PUBLISHER: Roots Analysis | PRODUCT CODE: 1771310

PUBLISHER: Roots Analysis | PRODUCT CODE: 1771310

Blockchain in Healthcare Market: Industry Trends and Global Forecasts - Distribution by Type of Blockchain Type of End-User and Key Geographical Regions

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: OVERVIEW

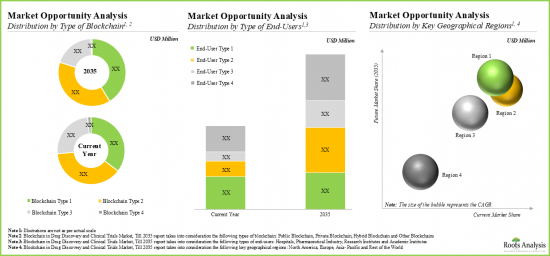

As per Roots Analysis, the global blockchain in healthcare market is estimated to grow from USD 67 million in the current year to USD 641 million by 2035, at a CAGR of 22.8% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Blockchain

- Public Blockchain

- Private Blockchain

- Hybrid Blockchain

- Other Blockchains

Type of End User

- Hospitals

- Pharmaceutical Industry

- Research Institutes

- Academic Institutes

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: GROWTH AND TRENDS

In recent years, blockchain has garnered significant interest from researchers, as well as industry players, as it has proven to be a versatile tool for decentralized monetary transactions and data exchange in various industries, such as banking, supply chain management and healthcare. Several stakeholders in healthcare have adopted blockchain for various operations, such as in maintaining patient records, in recruiting patients for trials and providing transparency and traceability during the supply chain. Moreover, it can effectively and potentially be used as a method to significantly improve the drug life cycle management. Gradually, blockchain in healthcare has disclosed unprecedented opportunities by unlocking significant advantages.

Despite the growing interest of stakeholders in blockchain technology, it is associated with several challenges, including scalability issues, lack of security and cyber-attacks. In order to deal with the aforementioned challenges, organizations have established transparency and privacy to conceal sensitive patient data while allowing access, only when required. Further, driven by the continuous efforts of industry players to develop advanced platforms, we anticipate that the global blockchain market is likely to grow at a significant pace in the foreseen future

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of global blockchain in the healthcare market and identifies potential growth opportunities within industry. Some key findings from the report include:

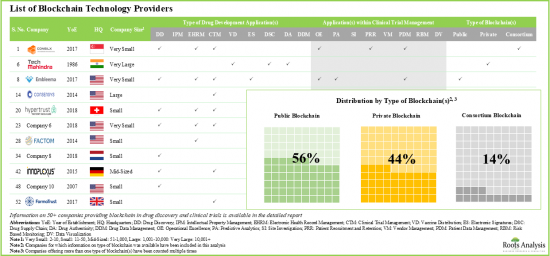

- Presently, more than 50 players claim to provide blockchain platform solutions across a wide range of drug development applications.

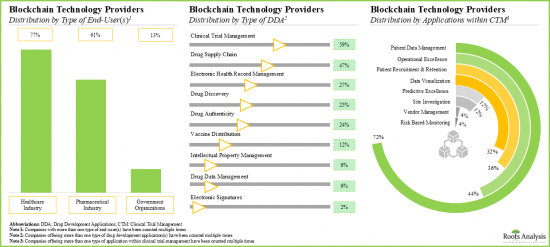

- The current market landscape features stakeholders offering blockchain technology to industries for various drug development applications; majority of these technology platforms are being used for clinical trial management.

- In pursuit of building a competitive edge, stakeholders are striving to enhance their existing capabilities and upgrade their proprietary blockchain platforms with advanced features.

- Around 37% of the articles focused on the use of blockchain technology in the pharmaceutical industry have been published recently, highlighting the substantial efforts undertaken by researchers.

- Over the years, there has been a significant increase in the number of publications related to blockchain; 130 articles have been published recently.

- Majority (~60%) of the publications in this domain are research articles focused on evaluating the use of blockchain in drug supply chain and clinical trial management.

