PUBLISHER: WinterGreen Research, Inc. | PRODUCT CODE: 1207186

PUBLISHER: WinterGreen Research, Inc. | PRODUCT CODE: 1207186

AI and Smart Contracts: Market Shares, Market Opportunity, Market Forecasts, 2023-2029

According to IBM, Hyperledger Fabric, open-source project, is the modular blockchain framework and de facto standard for enterprise solutions. The open, modular architecture uses plug-and-play components. With more than 120,000 contributing organizations and more than 15,000 engineer contributors working together, IBM Hyperledger Fabric offers data privacy.

Smart contracts implemented on blockchain and distributed ledgers leverage trust to develop a rapidly growing business. With the appropriate guards in place, digital assets and decentralized finance are transformed by smart contracts.

According to Goldman Sachs , Blockchain changes the way we buy and sell things and the way we interact with government. Via smart contracts, Blockchain is redefining the way transactions occur.

This is the 1,011 th report in a series of primary market research reports that provide forecasts in communications, telecommunications, the Internet, computer, software, telephone equipment, health equipment, and energy from WinterGreen Research.

Automated process and significant growth potential are priorities in topic selection. The project leaders take direct responsibility for writing and preparing each report. They have significant experience preparing industry studies. Forecasts are based on primary research and proprietary data bases.

The primary research is conducted by talking to customers, distributors and companies. The survey data is not enough to make accurate assessment of market size, so WinterGreen Research looks at the value of shipments and the average price to achieve market assessments. Our track record in achieving accuracy is unsurpassed in the industry. We are known for being able to develop accurate market shares and projections. This is our specialty.

The analyst process is concentrated on getting good market numbers. This process involves looking at the markets from several different perspectives, including vendor shipments. The interview process is an essential aspect as well. We do have a lot of granular analysis of the different shipments by vendor in the study and addenda prepared after the study was published if that is appropriate.

Forecasts reflect analysis of the market trends in the segment and related segments. Unit and dollar shipments are analyzed through consideration of dollar volume of each market participant in the segment. Installed base analysis and unit analysis is based on interviews and an information search. Market share analysis includes conversations with key customers of products, industry segment leaders, marketing directors, distributors, leading market participants, opinion leaders, and companies seeking to develop measurable market share.

Over 200 in depth interviews are conducted for each report with a broad range of key participants and industry leaders in the market segment. We establish accurate market forecasts based on economic and market conditions as a base. Use input/output ratios, flow charts, and other economic methods to quantify data. Use in-house analysts who meet stringent quality standards.

Interviewing key industry participants, experts and end-users is a central part of the study. Our research includes access to large proprietary databases. Literature search includes analysis of trade publications, government reports, and corporate literature.

Findings and conclusions of this report are based on information gathered from industry sources, including manufacturers, distributors, partners, opinion leaders, and users. Interview data was combined with information gathered through an extensive review of internet and printed sources such as trade publications, trade associations, company literature, and online databases. The projections contained in this report are checked from top down and bottom up analysis to be sure there is congruence from that perspective.

The base year for analysis and projection is 2019. With 2012 and several years prior to that baseline, market projections were developed for 2020 through 2026. These projections are based on a combination of a

consensus among the opinion leader contacts interviewed combined with understanding of the key market drivers and their impact from a historical and analytical perspective.

The analytical methodologies used to generate the market estimates are based on penetration analyses, similar market analyses, and delta calculations to supplement independent and dependent variable analysis. All analyses are displaying selected descriptions of products and services.

This research includes reference to an ROI model that is part of a series that provides IT systems financial planners access to information that supports analysis of all the numbers that impact management of a product launch or large and complex data center. The methodology used in the models relates to having a sophisticated analytical technique for understanding the impact of workload on processor consumption and cost.

Diverse market drivers including: the pace of global warming, Chinese investment in the military, and big tech R&D spending are driving unprecedented adoption of AI for military, for agriculture, for electric vehicles, for digital currency, for everything, creating the ability to implement more efficient business practices. Smart contracts fulfill the need to implement AI efficiently.

