PUBLISHER: SNE Research | PRODUCT CODE: 1784311

PUBLISHER: SNE Research | PRODUCT CODE: 1784311

<2025> Patent Report: Next-Generation Si-Anode Material Beyond Volume Expansion

The global technology trends and market outlook for silicon-based anode materials are emerging as a critical R&D focus, driven by the rapidly growing demand for high-energy-density batteries. In particular, patent analysis centered on SiO-SiC composite anode technologies highlights the increasing potential of silicon-based anode materials to overcome the limitations of graphite-based materials and support the development of next-generation energy storage systems.

The need for patent analysis on silicon-based anode materials can largely be explained in three aspects.

First, the protection of intellectual property rights and the securing of technological leadership serve as important drivers. Considering the unique nature of silicon-based anodes-having higher theoretical capacity than conventional graphite while needing to address the issue of expansion during repeated charge-discharge cycles-companies must file more detailed patents to understand the technological directions of competitors and protect their own innovations. In particular, the rapid increase in patent applications related to silicon-based composite anodes in countries such as the U.S., China, and Korea heightens the possibility of companies becoming involved in intellectual property disputes.

Second, companies need to analyze essential patents in order to identify potential patent disputes or issues in advance.

Lastly, the expiration of key patents and how to effectively utilize the resulting gaps remain critical challenges. If SiO-based patents dominate major markets, companies will need to develop SiC-based composite structures or new surface coating technologies.

The background behind the rise of silicon anode technology can first be attributed to the rapid increase in demand for high-energy-density batteries aimed at extending electric vehicle driving range. As the EV market has grown rapidly, the need for longer driving distances per charge at the cell level has intensified. Accordingly, improving battery capacity has become a core competitive factor, and silicon-based anode materials-with a theoretical capacity nearly 10 times that of graphite-have emerged as a strong alternative.

In this process, structural evolution of the materials has also progressed noticeably. While SiO-based composites were initially mainstream in the industry, SiC-based composites, with advantages in electrical conductivity and structural stability, have recently gained prominence. Reflecting this trend, research has been actively shifting from conventional "core-shell" approaches that coat or combine silicon, toward "yolk-shell" structures that can effectively absorb silicon expansion.

In addition, as China takes the lead in strengthening material localization strategies, Korean and Japanese companies are also beginning preparations to produce and procure silicon anode materials independently.

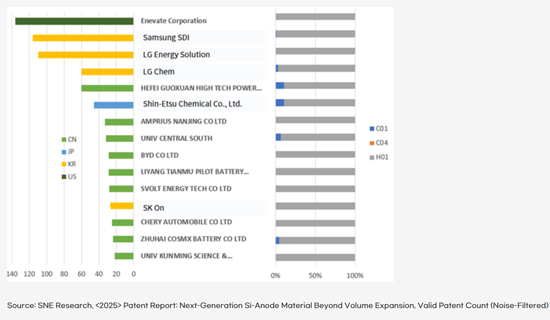

Lastly, a closer look at the patent analysis and technological development trends of silicon anode materials reveals that the core patent application areas can largely be divided into composite structure design and mass production processes. In the area of composite structure design, key themes include SiC-SiO, Si/C, and Si@C structural systems, as well as the development of porous architectures. Korean companies such as LG Energy Solution and Samsung SDI are actively filing patents related to composite structure design and interfacial stabilization technologies, thereby expanding methodologies for implementing high-energy-density batteries. Japan's Shin-Etsu, leveraging its expertise in Si-based material synthesis and surface modification (Si/C coating), is focusing on improving the quality and yield of silicon-based anode materials.

Ultimately, patent analysis of silicon-based anode materials goes beyond merely assessing the current state of technology-it serves as a foundational effort that will shape the core competitiveness of the secondary battery industry in the future. Through this, companies can not only systematically protect their own technologies, but also establish a platform for leading continuous innovation in a rapidly evolving market.

Strong Points of This Report:

- 1. Provides a multifaceted analysis of the current status of patent applications and competitor technology strategies for silicon-based anode materials as alternatives to graphite.

- 2. Compares and summarizes patent trends by major countries, including the United States, China, South Korea, and Japan.

- 3. Outlines the latest R&D trends shifting from SiO-based composites to SiC composites and yolk-shell structures, allowing readers to grasp changes in market trends at a glance.

- 4. Includes patent comparisons by company (e.g., BTR, BYD, LG Energy Solution, Samsung SDI, Shin-Etsu).

- 5. Covers a wide range of silicon-based anode technologies applicable to the entire battery industry-including EV batteries and ESS-making it broadly useful for material companies, battery manufacturers, and related research institutions.

Table of Contents

1. Introduction

- 1.1. Analysis Background and Purpose

- 1.2. Overview of Silicon Anode Materials

- 1.2.1. Structures of Silicon Anode Materials

- 1.2.2. Si/SiO/SiC

- 1.2.3. Disadvantages of Silicon Anode Materials

- 1.3. Power generation history of Silicon Anode. materials

- 1.3.1. Solution to the Shortcomings of Silicon Anode Materials

- 1.4. Patent Scope and Investigation Method

2. Introduction to Patent Application Trends

- 2.1. Raw Data / Valid Patent Selection

- 2.2. Trends in patent applications by year

- 2.3. Trends of Applicants by Country

- 2.4. Technology growth stage

- 2.5. Major National Applications Trends

- 2.6. Key applicant application trends

3. Investigation of key patents

- 3.1. Key patent list and technology classification

- 3.2. Identifying Key Patent Trends

- 3.3. Transfer, Introduction of Dispute Patents

4. Conclusion & Appendix

- 4.1. Key Patents

- 4.1.1. Sila

- 4.1.2. GROUP14

- 4.1.3. Shenzhen

- 4.1.4. Resonac

- 4.1.5. ENEVATE

- 4.1.6. Stanford

- 4.1.7. Large Kettle

- 4.1.8. Shin-Etsu

- 4.1.9. BTR

- 4.1.10. LG Chemical Co., Ltd.

- 4.1.11. SDI

- 4.2. Conclusions and Implications

- 4.3. Appendix 1. List of Key Patent Points