- The growing interest of stakeholders is also prevalent from the recent rise in partnership activity; ~60% of the deals, so far, have been focused on utilization and integration of proprietary blockchain platforms.

- In the past few years, the partnership activity in this domain has increased at a CAGR of over 73%; majority of the deals were platform utilization agreements.

- Majority of the intercontinental deals have been inked between players based in North America and Europe; 25% of these partnerships have been signed in 2022.

- The increasing demand for blockchain in clinical research, especially for drug discovery and clinical trials, is anticipated to create lucrative business opportunities for players within this field.

- We expect the market to witness an annualized growth of 22% in the coming decade; the opportunity is likely to be well distributed across various types of blockchain, types of end-users and key geographical regions.

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: KEY SEGMENTS

Private blockchain Segment Occupies the Largest Share of the Blockchain in Healthcare Market

Based on the type of blockchain, the market is segmented into public blockchain, private blockchain, hybrid blockchain, and other blockchains. At present, the private blockchain segment holds the maximum (~40%) share of the global blockchain in the healthcare market. Additionally, the public blockchain segment is likely to grow at a faster pace compared to the other segments.

By Type of End User, Pharmaceutical Industry Segment is the Fastest Growing Segment of the Global Blockchain in Healthcare Market

Based on the type of end user, the market is segmented into hospitals, pharmaceutical industry, research institutes and academic institutes. Currently, hospitals segment captures the highest proportion (~40%) of the blockchain in the healthcare market. Further, the pharmaceutical industry segment is likely to grow at a relatively higher CAGR.

Asia-Pacific Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, Asia-Pacific (>40%) dominates the blockchain in healthcare market and accounts for the largest revenue share. However, the market in the rest of the world is expected to grow at a higher CAGR.

Example Players in the Blockchain in Healthcare Market

- Alten Calsoft Labs

- ConsenSys

- Humanscape

- Hyperledger Foundation

- IBM

- Infosys

- Innoplexus

- Medsphere

- Solulab

- Stratumn

- Tech Mahindra

GLOBAL BLOCKCHAIN IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global blockchain in healthcare market, focusing on key market segments, including [A] type of blockchain, [B] type of end user and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of healthcare companies using blockchain technology for drug discovery and clinical trials, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of blockchains, [E] type of drug development applications, [F] applications within clinical trial management and [G] type of end users.

- Company Competitiveness Analysis: A comprehensive company competitive analysis of blockchain technology providers, examining factors, such as [A] supplier strength, [B] portfolio diversity and [C] portfolio strength.

- Company Profiles: In-depth profiles companies providing blockchain platforms for drug discovery applications, focusing on [A] company overview, [B] financial information (if available), [C] details on application areas of proprietary platform, and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the blockchain in healthcare market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of pharmaceutical applications, [E] most active players (in terms of the number of partnerships signed) and [F] geography.

- Publication Analysis: An insightful analysis of more than 500 peer-reviewed scientific articles focused on blockchain in the pharmaceutical industry, based on various relevant parameters, such as [A] year of publication, [B] type of publication, [C] popular publishers, [D] popular copyright holders and [E] keywords.

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of blockchain in healthcare market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

- Case Study: A detailed discussion highlighting the applications of blockchain across various industries, such as [A] healthcare, [B] banking and financial, [C] automotive, [D] education, [E] telecom, [F] transportation and [G] travel industries.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

- 2.1. Chapter Overview

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Blockchain Technology

- 3.2.1. Ethereum vs Hyperledger Fabric

- 3.3. Types of Blockchain

- 3.3.1. Permissionless or Public Blockchain

- 3.3.2. Permission or Private Blockchain

- 3.3.3. Federated or Consortium Blockchain

- 3.4. Applications of Blockchain Across Various Industries

- 3.5. Applications of Blockchain in Drug Discovery and Clinical Trials

- 3.6. Advantages and Limitations of Blockchain

- 3.7. Future Perspectives

4. MARKET OVERVIEW

- 4.1. Chapter Overview

- 4.2. List of Blockchain Technology Providers

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Region of Headquarters

- 4.2.4. Analysis by Location of Headquarters

- 4.2.5. Analysis by Year of Establishment, Company Size, and Region of Headquarters

