PUBLISHER: SNE Research | PRODUCT CODE: 1343611

PUBLISHER: SNE Research | PRODUCT CODE: 1343611

<2023> Lithium-Ion Battery Electrolyte Technology Trends and Market Forecast (~2030)

Recently, the secondary battery market has expanded from small IT applications to ESS and electric vehicles. Japanese companies such as Panasonic, which developed secondary batteries and pioneered the industry, are losing out to Korean powerhouses such as LGES, while Chinese companies such as CATL, BYD, and CALB are further expanding their M/S with the support of the Chinese government and an unlimited domestic market. Although the Korean, Chinese, and Japanese "trilateral system" is expected to continue for the foreseeable future, North America and Europe are also showing continued interest in the large-capacity secondary battery manufacturing and materials market due to the expansion of the electric vehicle market. In particular, the policies and regulations of each country, such as the IRA, are expected to significantly change the landscape of the secondary battery market.

The electrolyte is mainly composed of solvents, lithium salts, and additives. Depending on the nature of the product, the electrolyte will be developed in collaboration with lithium-ion secondary battery manufacturers. For small IT-type products, the development period is as short as three to four months, while electrolytes for xEVs are developed and evaluated for more than a year. Excellent R&D capabilities are required to develop and respond to various products according to customer needs.

In the past, the electrolyte market was dominated by Japan and South Korea, but with the recent rapid growth of Chinese companies, the top three market shares have been taken over by Chinese companies. In Korea, Donghwa Electrolyte, Soulbrain, and Enchem have been able to grow together as electrolyte suppliers with the three major lithium-ion secondary battery companies (Samsung SDI, LG Energy Solution, and SK energy). In Japan, Mitsubishi Chemical has diversified its portfolio of customers producing IT small, xEV medium and large cells. In China, Tinci, Guotai-Huarong, and Capchem dominate the market.

Lithium salts (LiPF6), the main ingredient of electrolyte, have been mostly supplied by Japanese companies in the past, but the game has changed as Chinese companies have increased their CAPA. In South Korea, Foosung provides general-purpose lithium salts (LiPF6), while Chunbo mass-produces specialized lithium salts (LiFSI, LiPO2F2, LiDFOP, LiBOB). Additives are added during the electrolyte manufacturing process to improve the lifespan and stability of Li-ion secondary batteries, such as SEI protection, overcharge prevention agents, and conductive properties. While Japanese companies dominate the additives market, in Korea Chunbo and Chemtros are among the main suppliers.

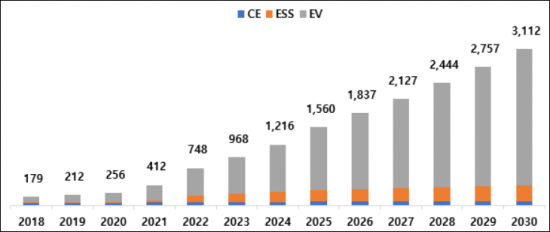

Electrolyte is one of the four key materials that make up a secondary battery. In the manufacturing cost composition of a typical Li-ion battery, the order of importance is anode material > separator > cathode material > electrolyte. To increase the energy density per unit cell, secondary battery manufacturers are increasing the input of anode and cathode materials, while reducing the input of electrolyte. However, from 2022 to 2030, the battery market is expected to grow at an average annual rate of around 23% (by capacity). The electrolyte market is expected to grow accordingly.

For large-scale rechargeable batteries for electric vehicles and ESS, the amount of electrolyte used is about 200 times to 4,000 times higher on a unit cell basis than for IT, so securing stability is becoming a particularly important issue. In addition to liquid electrolytes and gel polymer electrolytes (polymers) that are currently commercialized, research and development is underway to improve the stability of solid polymer electrolytes and all-solid ceramic electrolytes with excellent high temperature stability.

This report provides detailed technical information on finished electrolyte products and their components for application in lithium-ion secondary batteries and forecasts the demand and market for binders based on our various forecasts to help readers understand the overall scale.

Finally, by summarizing the electrolyte demand of major battery manufacturers and the supply status and outlook of electrolyte companies, the report aims to provide researchers and interested parties in this field with a wide range of insights from technology to market.