AI will bring the same digital revolution that PCs, smart phones, and the Internet have already brought, but quicker and with greater impact.

Smart contracts make AI work. All these shifts to AI bring strong growth of the US and World GDP. They create an economic push for CBDCs and smart contracts. AI is already here, making change immediate.

Electric vehicle implementation is anticipated to add $114 trillion to the global economy by 2029 over and above what is part of the world economy now. Microsoft is said to be investing another $10 billion into CHATgpt and adding the AI functionality to Excel and Word immediately. AI functionality is driving another $100 trillion into the global economy. Teachers, professors, and users are already noticing the effects of CHATgbt.

Smart Contracts Drive Economic Growth and the Adoption of Central Bank Digital Currency (CBDC)

TABLE OF CONTENTS

AI AND SMART CONTRACTS EXECUTIVE SUMMARY

- Smart Contracts

AI

- Smart Contracts Integrate with Industrial Internet of Things (IIoT), Blockchain and Distributed Ledger (DLT) Technology

AI and Smart Contract Blockchain and Distributed Ledger Market Shares, Dollars, 2022

1. SMART CONTRACT MARKET DEFINITION AND MARKET DYNAMICS

- 1.1. Business Built on Trust

- 1.1.1. Smart Contracts Disruptive Technology

- 1.2. AI and Smart Contracts Leverage Digital Currency for Transaction Settlements

- 1.3. Using Smart Contracts to Improve Data Management

- 1.4. Blockchain as an Electronic List of Connected Records

- 1.5. Immutability: Preventing Change to Smart Contracts

- 1.6. Self-Enforcing Contracts

- 1.7. Signing Smart Contracts: Legal Considerations

- 1.8. Obstacles to Smart Contracts

- 1.9. Security And Privacy

2. SMART CONTRACTS MARKET SHARES, MARKET FORECASTS

- 2.1. Smart Contracts Market Driving Forces

- 2.2. Smart Contract Blockchain Market Shares

- 2.3. Smart Contract Market Forecasts

- 2.3.1. Improvements In Payment Systems

3. CBDCS AND SMART CONTRACTS

- 3.1. Central Bank Monetary Policy

- 3.2. Digital Money

- 3.3. US Central Bank Money: Most Trusted

- 3.4. Cryptocurrency Value Decline

- 3.5. Token-Based CBDCs

- 3.6. Sonoco and IBM Applications of Smart Contracts

- 3.7. Everscale Consensus Mechanism

- 3.8. Variability in Value of Private and Crypto Currencies

- 3.9. Private Digital Money

- 3.9.1. Private Platforms Can Be Risky

- 3.9.2. Fedcoin Features

- 3.10. Barclays CBDC Analysis

- 3.10.1. Barklays Working with Central Banks

4. SMART CONTRACTS REGIONAL ANALYSIS

- 4.1. Countries Move to Control Blockchain, Reducing Tax Evasion, Money Laundering, and Fraud

- 4.2. US

- 4.2.1. US Central Bank Digital Currency (CBDC) Executive Order: Research a Matter of Urgency

- 4.2.2. Federal Reserve Bank of Boston and the Massachusetts Institute of Technology Digital Currency Initiative

- 4.3. China

- 4.3.1. CBDC for China

- 4.4. India

- 4.4.1. IBM Blockchain Platform for Supply Chain Financing and Security in India

- 4.5. Japan

- 4.6. UK

- 4.7. Switzerland

- 4.8. Bahamas and Cambodia

- 4.9. Central Bank of Bahrain and JPMorgan to Work on Digital Currency Settlement Pilot