- 4.2.6. Analysis by Type of Blockchain(s)

- 4.2.7. Analysis by Type of Drug Development Application(s)

- 4.2.8. Analysis by Application(s) within Clinical Trial Management

- 4.2.9. Analysis by Type of End-User(s)

- 4.2.10. Analysis by Type of Blockchain and Type of End-User(s)

- 4.2.11. Analysis by Type of Blockchain and Type of Drug Development Application(s)

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions / Key Parameters

- 5.3. Methodology

- 5.4. Company Competitiveness Analysis: Blockchain Technology Providers based in North America (Peer Group I)

- 5.5. Company Competitiveness Analysis: Blockchain Technology Providers based in Europe (Peer Group II)

- 5.6. Company Competitiveness Analysis: Blockchain Technology Providers based in Asia Pacific and RoW (Peer Group III)

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Alten Calsoft Labs

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Application Areas of Proprietary Platform

- 6.2.4. Recent Developments and Future Outlook

- 6.3. ConsenSys

- 6.3.1. Company Overview

- 6.3.2. Application Areas of Proprietary Platform

- 6.3.3. Recent Developments and Future Outlook

- 6.4. IBM

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Application Areas of Proprietary Platform

- 6.4.4. Recent Development and Future Outlooks

- 6.5. Stratumn

- 6.5.1. Company Overview

- 6.5.2. Application Areas of Proprietary Platform

- 6.5.3. Recent Development and Future Outlook

- 6.6. Infosys

- 6.6.1. Company Overview

- 6.6.2. Financial Information

- 6.6.3. Application Areas of Proprietary Platform

- 6.6.4. Recent Developments and Future Outlook

- 6.7. Tech Mahindra

- 6.7.1. Company Overview

- 6.7.2. Financial Information

- 6.7.3. Application Areas of Proprietary Platform

- 6.7.4. Recent Developments and Future Outlook

- 6.8. Humanscape

- 6.8.1. Company Overview

- 6.8.2. Application Areas of Proprietary Platform

- 6.8.3. Recent Developments and Future Outlook

- 6.9. Hyperledger Foundation

- 6.9.1. Company Overview

- 6.9.2. Application Areas of Proprietary Platform

- 6.9.3. Recent Developments and Future Outlook

- 6.10. Innoplexus

- 6.10.1. Company Overview

- 6.10.2. Application Areas of Proprietary Platform

- 6.10.3. Recent Developments and Future Outlook

- 6.11. Medsphere

- 6.11.1. Company Overview

- 6.11.2. Application Areas of Proprietary Platform

- 6.11.3. Recent Developments and Future Outlook

- 6.12. Solulab

- 6.12.1. Company Overview

- 6.12.2. Application Areas of Proprietary Platform

- 6.12.3. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Chapter Overview

- 7.2. Partnership Models

- 7.3. Blockchain in Drug Discovery and Clinical Trials: Recent Partnerships and Collaborations

- 7.3.1. Analysis by Year of Partnership

- 7.3.2. Analysis by Type of Partnership

- 7.3.3. Analysis by Year and Type of Partnership

- 7.3.4. Analysis by Company Size and Type of Partnership

- 7.3.5. Most Active Players: Distribution by Number of Partnerships

- 7.3.6. Most Active Players: Distribution by Type of Partnership

- 7.3.7. Analysis by Type of Pharmaceutical Applications

- 7.3.8. Analysis by Type of Partner

- 7.3.9. Analysis by Geographical Region

- 7.3.9.1. Local and International Agreements

- 7.3.9.2. Intercontinental and Intracontinental Agreements

8. PUBLICATION ANALYSIS

- 8.1. Chapter Overview

- 8.2. Scope and Methodology

- 8.3. Blockchain Technology in Pharmaceutical Industry: Recent Publications

- 8.3.1. Analysis by Year of Publication

- 8.3.2. Analysis by Type of Article

- 8.3.3. Popular Journals: Analysis by Number of Publications

- 8.3.4. Popular Publishers: Analysis by Number of Publications

- 8.3.5. Popular Copyright Holders: Analysis by Number of Publications

- 8.3.6. Analysis by Popular Keywords

- 8.3.7. Analysis by Impact Factor

- 8.3.8. Popular Journals: Analysis by Journal Impact Factor

9. SWOT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Blockchain in Drug Discovery and Clinical Trials: SWOT Analysis

