PUBLISHER: Zhar Research | PRODUCT CODE: 1871065

PUBLISHER: Zhar Research | PRODUCT CODE: 1871065

Long Duration Energy Storage (LDES) Overview: Technologies, Materials, Projects, Companies, Research Advances in 2025-2026, Escape Routes, Markets 2026-2046

Summary

A new report gives the reality about LDES, presenting detailed opportunities in materials and systems without the usual exaggeration. It is Zhar Research 602-page, "Long Duration Energy Storage Grand Overview: Technologies, Materials, Projects, Companies, Research Advances in 2025-6, Escape Routes, Markets 2026-2046".

Essential

Long Duration Energy Storage LDES is increasingly essential to cover intermittency of wind and solar power. It is also useful to cover down time of all other green options. Enthusiasts push for trillions of dollars to be spent on it but what is the reality after considering escape routes, paybacks and real-world delays? The new Zhar Research report has the answers with detailed forecasts in 23 lines and roadmaps in three lines for 2026-2046. Importantly, that includes a very close look at research and company advances 2025-6. The result is that over the next 20 years around one trillion dollars will be needed to deliver the lower cost of green electricity resulting from LDES while escape routes are also increasingly activated such as grids and their interconnectors widening across more weather and time zones. See 12 other groupings.

Latest in-depth information

The report has 12 chapters, 17 parameters compared, 22 SWOT appraisals, 23 forecast lines and PhD level analysis throughout, with over 104 companies covered. That includes consideration of units and companies with technologies capable of LDES but currently only used for short-duration storage.

The Executive Summary and Conclusions uses 50 pages to present 23 key conclusions, most of the SWOT appraisals and new infograms, tables and graphs for easy assimilation of the essentials including roadmaps. See all forecasts as tables and graphs with explanation.

Escape routes

Chapter 2. LDES need and design principles (30 pages) explains the context of green electricity then introduces LDES definitions, needs, toolkit, metrics and more. Chapter 3. LDES escape routes (13 pages) presents the large number of escape routes, deliberate and otherwise, that are arriving to reduce the need for LDES by reducing the need for electricity, reducing the intermittency of green production of electricity and permitting us to viably live with intermittency. Together, they may later reduce demand for the band aid of LDES by at least 50%, something largely ignored by suppliers and their trade association.

Latest technology thoroughly examined

Technology chapters then follow, each with new parameter tables, SWOT appraisals and how research advances 2025-6 change the situation. The authors find that Pumped Hydro is the gold standard of LDES on a host of criteria and that it has much further to go including in forms called Advanced Pumped Hydro. These are covered in Chapter 4. Pumped Hydro: conventional PHES (30 pages) and Chapter 5. Advanced Pumped Hydro APHES with 42 pages covering many seawater forms, plus using loaded heavier water on mere hills and other options. Some make pumped hydro useful for large microgrids such as AI datacenters and flat terrain using old mines and underground sprung rock. One conclusion is that APHES widens the scope of PHES rather than competing with it.

Chapter 6. Compressed Air CAES ( 64 pages) shows how this option can have lower capital expenditure that PHES by using existing salt caverns and may approach the Levelised Cost of Storage LCOS of PHES and be located where PHES is not practicable. The activities of 12 companies, various regions, technology options and many latest research advances are appraised.

Chapter 7. Redox Flow Batteries RFB (154 pages) involve the most suppliers with 45 of them compared by many parameters. These may never have the lowest LDES LCOS but they have advantages such as economy of scale of increasing size (like PHES, APHES and few others) to follow the market trend to units with more capacity and smaller footprint being safely stackable. Indeed, they may win for microgrids if named problems are fixed. Large RFB in China used for short duration grid storage can be operated as LDES when the need arises. Understand the RFB progression from using valuable metal and incurring recycling to ones using everyday materials and some hybrids of RFB with Advanced Conventional Construction Batteries ACCB for smaller size but with some named disadvantages.