Strong points of this report:

- 1. overall overview and technical information on electrolyte finished products and components

- 2. Introduction to solid and polymer electrolytes that will be applied to next-generation batteries other than conventional LIBs

- 3. Provides objective data on the electrolyte market outlook based on our forecast data

- 4. Detailed information on the product and production status of major electrolyte players in Korea, China, and Japan

<Global Electrolytes Market Demand Forecas (~2030)>

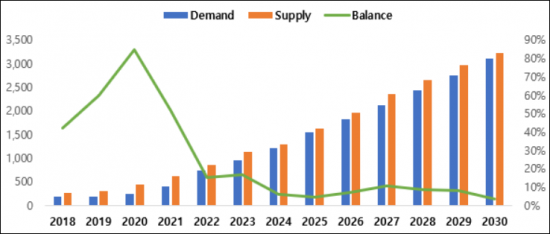

*Based on SNE battery demand forecasts.

<Global Electrolyte Supply and Demand Outlook (2018~2030)>

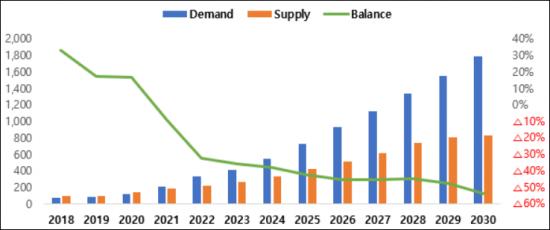

<Electrolyte Supply and Demand Outlook for Non-Chinese Markets (2018~2030)>

*Except for Chinese market supply and demand.

Table of Contents

Outline of Report

Chapter I. Electrolyte Overview

- 1.1. Understanding of electrolytes

- 1.2. Development trends and major issues of electrolytes

Chapter II. Development Trend of Liquid Electrolytes

- 2.1. Composition of liquid electrolytes

- 2.2. Characteristics of liquid electrolytes

- 2.3. Flame retardant material

Chapter III. Development Trend of Polymer Electrolyte

- 3.1. Types of polymer electrolytes

- 3.2. Characteristics of polymer electrolytes

- 3.3. Manufacturing method of polymer electrolytes

Chapter IV. Solid Electrolytes

- 4.1. Necessity for development of solid electrolytes

- 4.2. Types and technical characteristics of solid electrolytes

- 4.3. Development trends of solid electrolytes

Chapter V. Latest Development Trends of Electrolytes

- 5.1. High voltage electrolyte solvents

- 5.2. Lithium salts

- 5.3. Additives

- 5.4. Polyelectrolytes

Chapter VI. Electrolyte Solvents

- 6.1. Cyclic carbonate

- 6.2. Linear carbonate

- 6.3. Gas generation mechanism by additives for forming the protective film on the electrode surface

Chapter VII. Electrolyte Additives

- 7.1. Electrolyte additives for high-Ni cathode interface stabilization

- 7.2. Electrolyte additives for improved output characteristics

- 7.3. Electrolytes using LiFSI salts

- 7.4. Flame retardant additives for improved thermal stability

- 7.5. Additives for high-capacity anode interface stabilization

Chapter VIII-1. Electrolyte Market Trends and Outlook

- 8.1.1. Electrolyte demand by country

- 8.1.2. Electrolyte usage by application

- 8.1.3. Market status by suppliers

- 8.1.4. Electrolyte demand by LIB companies

- (SDI/LGES/SKon/Panasonic/CATL/ATL/BYD/Lishen/Guoxuan(Gotion)/AESC)

- 8.1.5. Electrolyte demand outlook

- 8.1.6. Electrolyte CAPA and supply & demand outlook

- 8.1.7. Electrolyte price trends

- 8.1.8. Electrolyte market size forecast

Chapter VIII-2. Electrolyte Material Status

- 8.2.1. General lithium salts (LiPF6)

- 8.2.2. Non-LiPF6 lithium salts

- 8.2.3. Functional additives

Chapter IX. Electrolyte Manufacturer Status

- 9.1. Korean electrolyte companies

- Dongwha Electrolyte / Soulbrain / Enchem / Foosung / Chunbo / Chemtros

- 9.2. Japanese electrolyte companies

- Mitsubishi / Ube / Centralglass / Tomiyama / MUIS / Nippon Shokubai

- 9.3. Chines electrolyte companies

- Tinci / Capchem / Guotai Huarong / Shanshan / Jinniu / DFD / Shinghwa