.1.1. Analysis by Year of Establishment

- 8.1.2. Analysis by Company Size

- 8.1.3. Analysis by Company Size and Year of Establishment

- 8.1.4. Analysis by Location of Headquarters

- 8.1.5. Analysis by Company Size and Location of Headquarters

- 8.1.6. Analysis by Technology

- 8.1.7. Analysis by Distribution Channel

- 8.1.8. Analysis by Renewable Sources

- 8.1.9. Analysis by Applications

- 8.1.10. Analysis by Production Scale

- 8.1.11. Analysis by Purity Level

- 8.1.12. Analysis by End Users

9. STARTUP ECOSYSTEM IN THE GREEN HYDROGEN MARKET

- 9.1. Green Hydrogen Market: Market Landscape of Startups

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Company Size and Year of Establishment

- 9.1.4. Analysis by Location of Headquarters

- 9.1.5. Analysis by Company Size and Location of Headquarters

- 9.1.6. Analysis by Technology

- 9.1.7. Analysis by Distribution Channel

- 9.1.8. Analysis by Renewable Sources

- 9.1.9. Analysis by Applications

- 9.1.10. Analysis by Production Scale

- 9.1.11. Analysis by Purity Level

- 9.1.12. Analysis by End Users

10. PATENT ANLYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Green Hydrogen Market: Patent Analysis

- 10.3.1. Analysis by Patent Publication Year

- 10.3.2. Analysis by Patent Application Year

- 10.3.3. Analysis of Granted Patents and Patent Applications by Publication Year

- 10.3.4. Analysis by Patent Jurisdiction

- 10.3.5. Analysis by CPC Symbols

- 10.3.6. Analysis by Type of Applicant

- 10.3.7. Leading Industry Players: Analysis by Number of Patents

- 10.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 10.4. Green Hydrogen Market: Patent Benchmarking Analysis

- 10.4.1. Analysis by Patent Characteristics

- 10.5. Green Hydrogen Market: Patent Valuation

- 10.6. Leading Patents by Number of Citations

11. DEMAND ANALYSIS

- 11.1. Chapter Overview

- 11.2. Assumptions and Methodology

- 11.3. Global Annual Demand for Green Hydrogen, till 2035

- 11.3.1. Annual Commercial Demand for Green Hydrogen: Distribution by End User, till 2035

- 11.3.1.1. Annual Commercial Demand for Green Hydrogen by Mobility End User, till 2035

- 11.3.1.2. Annual Commercial Demand for Green Hydrogen by Chemical End User, till 2035

- 11.3.1.3. Annual Commercial Demand for Green Hydrogen by Power End User, till 2035

- 11.3.1.4. Annual Commercial Demand for Green Hydrogen by Grid Injection End User, till 2035

- 11.3.1.5. Annual Commercial Demand for Green Hydrogen by Industrial End User, till 2035

- 11.3.1.6. Annual Commercial Demand for Green Hydrogen by Refining End User, till 2035

- 11.3.1.7. Annual Commercial Demand for Green Hydrogen by Other End User, till 2035

- 11.3.2. Annual Commercial Demand for Green Hydrogen: Distribution by Geography, till 2035

- 11.3.2.1. Annual Commercial Demand for Green Hydrogen in North America, till 2035

- 11.3.2.2. Annual Commercial Demand for Green Hydrogen in Europe, till 2035

- 11.3.2.3. Annual Commercial Demand for Green Hydrogen in Asia-Pacific, till 2035

- 11.3.2.4. Annual Commercial Demand for Green Hydrogen in Latin America, till 2035

- 11.3.2.5. Annual Commercial Demand for Green Hydrogen in Middle East and North Africa, till 2035

- 11.3.1. Annual Commercial Demand for Green Hydrogen: Distribution by End User, till 2035

12. SUPPLY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Assumption and Methodology

- 12.3. Global Annual Supply of Green Hydrogen, till 2035

- 12.3.1. Annual Supply of Green Hydrogen: Distribution by End User, till 2035

- 12.3.1.1. Annual Supply of Green Hydrogen for Mobility End User, till 2035

- 12.3.1.2. Annual Supply of Green Hydrogen for Chemical End User, till 2035

- 12.3.1.3. Annual Supply of Green Hydrogen for Power End User, till 2035

- 12.3.1.4. Annual Supply of Green Hydrogen for Grid Injection End User, till 2035