- 9.3. Comparison of SWOT Factors

- 9.3.1. Strengths

- 9.3.1.1. Transparency and Traceability

- 9.3.1.2. Cost Reduction and Data Integrity

- 9.3.1.3. Safe and Secure Transactions

- 9.3.1.4. Patient Data Management

- 9.3.2. Weaknesses

- 9.3.2.1. Implementation Expense

- 9.3.2.2. Storage

- 9.3.2.3. Immutability of Data

- 9.3.2.4. High Energy Consumption

- 9.3.3. Threats

- 9.3.3.1. Blockchain is Prone to Cyber Attacks

- 9.3.3.2. Scalability

- 9.3.3.3. Lack of Regulations Issued by Legal Authorities

- 9.3.4. Opportunities

- 9.3.1. Strengths

10. CASE STUDY: APPLICATIONS OF BLOCKCHAIN IN HEALTHCARE AND OTHER INDUSTRIES

- 10.1. Chapter Overview

- 10.2. Applications of Blockchain Across Various Industries

- 10.2.1. Blockchain in Healthcare

- 10.2.2. Blockchain in Banking and Financial Industry

- 10.2.3. Blockchain in Automotive Industry

- 10.2.4. Blockchain in Education

- 10.2.5. Blockchain in Telecom Industry

- 10.2.6. Blockchain in Transportation

- 10.2.7. Blockchain in Travel Industry

11. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Blockchain in Drug Discovery and Clinical Trials Market, Till 2035

- 11.4. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain

- 11.4.1. Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035

- 11.4.2. Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035

- 11.4.3. Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035

- 11.4.4. Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035

- 11.5. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User

- 11.5.1. Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035

- 11.5.2. Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, Till 2035

- 11.5.3. Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035

- 11.5.4. Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035

- 11.6. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions

- 11.6.1. Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035

- 11.6.2. Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035

- 11.6.3. Blockchain in Drug Discovery and Clinical Trials Market in Asia-Pacific, Till 2035

- 11.6.4. Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035

12. CONCLUDING REMARKS

13. EXECUTIVE INSIGHTS

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 List of Blockchain Technology Providers

- Table 4.2 Blockchain Technology Providers: Information on Type of Blockchain(s)

- Table 4.3 Blockchain Technology Providers: Information on Type of Drug Development Application(s)

- Table 4.4 Blockchain Technology Providers: Information on Application(s) within Clinical Trial Management

- Table 4.5 Blockchain Technology Providers: Information on Type of End-User(s)