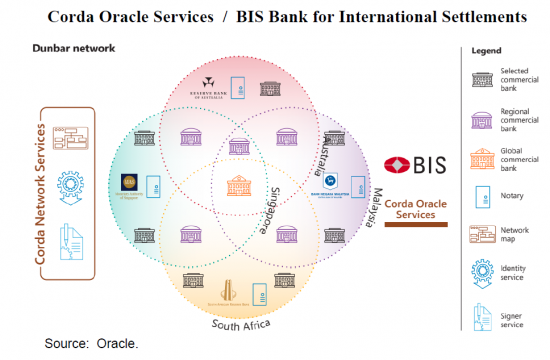

- 4.10. Bank for International Settlements (BIS) - Australia, Malaysia, Singapore, South Africa

- 4.10.1. Bank for International Settlements (BIS) Core CBDC Technology Options

- 4.11. AI Smart Contract Software

5. COMPANY PROFILES

- 5.1. AIWORK

- 5.2. Accenture Smart Contracts

- 5.2.1. Accenture Blockchain for Contracts

- 5.3. AWS Smart Contracts

- 5.4. OpenAI / ChatGPT

- 5.4.1. Microsoft Set to Invest Billions in ChatGPT

- 5.5. Ethereum

- 5.6. Everscale

- 5.6.1. Everscale GameFi and Metaverse SDK

- 5.6.2. Everscale API

- 5.6.3. Everscale Low Transaction Fees Enable CBDCs

- 5.6.4. Everscale CBDC

- 5.7. Goldman Sacks Smart Contracts

- 5.7.1. Goldman Sachs Blockchain Redefines the Way Transactions Occur

- 5.8. Huawei Smart Contracts

- 5.8.1. Huawei Smart Contract Systems Vision For 2030 Intelligent World

- 5.9. IBM

- 5.9.1. IBM Smart Contracts

- 5.9.2. IBM Smart Contracts Safeguarding the Efficacy of Medications

- 5.9.3. IBM Supply Chain Transparency

- 5.9.4. Blockchain for Trade Finance

- 5.9.5. Blockchain for Food Supply

- 5.10. JP Morgan Chase

- 5.11. L4S / TapestryX

- 5.11.1. L4S Tapestry Distributed Ledger

- 5.11.2. L4S / TapestryX

- 5.12. Microsoft Smart Contracts

- 5.12.1. Microsoft Implementing Enterprise Smart Contracts

- 5.12.2. Microsoft Azure - The Enabler

- 5.12.3. Microsoft Enterprise Smart Contracts - Framework

- 5.12.4. Microsoft Smart Contracts Summary

- 5.13. Near

- 5.14. Oracle

- 5.14.1. Oracle Smart Contract Benefits

- 5.14.2. Oracle Blockchain for Smart Contracts: Use Cases - Banking, Government, Insurance, Business

- 5.15. Partior Smart Contracts

- 5.16. R3 / Corda

- 5.16.1. Smart Contracts - R3 Documentation

- 5.17. Solana

- 5.18. Swift

- 5.18.1. SWIFT Experiments with Accenture

- 5.19. Tata Consultancy Services (TCS)

- 5.20. Wipro

- 5.20.1. Wipro and R3 Target Thailand

- 5.20.2. Wipro Revenue

- 5.21. Selected Smart Contract Market Participants and Legal Firms

List of Tables and Figures

- Figure 1. Basic Rules of Smart Contract Contractual Agreements

- Figure 2. Smart Contract Efficiency That Accrues from The Automation Of Contract Terms

- Figure 3. AI and Smart Contract Blockchain and Distributed Ledger Market Shares, Dollars, 2022

- Figure 4. Smart Contracts

- Figure 5. Benefits of Blockchain Electronic Ledger

- Figure 6. Smart Contract Interruption Events

- Figure 7. Smart Contracts Business Market Driving Forces

- Figure 8. AI and Smart Contract Blockchain and Distributed Ledger Market Shares, Dollars, 2022

- Figure 9. AI and Smart Contracts Blockchain and Distributed Ledger Market Shares, Dollars, Worldwide, 2022