- 12.3.1.5. Annual Supply of Green Hydrogen for Industrial End User, till 2035

- 12.3.1.6. Annual Supply of Green Hydrogen for Refining End User, till 2035

- 12.3.1.7. Annual Supply of Green Hydrogen for Other End User, till 2035

- 12.3.2. Annual Supply of Green Hydrogen: Distribution by Geography, till 2035

- 12.3.2.1. Annual Supply of Green Hydrogen in North America, till 2035

- 12.3.2.2. Annual Supply of Green Hydrogen in Europe, till 2035

- 12.3.2.3. Annual Supply of Green Hydrogen in Asia-Pacific, till 2035

- 12.3.2.4. Annual Supply of Green Hydrogen in Latin America, till 2035

- 12.3.2.5. Annual Supply of Green Hydrogen in Middle East and North Africa, till 2035

- 12.3.1. Annual Supply of Green Hydrogen: Distribution by End User, till 2035

13. TOTAL COST OF OWNERSHIP IN GREEN HYDROGEN MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Output

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL GREEN HYDROGEN MARKET

- 15.1. Assumptions and Methodology

- 15.2. Global Green Hydrogen Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.2.1. Scenario Analysis

- 15.2.1.1. Conservative Scenario

- 15.2.1.2. Optimistic Scenario

- 15.2.1. Scenario Analysis

- 15.3. Global Green Hydrogen Market: Distribution by Geography, 2018, 2024 and 2035

- 15.4. Key Market Segmentations

16. GREEN HYDROGEN MARKET, BY TECHNOLOGY

- 16.1. Assumptions and Methodology

- 16.2. Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 16.2.1. Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.2. Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.3. Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3. Data Triangulation and Validation

17. GREEN HYDROGEN MARKET, BY DISTRIBUTION CHANNEL

- 17.1. Assumptions and Methodology

- 17.2. Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 17.2.1. Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.2.2. Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3. Data Triangulation and Validation

18. GREEN HYDROGEN MARKET, BY RENEWABLE SOURCES

- 18.1. Assumptions and Methodology

- 18.2. Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 18.2.1. Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.2. Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.3. Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.4. Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 18.2.5. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3. Data Triangulation and Validation

19. GREEN HYDROGEN MARKET, BY STORAGE

- 19.1. Assumptions and Methodology

- 19.2. Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 19.2.1. Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.2. Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.3. Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.4. Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3. Data Triangulation and Validation

20. GREEN HYDROGEN MARKET, BY APPLICATIONS

- 20.1. Assumptions and Methodology

- 20.2. Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 20.2.1. Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.2. Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.3. Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.4. Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.5. Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3. Data Triangulation and Validation

21. GREEN HYDROGEN MARKET, BY PRODUCTION SCALE

- 21.1. Assumptions and Methodology

- 21.2. Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 21.2.1. Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.2. Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.3. Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3. Data Triangulation and Validation

22. GREEN HYDROGEN MARKET, BY PURITY LEVEL

- 22.1. Assumptions and Methodology

- 22.2. Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 22.2.1. Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.2. Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.3. Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3. Data Triangulation and Validation

23. GREEN HYDROGEN MARKET, BY END USERS

- 23.1. Assumptions and Methodology

- 23.2. Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 23.2.1. Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.2. Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.3. Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.4. Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.5. Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.6. Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.7. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3. Data Triangulation and Validation

24. NORTH AMERICA GREEN HYDROGEN MARKET

- 24.1. Assumptions and Methodology

- 24.2. North America Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 24.2.1. North America Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.2.2. North America Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.2.3. North America Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.3. North America Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 24.3.1. North America Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.3.2. North America Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 203

- 24.4. North America Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 24.4.1. North America Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.4.2. North America Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.4.3. North America Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.4.4. North America Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 24.4.5. North America Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.5. North America Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 24.5.1. North America Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.5.2. North America Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.5.3. North America Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.5.4. North America Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6. North America Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 24.6.1. North America Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.2. North America Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.3. North America Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.4. North America Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.6.5. North America Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.7. North America Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 24.7.1. North America Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.7.2. North America Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.7.3. North America Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.8. North America Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 24.8.1. North America Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.8.2. North America Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.8.3. North America Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9. North America Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 24.9.1. North America Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.2. North America Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.3. North America Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.4. North America Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.5. North America Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.6. North America Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.9.7. North America Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.10. Green Hydrogen Market in the US (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.11. Green Hydrogen Market in Canada (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 24.12. Data Triangulation and Validation

25. EUROPE GREEN HYDROGEN MARKET

- 25.1. Assumptions and Methodology

- 25.2. Europe Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 25.2.1. Europe Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.2.2. Europe Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.2.3. Europe Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.3. Europe Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 25.3.1. Europe Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.3.2. Europe Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 203