- Table 6.1 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

- Table 6.2 Alten Calsoft Labs: Key Highlights

- Table 6.3 Alten Calsoft Labs: Recent Developments and Future Outlook

- Table 6.4 ConsenSys: Key Highlights

- Table 6.5 ConsenSys: Recent Developments and Future Outlook

- Table 6.6 IBM: Key Highlights

- Table 6.7 IBM: Recent Developments and Future Outlook

- Table 6.8 Stratumn: Key Highlights

- Table 6.9 Infosys: Key Highlights

- Table 6.10 Infosys: Recent Developments and Future Outlook

- Table 6.11 Tech mahindra: Key Highlights

- Table 6.12 Tech Mahindra: Recent Developments and Future Outlook

- Table 6.13 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

- Table 6.14 Humanscape: Key Highlights

- Table 6.15 Humanscape: Application Areas of Proprietary Platform

- Table 6.16 Humanscape: Recent Developments and Future Outlook

- Table 6.17 Hyperledger Foundation: Key Highlights

- Table 6.18 Hyperledger Foundation: Application Areas of Proprietary Platform

- Table 6.19 Hyperledger Foundation: Recent Developments and Future Outlook

- Table 6.20 Innoplexus: Key Highlights

- Table 6.21 Innoplexus: Application Areas of Proprietary Platform

- Table 6.22 Innoplexus: Recent Developments and Future Outlook

- Table 6.23 Medsphere: Key Highlights

- Table 6.24 Medsphere: Application Areas of Proprietary Platform

- Table 6.25 Medsphere: Recent Developments and Future Outlook

- Table 6.26 Solulab: Key Highlights

- Table 6.27 Solulab: Application Areas of Proprietary Platform

- Table 6.28 Solulab: Recent Developments and Future Outlook

- Table 7.1 Blockchain in Drug Discovery and Clinical Trials: List of Partnerships and Collaborations, Since 2017

- Table 10.1 Blockchain Technology in Education: Use Cases

- Table 14.1 Blockchain Technology Providers: Distribution by Year of Establishment

- Table 14.2 Blockchain Technology Providers: Distribution by Company Size

- Table 14.3 Blockchain Technology Providers: Distribution by Region of Headquarters

- Table 14.4 Blockchain Technology Providers: Distribution by Location of Headquarters

- Table 14.5 Blockchain Technology Providers: Distribution by Year of Establishment, Company Size, and Region of Headquarters

- Table 14.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

- Table 14.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

- Table 14.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

- Table 14.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

- Table 14.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

- Table 14.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

- Table 14.12 Alten Calsoft Labs: Annual Revenues, Since 2018 (EUR Billion)

- Table 14.13 IBM: Annual Revenues, Since 2018 (USD Billion)

- Table 14.14 Infosys: Annual Revenues, Since 2018 (USD Billion)

- Table 14.15 Tech Mahindra: Annual Revenues, Since 2018 (USD Billion)

- Table 14.16 Partnerships and Collaborations: Distribution by Year of Partnership, Since 2017

- Table 14.17 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 14.18 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2017

- Table 14.19 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Table 14.20 Most Active Players: Distribution by Number of Partnerships

- Table 14.21 Most Active Players: Distribution by Type of Partnerships

- Table 14.22 Partnerships and Collaborations: Distribution by Type of Pharmaceutical Applications

- Table 14.23 Partnerships and Collaborations: Distribution by Type of Partner

- Table 14.24 Partnerships and Collaborations: Local and International Agreements

- Table 14.25 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 14.26 Publication Analysis: Cumulative Year-Wise Trend, Since 2016

- Table 14.27 Publication Analysis: Distribution by Type of Article

- Table 14.28 Popular Journals: Distribution by Number of Publications

- Table 14.29 Popular Publishers: Distribution by Number of Publications

- Table 14.30 Popular Copyright Holders: Distribution by Number of Publications

- Table 14.31 Publication Analysis: Distribution by Impact Factor

- Table 14.32 Popular Journals: Distribution by Journal Impact Factor

- Table 14.33 Blockchain in Drug Discovery and Clinical Trials Market Till 2035, Conservative, Base, and Optimistic Scenarios, Till 2035 (USD Million)

- Table 14.34 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain

- Table 14.35 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035: Conservative, Base, and Optimistic Scenarios (USD Million)

- Table 14.36 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.37 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.38 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.39 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User

- Table 14.40 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.41 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.42 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.43 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.44 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions

- Table 14.45 Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.46 Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.47 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

- Table 14.48 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035: Conservative, Base and Optimistic Scenarios, (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Publication Analysis

- Figure 2.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Historical Evolution of Blockchain Technology

- Figure 3.2 Types of Blockchain

- Figure 3.3 Applications of Blockchain Across Various Industries

- Figure 3.4 Advantages and Limitations of Blockchain

- Figure 4.1 Blockchain Technology Providers: Distribution by Year of Establishment

- Figure 4.2 Blockchain Technology Providers: Distribution by Company Size

- Figure 4.3 Blockchain Technology Providers: Distribution by Region of Headquarters

- Figure 4.4 Blockchain Technology Providers: Distribution by Location of Headquarters