Chapter 8. Solid Gravity Energy Storage SGES (37 pages) involves lifting blocks but there is also an option using sand. The high capital cost of assembling what looks like a large array of dock cranes in a huge building can be reduced for smaller capacities when it is done in mines. Beyond China, where six monsters are being erected above ground, the chapter examines the activities of five companies across the world taking different approaches all capable of longest duration with no self-leakage or fade but some named challenges.

Chapter 9. Advanced Conventional Construction Batteries ACCB (49 pages) spans many chemistries and fortunes from bankruptcies to Form Energy iron-air batteries raising more money than anyone by promising viable 100-hour grid LDES. It is erecting several commercial facilities to prove it but there are issues for this option and others presented in this chapter. See then all compared by parameter, SWOT and latest research advances.

Chapter 10. Liquefied gas energy storage LGES: Liquid Air LAES or CO2 (44 pages) examines these options in China and by companies elsewhere gaining traction. They have economy of scaling in size but also advantages for large microgrids. They have strong competition in their sweet spot of LDES duration but they use proven subsystems. What trials are being prepared? Will LCOS be an issue? Latest research? It is all here.

Chapter 11. Thermal Energy Storage for delayed electricity ETES (23 pages) reveals the lessons from several bankruptcies and exits in this sector that is not to be confused with the mature, successful business of delayed heat. Understand a new approach in Alaska using heat pumps instead of a steam cycle and the many pros, cons and research studies.

Chapter 12. Hydrogen and Other Chemical Intermediary LDES (42 pages) explains why most agree that the best chemical intermediary for delayed electricity should be hydrogen. However, it is the smallest molecule, leaking easily and, indirectly, it is a potent greenhouse gas. Full cycle efficiency for LDES is poor. It attracts as a possibility in existing salt caverns for extremely high capacity and longest duration but why no major trials? What about two projects with above ground tanks and the work in China with hydrogen storage not offering LDES as a priority?

Your most thorough, up-to-date, truly independent source book on all of this is the Zhar Research report, "Long Duration Energy Storage Grand Overview: Technologies, Materials, Projects, Companies, Research Advances in 2025-6, Escape Routes, Markets 2026-2046".

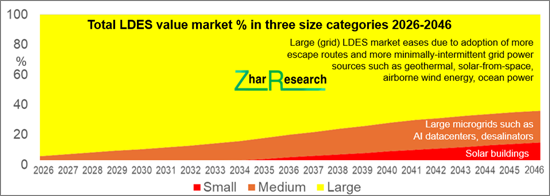

CAPTION: Total LDES value market % in three size categories 2026-2046. Source Zhar Research report, "Long Duration Energy Storage Grand Overview: Technologies, Materials, Projects, Companies, Research Advances in 2025-6, Escape Routes, Markets 2026-2046".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose and unique scope of this report

- 1.2. Methodology of this analysis

- 1.3. Key conclusions concerning electrification and LDES definition, needs, candidates

- 1.4. Key conclusions concerning LDES parameters and calculations

- 1.5. Key conclusions: LDES for grid, microgrid and escape routes

- 1.5.1. Different LDES needs and technologies for grid and microgrid

- 1.5.2. Escape routes from LDES with infogram

- 1.5.3. Grids have more options reducing the need for LDES

- 1.6. Actual and proposed types of LDES and the gold standard

- 1.7. Potential LDES performance by ten technologies in 19 columns

- 1.8. Examples of current installations and potential

- 1.9. Three LDES sizes, with different technology winners 2026-2046 on current evidence

- 1.10. Acceptable sites: numbers by technology 2026-2046

- 1.11. Calculations of LDES need by technology with implications

- 1.12. Current and emerging LDES duration vs power deliverable

- 1.12.1. Current LDES situation in green and trend in grid need in blue: simplified version

- 1.12.2. Duration hours vs power delivered by project and 12 technologies in 2026

- 1.13. SWOT appraisals of nine important LDES technologies for 2026-2046

- 1.14. Companies to watch, investment trends by company and technology, important regions