- 25.4. Europe Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 25.4.1. Europe Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.4.2. Europe Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.4.3. Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.4.4. Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 25.4.5. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.5. Europe Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 25.5.1. Europe Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.5.2. Europe Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.5.3. Europe Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.5.4. Europe Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6. Europe Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 25.6.1. Europe Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.2. Europe Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.3. Europe Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.4. Europe Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.6.5. Europe Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.7. Europe Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 25.7.1. Europe Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.7.2. Europe Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.7.3. Europe Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.8. Europe Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 25.8.1. Europe Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.8.2. Europe Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.8.3. Europe Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9. Europe Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 25.9.1. Europe Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.2. Europe Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.3. Europe Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.4. Europe Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.5. Europe Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.6. Europe Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.9.7. Europe Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.10. Green Hydrogen Market in Germany (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.11. Green Hydrogen Market in France (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.12. Green Hydrogen Market in Italy (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.13. Green Hydrogen Market in the UK (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.14. Green Hydrogen Market in Spain (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.15. Green Hydrogen Market in Rest of Europe (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 25.16. Data Triangulation and Validation

26. ASIA-PACIFIC GREEN HYDROGEN MARKET

- 26.1. Assumptions and Methodology

- 26.2. Asia-Pacific Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 26.2.1. Asia-Pacific Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.2.2. Asia-Pacific Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.2.3. Asia-Pacific Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.3. Asia-Pacific Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 26.3.1. Asia-Pacific Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.3.2. Asia-Pacific Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 203

- 26.4. Asia-Pacific Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 26.4.1. Asia-Pacific Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.4.2. Asia-Pacific Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.4.3. Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.4.4. Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 26.4.5. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.5. Asia-Pacific Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 26.5.1. Asia-Pacific Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.5.2. Asia-Pacific Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.5.3. Asia-Pacific Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.5.4. Asia-Pacific Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.6. Asia-Pacific Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 26.6.1. Asia-Pacific Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.6.2. Asia-Pacific Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.6.3. Asia-Pacific Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.6.4. Asia-Pacific Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.6.5. Asia-Pacific Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.7. Asia-Pacific Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 26.7.1. Asia-Pacific Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.7.2. Asia-Pacific Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.7.3. Asia-Pacific Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.8. Asia-Pacific Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 26.8.1. Asia-Pacific Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.8.2. Asia-Pacific Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.8.3. Asia-Pacific Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9. Asia-Pacific Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 26.9.1. Asia-Pacific Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.2. Asia-Pacific Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.3. Asia-Pacific Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.4. Asia-Pacific Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.5. Asia-Pacific Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.6. Asia-Pacific Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.9.7. Asia-Pacific Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.10. Green Hydrogen Market in China (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.11. Green Hydrogen Market in Japan (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.12. Green Hydrogen Market in South Korea (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.13. Green Hydrogen Market in India (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.14. Green Hydrogen Market in Australia (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.15. Green Hydrogen Market in Rest of Asia-Pacific (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 26.16. Data Triangulation and Validation

27. LATIN AMERICA GREEN HYDROGEN MARKET

- 27.1. Assumptions and Methodology

- 27.2. Latin America Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 27.2.1. Latin America Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.2.2. Latin America Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.2.3. Latin America Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.3. Latin America Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 27.3.1. Latin America Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.3.2. Latin America Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 203

- 27.4. Latin America Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 27.4.1. Latin America Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.4.2. Latin America Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.4.3. Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.4.4. Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 27.4.5. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.5. Latin America Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 27.5.1. Latin America Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.5.2. Latin America Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.5.3. Latin America Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.5.4. Latin America Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.6. Latin America Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 27.6.1. Latin America Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.6.2. Latin America Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.6.3. Latin America Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.6.4. Latin America Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.6.5. Latin America Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.7. Latin America Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 27.7.1. Latin America Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.7.2. Latin America Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.7.3. Latin America Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.8. Latin America Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 27.8.1. Latin America Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.8.2. Latin America Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.8.3. Latin America Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9. Latin America Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 27.9.1. Latin America Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.2. Latin America Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.3. Latin America Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.4. Latin America Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.5. Latin America Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.6. Latin America Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.9.7. Latin America Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.10. Green Hydrogen Market in Brazil (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.11. Green Hydrogen Market in Argentina (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.12. Green Hydrogen Market in Rest of Latin America (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 27.13. Data Triangulation and Validation

28. MIDDLE EAST AND NORTH AFRICA GREEN HYDROGEN MARKET

- 28.1. Assumptions and Methodology

- 28.2. Middle East and North Africa Green Hydrogen Market: Distribution by Technology, 2018, 2024 and 2035

- 28.2.1. Middle East and North Africa Green Hydrogen Market for Alkaline Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.2.2. Middle East and North Africa Green Hydrogen Market for Proton Exchange Membrane Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.2.3. Middle East and North Africa Green Hydrogen Market for Solid Oxide Electrolyzer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.3. Middle East and North Africa Green Hydrogen Market: Distribution by Distribution Channel, 2018, 2024 and 2035

- 28.3.1. Middle East and North Africa Green Hydrogen Market for Cargo (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.3.2. Middle East and North Africa Green Hydrogen Market for Pipeline (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 203