- Figure 4.5 Blockchain Technology Providers: Distribution Year of Establishment, Company Size, and Region of Headquarters

- Figure 4.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

- Figure 4.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

- Figure 4.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

- Figure 4.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

- Figure 4.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

- Figure 4.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

- Figure 5.1 Company Competitiveness Analysis: Blockchain Technology Providers based in North America (Peer Group I)

- Figure 5.2 Company Competitiveness Analysis: Blockchain Technology Providers based in Europe (Peer Group II)

- Figure 5.3 Company Competitiveness Analysis: Blockchain Technology Providers based in Asia Pacific and RoW (Peer Group III)

- Figure 6.1 Alten Calsoft Labs: Annual Revenues, Since 2018 (EUR Billion)

- Figure 6.2 Alten Calsoft Labs: Application Areas of Proprietary Platform

- Figure 6.3 ConsenSys: Application Areas of Proprietary Platform

- Figure 6.4 IBM: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.5 IBM: Application Areas of Proprietary Platform

- Figure 6.6 Stratumn: Application Areas of Proprietary Platform

- Figure 6.7 Infosys: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.8 Infosys: Application Areas of Proprietary Platform

- Figure 6.9 Tech Mahindra: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.10 Tech Mahindra: Application Areas of Proprietary Platform

- Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership, Since 2017

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 7.4 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

- Figure 7.5 Most Active Partners: Distribution by Number of Partnerships

- Figure 7.6 Most Active Players: Distribution by Type of Partnership

- Figure 7.7 Partnerships and Collaborations: Distribution by Type of Pharmaceutical Applications

- Figure 7.8 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 7.9 Partnerships and Collaborations: Local and International Agreements

- Figure 7.10 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 8.1 Publication Analysis: Cumulative Year-wise Trend, Since 2016

- Figure 8.2 Publication Analysis: Distribution by Type of Article

- Figure 8.3 Popular Journals: Distribution by Number of Publications

- Figure 8.4 Popular Publishers: Distribution by Number of Publications

- Figure 8.5 Popular Copyright Holders: Distribution by Number of Publications

- Figure 8.6 Word Cloud: Key Focus Areas

- Figure 8.7 Publication Analysis: Distribution by Impact Factor

- Figure 8.8 Popular Journals: Distribution by Journal Impact Factor

- Figure 9.1 Blockchain Technology in Pharmaceutical Industry: SWOT Analysis

- Figure 9.2 SWOT Factors: Harvey Ball Analysis

- Figure 10.1 Key Applications of Blockchain Across Various Industries

- Figure 11.1 Blockchain in Drug Discovery and Clinical Trials Market, Till 2035 (USD Million)

- Figure 11.2 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain (USD Million)

- Figure 11.3 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, Till 2035 (USD Million)

- Figure 11.4 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, Till 2035 USD Million)

- Figure 11.5 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, Till 2035 USD Million)

- Figure 11.6 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, Till 2035 (USD Million)

- Figure 11.7 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User (USD Million)

- Figure 11.8 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, Till 2035 (USD Million)

- Figure 11.9 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, 2023- 2035 (USD Million)

- Figure 11.10 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, Till 2035 (USD Million)

- Figure 11.11 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, Till 2035 (USD Million)

- Figure 11.12 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions (USD Million)

- Figure 11.13 Blockchain in Drug Discovery and Clinical Trials Market in North America, Till 2035 (USD Million)

- Figure 11.14 Blockchain in Drug Discovery and Clinical Trials Market in Europe, Till 2035 (USD Million)

- Figure 11.15 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, Till 2035 (USD Million)

- Figure 11.16 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, Till 2035 (USD Million)

- Figure 12.1 Concluding Remarks: Blockchain Technology Providers Market Landscape

- Figure 12.2 Concluding Remarks: Partnerships and Collaborations

- Figure 12.3 Concluding Remarks: Publication Analysis

- Figure 12.4 Concluding Remarks: SWOT Analysis

- Figure 12.4 Concluding Remarks: Market Forecast and Opportunity Analysis