- Figure 10. AI and Smart Contracts Blockchain and Distributed Ledger Market Shares, Dollars, Worldwide, 2022

- Figure 11. Smart Contracts Blockchain and Digital Ledger Market Forecasts, Dollars Shipped, Worldwide, 2023-2029

- Figure 12. CBDC Implementation: Large Bank Interbank Settlement and Cross Border Payments Savings Market Forecasts, Dollars, Worldwide, 2022-2028

- Figure 13. IBM Blockchain Transparent Supply

- Figure 14. Benefits of Smart Contracts

- Figure 15. Sears Roebuck and Co. Had its Own Currency Years Ago

- Figure 16. Private money before crypto: Chesapeake and Ohio Canal Company note (1841)

- Figure 17. Threats Cryptocurrencies Pose to Financial System Stability

- Figure 18. The US Federal Reserve

- Figure 19. The US Federal Reserve Key Functions

- Figure 20. The US Federal Reserve Activities

- Figure 21. IBM Security Command Center in Bengaluru, India

- Figure 22. The Rise of Decentralized Finance

- Figure 23. Core CBDC Technology Options

- Figure 24. CBDC Access Implementation

- Figure 25. CBDC Commercial Deployment and Operation

- Figure 26. Benefits of Smart Contract Software

- Figure 27. AWS Blockchain Smart Contract Templates

- Figure 28. Everscale Value to Developers

- Figure 29. Everscale Scalable Network Benefits

- Figure 30. Everscale SDK Features

- Figure 31. Goldman Sacks Smart Contracts Functions

- Figure 32. Goldman Sachs Blockchain Positioning

- Figure 33. Goldman Sachs Blockchain Transaction Management

- Figure 34. Goldman Sachs Blockchain Redefines the Way Transactions Occur

- Figure 35. Huawei Envisions An Era Of Intelligent Smart Contracts Powering A 4th Industrial Revolution, Intelligent Vehicles

- Figure 36. IBM Smart Contracts

- Figure 37. IBM Provides Home Depo Increased Visibility Into The Supply Chain,

- Figure 38. IBM We Trade

- Figure 39. IBM Benefits of Smart Contracts

- Figure 40. Sonoco + IBM: Safeguarding the Efficacy of Lifesaving Medications with Blockchain

- Figure 41. JPMC Cross Border Transactional Cash Management Metrics

- Figure 42. Global Payments Infrastructure

- Figure 43. Twitter November 2,2022 Token Digital Asset Transfer by Bank

- Figure 44. L4S DLT Supply Chain Benefits

- Figure 45. L4S Tapestry Distributed Ledger

- Figure 46. L4S DL/Blockchain Features

- Figure 47. TapestryX Fundamental DTL Requirements vs Blockchain Capabilities

- Figure 48. Microsoft Smart Contracts

- Figure 49. Microsoft Enterprise Smart Contract Components

- Figure 50. Microsoft Blockchain and Cloud

- Figure 51. Microsoft Azure Smart Contracts Composition

- Figure 52. Microsoft Smart Contracts Axure Platform Building Blocks

- Figure 53. Microsoft Smart Contracts Message Based API

- Figure 54. Microsoft Smart Contracts Message Based API Functions

- Figure 55. Using Microsoft Azure Enterprise Smart Contracts

- Figure 56. NEAR Apps Functions

- Figure 57. NEAR-api-js Features

- Figure 58. NEAR-api-js: Functions

- Figure 59. Developer Choices for Compiling a NEAR Smart Contract:

- Figure 60. Oracle Smart Contract Benefits

- Figure 61. Partior Services:

- Figure 62. Partior Countries Served

- Figure 63. R3 / Corda DLT Production Ecosystem

- Figure 64. Solana Smart Contract Technology Features

- Figure 65. Wipro Revenue 2001-2021

- Figure 66. Project Inthanon: Wipro and R3 Launch Interbank Settlement Blockchain with Digital Currency

- Figure 67. Project Inthanon Functions