- 1.15. Long Duration Energy Storage LDES roadmap 2026-2046

- 1.16. Market forecasts in 23 lines 2026-2046 with graphs and explanation

- 1.16.1. LDES total value market showing beyond-grid gaining share 2024-2046

- 1.16.2. Number of LDES actual and putative manufacturers: RFB vs Other showing shakeout 2026-2046

- 1.16.3. Total LDES value market % in three size categories 2026-2046 table, graph, explanation

- 1.16.4. Regional share of LDES value market % in four regions 2026-2046 table, graph, explanation

- 1.16.5. LDES market in 9 technology categories $ billion 2026-2046 table, graphs, explanation

- 1.16.6. Vanadium vs iron vs other RFB LDES market % value sales with technology strategies 2026-2046

2. LDES need and design principles

- 2.1. Energy fundamentals

- 2.2. Racing into renewables with rapid cost reduction: 2025 statistics and trends

- 2.3. Solar winning and the intermittency challenge

- 2.4. Adoption of LDES of increasing duration driven by increased wind/solar percentage and cost reduction

- 2.5. LDES definitions and needs

- 2.5.1. General

- 2.5.2. Integrated energy storage systems for grids

- 2.5.3. Example of urgent need for grid LDES - UK government report

- 2.5.4. Very different needs for grid vs beyond-grid LDES 2026-2046

- 2.5.5. Duration vs power showing three size sectors needing different technologies

- 2.6. LDES metrics

- 2.7. LDES projects in 2025-6 showing leading technology subsets

- 2.7.1. Current LDES zones of duration vs power and trend in need

- 2.7.2. Leading projects in 2025-6 showing detail and leading technology subsets, trend

- 2.8. LDES impediments, alternatives and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.9.3. Electrochemical LDES options explained

- 2.10. Latest independent assessments of performance by technology

- 2.11. Batteries that struggle above 8-hour duration

- 2.12. Drill down report on beyond-grid LDES

3. LDES escape routes

- 3.1. General situation

- 3.2. Infogram: 13 escape routes from LDES 2026-2046

- 3.3. Examples across the world: Denmark, Singapore, China, USA

- 3.4. Capacity factor of wind, solar and options that need little or no LDES

- 3.5. Extensive 2025 research on LDES escape routes

- 3.6. Research in 2025 on Home Energy Management Systems coping with intermittent supply

4. Pumped hydro: conventional PHES

- 4.1. Overview

- 4.1.1. Three options

- 4.1.2. History, environmental, timescales, potential sites, DOE appraisal

- 4.1.3. Site-limited primarily due environmental concerns not number of appropriate topologies

- 4.1.4. Problem analysis, actions to reduce PHES emissions, ugliness, water use, cost

- 4.2. Research advances and view of potential through 2025

- 4.3. Projects and intentions across the world

- 4.3.1. Geographical

- 4.3.2. Large pumped hydro schemes worldwide

- 4.4. Economics

- 4.5. Policy recommendations

- 4.6. Parameter appraisal of conventional pumped hydro PHES

- 4.7. SWOT appraisal of conventional pumped hydro PHES

5. Advanced pumped hydro APHES

- 5.1. Overview

- 5.2. Using mining sites

- 5.2.1. Potential

- 5.2.2. Research advances in 2025

- 5.3. Pressurised underground: Quidnet Energy USA

- 5.4. Using heavier water up mere hills: RheEnergise UK

- 5.4.1. General

- 5.4.2. RheEnergise installation progress 2025-6

- 5.4.3. Power for mines and other targets with appraisal of prospects

- 5.5. Using seawater or other brine

- 5.5.1. General

- 5.5.2. Brine in salt caverns Cavern Energy USA

- 5.5.3. SWOT appraisal of seawater pumped hydro on land

- 5.6. Sizeable Energy Italy, StEnSea Germany, Ocean Grazer Netherlands

- 5.6.1. General

- 5.6.2. Sizable Energy Itay

- 5.6.3. StEnSea Germany

- 5.6.4. Ocean Grazer Netherlands

- 5.6.5. SWOT appraisal of underwater energy storage for LDES

- 5.7. Hybrid technologies: research advances in 2024 and 2025

- 5.8. Research advances in 2024 and 2025

- 5.9. SWOT appraisal of APHES

6. Compressed air CAES

- 6.1. Overview including research advances announced in 2025

- 6.1.1. Basics

- 6.1.2. Research advances in 2025

- 6.2. Undersupply attracts clones

- 6.3. Market positioning of CAES

- 6.4. SWOT appraisal and parameter comparison of CAES for LDES

- 6.5. CAES technology options

- 6.5.1. Thermodynamic

- 6.4.2. Isochoric or isobaric storage

- 6.4.3. Adiabatic choice of cooling is winning

- 6.6. CAES projects, subsystem manufacturers, objectives, research 2025 onwards

- 6.6.1. Overview

- 6.6.2. Siemens Energy Germany

- 6.6.3. MAN Energy Solutions Germany

- 6.6.4. Increasing the CAES storage time and discharge duration

- 6.6.5. Research in UK and European Union 2025 onwards

- 6.7. Profiles of CAES company progress with Zhar Research appraisals

- 6.7.1. ALCAES Switzerland

- 6.7.2. APEX CAES USA

- 6.7.3. Augwind Energy Israel

- 6.7.4. Keep Energy Systems UK formerly Cheesecake

- 6.7.5. Corre Energy Netherlands

- 6.7.6. Huaneng Group China

- 6.7.7. Hydrostor Canada

- 6.7.8. LiGE Pty South Africa

- 6.7.9. Storelectric UK

- 6.7.10. Terrastor Energy Corporation USA

7. Redox flow batteries RFB

- 7.1. Overview

- 7.2. RFB research pivoting to LDES

- 7.2.1. Overview of RFB and its potential for LDES

- 7.2.2. Infogram: RFB achievements and aspirations 2026-2046

- 7.2.3. 72 RFB research advances in 2025

- 7.2.4. 18 examples of RFB research advances in 2024

- 7.3. Winning LDES redox flow battery technologies 2026-2046

- 7.4. SWOT appraisal and parameter comparison of RFB for LDES

- 7.5 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 7.6. RFB technologies with research advances through 2025

- 7.6.1. Regular or hybrid, their chemistries and the main ones being commercialised

- 7.6.2. SWOT appraisals of regular vs hybrid options

- 7.7. Specific designs by material: vanadium, iron and variants, other metal ligand, halogen-based, organic, manganese with 2025 research, three SWOT appraisals

- 7.7.1. Vanadium RFB design and SWOT appraisal

- 7.7.2. All-iron and variants RFB design and SWOT appraisal

- 7.8. RFB manufacturer profiles

8. Solid gravity energy storage SGES

- 8.1. Overview including research in 2025

- 8.1.1. General

- 8.1.2. Three stages of operation

- 8.1.3. Three geometries

- 8.1.4. Pumped hydro gravity storage compared to the three SGES options

- 8.1.5. Basics

- 8.1.6. SWOT appraisal of solid gravity storage SGES for LDES

- 8.1.7. Parameter appraisal of solid gravity energy storage SGES for LDES

- 8.1.8. CAPEX challenge

- 8.1.9. Challenge of ongoing expenses

- 8.1.10. Possibility of pumping sand

- 8.1.11. Hydraulic piston lift instead of cable: 2025 modelling

- 8.1.12. Appraisal of other SGES research through 2025 and 2024

- 8.2. ARES USA

- 8.3. Energy Vault Switzerland, USA and China, India licensees

- 8.4. Gravitricity

- 8.5. Green Gravity Australia

- 8.6. SinkFloatSolutions France

9. Advanced conventional construction batteries ACCB

- 9.1. Overview

- 9.2. Eight ACCB manufacturers compared: 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 9.3. Parameter appraisal and SWOT appraisal of ACCB for LDES

- 9.3.1. Parameter appraisal

- 9.3.2. SWOT appraisal of ACCB for LDES

- 9.3.3. Research appraisal published in 2025

- 9.4. Metal-air batteries

- 9.4.1. Iron-air with SWOT and 2025 research: Form Energy USA

- 9.4.2. Aluminium-air : Phinergy Israel

- 9.4.3. Zinc-air with SWOT: E-Zinc, AZA battery, Zinc8 (Abound)

- 9.5. High temperature batteries

- 9.5.1. Molten calcium antimony: Ambri USA out of business, SWOT

- 9.5.2. Sodium or lithium sulfur: NGK/ BASF Japan/ Germany, others, research in 2025, SWOT

- 9.6. Metal-ion batteries including Inlyte, Altris, HiNa, Tiamat, Natron, Faradion

- 9.6.1. Sodium-ion with SWOT

- 9.6.2. Zinc halide Eos Energy Enterprises USA with SWOT

- 9.6.3. Zinc-ion Enerpoly, Urban Electric Power USA, NextEra USA

- 9.7. Nickel hydrogen batteries: EnerVenue USA with SWOT

10. Liquefied gas energy storage LGES: Liquid air LAES or CO2

- 10.1. Overview

- 10.2. Liquid air LAES LDES

- 10.2.1. Technology and research advances through 2025

- 10.2.2. Parameter comparison of LAES for LDES

- 10.2.3. SWOT appraisal of LAES for LDES

- 10.2.4. Indicative LAES systems, footprints and operating parameters

- 10.2.5. Research advances in 2025 and 2024

- 10.2.6. CGDG, Zhongli Zhongke Energy Storage Technology Co China

- 10.2.7. Highview Energy UK and partners Sumitomo, Centrica, Rio Tinto and others

- 10.2.8. MIT study of LAES viability in USA

- 10.2.9. Phelas Germany

- 10.3. Liquid and compressed carbon dioxide LDES

- 10.3.1. Overview

- 10.3.2. Parameter comparison of CO2 for LDES

- 10.3.3. SWOT appraisal of liquid CO2 for LDES

- 10.3.4. Research advances in 2025

- 10.3.5. Energy Dome Italy

- 10.3.6. China and Kazakhstan

11. Thermal energy storage for delayed electricity ETES

- 11.1. Overview and research advances in 2025

- 11.2. Research advances in 2025 and 2024

- 11.3. Lessons of failure: Siemens Gamesa, Azelio, Steisdal, Lumenion

- 11.4. The heat engine approach proceeds: Echogen USA

- 11.5. Use of extreme temperatures and photovoltaic conversion

- 11.5.1. Antora USA

- 11.5.2. Fourth Power USA

- 11.6. Marketing delayed heat and electricity from one plant

- 11.6.1. Overview

- 11.6.2. MGA Thermal Australia

- 11.6.3. Malta Inc Germany

12. Hydrogen and other chemical intermediary LDES

- 12.1. Overview with research progress in 2025-6

- 12.1.1. Overview

- 12.1.2. Sweet spot for chemical intermediary LDES but safety issues

- 12.1.3. Mainstream research through 2025-6

- 12.1.4. Research dreaming of niches through 2025-6

- 12.1.5. Research on complex mechanisms for hydrogen loss

- 12.1.6. Research on hydrogen leakage causing global warming

- 12.1.7. Examples of hydrogen storage advances 2025-6

- 12.2. Parameter appraisal of hydrogen storage for LDES

- 12.3. SWOT appraisal of hydrogen, methane, ammonia for LDES

- 12.4. The small number of actual projects

- 12.4.1. Calistoga Resiliency Centre USA 48-hour microgrid

- 12.4.2. Ulm University microgrid trial Germany 2025-2027

- 12.4.3. China plans in 2025 and 2026

- 12.5. Calculations showing H2ES best only for seasonal storage, needed later

- 12.6. Calculations with other conclusions partly due to lack of operating data

- 12.7. Candidate technologies for hydrogen storage within LDES systems