- 28.4. Middle East and North Africa Green Hydrogen Market: Distribution by Renewable Sources, 2018, 2024 and 2035

- 28.4.1. Middle East and North Africa Green Hydrogen Market for Wind (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.4.2. Middle East and North Africa Green Hydrogen Market for Solar (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.4.3. Green Hydrogen Market for Hydrothermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.4.4. Green Hydrogen Market for Power Thermal (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035

- 28.4.5. Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.5. Middle East and North Africa Green Hydrogen Market: Distribution by Storage, 2018, 2024 and 2035

- 28.5.1. Middle East and North Africa Green Hydrogen Market for Compressed Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.5.2. Middle East and North Africa Green Hydrogen Market for Liquid Hydrogen (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.5.3. Middle East and North Africa Green Hydrogen Market for Metal Hydrides (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.5.4. Middle East and North Africa Green Hydrogen Market for Underground Storage (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.6. Middle East and North Africa Green Hydrogen Market: Distribution by Applications, 2018, 2024 and 2035

- 28.6.1. Middle East and North Africa Green Hydrogen Market for Fuel Cells (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.6.2. Middle East and North Africa Green Hydrogen Market for Power-to-Gas (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.6.3. Middle East and North Africa Green Hydrogen Market for Ammonia Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.6.4. Middle East and North Africa Green Hydrogen Market for Methanol Production (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.6.5. Middle East and North Africa Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.7. Middle East and North Africa Green Hydrogen Market: Distribution by Production Scale, 2018, 2024 and 2035

- 28.7.1. Middle East and North Africa Green Hydrogen Market for Small-scale (< 1 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.7.2. Middle East and North Africa Green Hydrogen Market for Medium-scale (1-10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.7.3. Middle East and North Africa Green Hydrogen Market for Large-scale (> 10 MW) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.8. Middle East and North Africa Green Hydrogen Market: Distribution by Purity Level, 2018, 2024 and 2035

- 28.8.1. Middle East and North Africa Green Hydrogen Market for Ultra-high Purity (99.999%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.8.2. Middle East and North Africa Green Hydrogen Market for High Purity (99.99%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.8.3. Middle East and North Africa Green Hydrogen Market for Standard Purity (99.9%+) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9. Middle East and North Africa Green Hydrogen Market: Distribution by Type of End Users, 2018, 2024 and 2035

- 28.9.1. Middle East and North Africa Green Hydrogen Market for Mobility (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.2. Middle East and North Africa Green Hydrogen Market for Chemical (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.3. Middle East and North Africa Green Hydrogen Market for Power (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.4. Middle East and North Africa Green Hydrogen Market for Grid Injection (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.5. Middle East and North Africa Green Hydrogen Market for Industrial (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.6. Middle East and North Africa Green Hydrogen Market for Refining (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.9.7. Nor Middle East and North Africa Green Hydrogen Market for Others (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.10. Green Hydrogen Market in Africa (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.11. Green Hydrogen Market in UAE (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.12. Green Hydrogen Market in Rest of Middle East and Africa (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 28.13. Data Triangulation and Validation

29. COMPANY PROFILES

- 29.1. Chapter Overview

- 29.2. Leading Players in the Green Hydrogen Market

- 29.2.1. Air Liquide

- 29.2.1.1. Company Overview

- 29.2.1.2. Company Portfolio

- 29.2.1.3. Financial Details

- 29.2.1.4. Recent Developments and Future Outlook

- 29.2.2. Air Liquide

- 29.2.3. Air Products

- 29.2.4. Bloom Energy

- 29.2.5. Cummins

- 29.2.6. Enapter

- 29.2.7. ENGIE

- 29.2.8. Green Hydrogen Systems

- 29.2.9. H&R Olwerke Schindler

- 29.2.10. ITM Power

- 29.2.11. Linde

- 29.2.12. Nel ASA

- 29.2.13. Plug Power

- 29.2.14. Siemens Energy

- 29.2.15. Toshiba Energy Systems & Solutions Corporation

- 29.2.16. Uniper

- 29.2.1. Air Liquide

30. PORTER'S FIVE FORCES ANALYSIS

- 30.1. Chapter Overview

- 30.2. Research Methodology

- 30.3. Key Parameters

- 30.3.1. Threats to New Entrants

- 30.3.2. Bargaining Power of Buyers

- 30.3.3. Bargaining Power of Product Providers

- 30.3.4. Threats of Substitute Products

- 30.3.5. Rivalry among Existing Competitors

- 30.4. Harvey Ball Analysis

- 30.5. Concluding Remarks

31. EXECUTIVE INSIGHTS

32. APPENDIX 1: TABULATED DATA

33. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS