PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744370

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1744370

Global Tactical Missiles Market 2025-2035

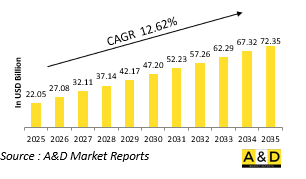

The Global Tactical Missiles market is estimated at USD 22.05 billion in 2025, projected to grow to USD 72.35 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 12.62% over the forecast period 2025-2035.

Introduction to Tactical Missiles Market:

Tactical missiles play a crucial role in modern military strategy by providing precise, short-to-medium-range strike capabilities during active operations. Unlike strategic missile systems designed for long-range deterrence, tactical variants are engineered for battlefield effectiveness, supporting ground forces and neutralizing enemy assets with speed and accuracy. These systems are typically deployed in regional conflicts or during rapid-response scenarios where time-sensitive targets must be engaged. They include a variety of missile types such as surface-to-surface, surface-to-air, and air-to-ground, tailored for different operational needs. The growing importance of mobility and rapid deployment has led to the development of compact, easily transportable launch platforms. These weapons serve as both offensive and defensive tools, deterring aggression and enabling swift retaliatory action. Their integration into modern warfare reflects the demand for precision, adaptability, and lower collateral impact in high-stakes environments. As global military doctrines shift toward network-centric operations and hybrid warfare models, tactical missile systems have become indispensable assets. Nations continue to invest in these capabilities to protect territorial integrity, enforce airspace control, and support allied operations. With rising instability in several regions, the relevance of tactical missile forces is expanding, reinforcing their role in both conventional and non-conventional military engagements.

Technology Impact in Tactical Missiles Market:

Technological innovation is rapidly transforming the capabilities and applications of defense tactical missile systems. Advancements in propulsion have significantly increased speed and maneuverability, allowing these weapons to evade traditional air defense measures. Precision-guidance technologies such as GPS-aided inertial navigation, electro-optical seekers, and real-time data links enable higher accuracy and adaptability during flight. These improvements reduce unintended damage while enhancing mission success in complex environments. Warhead designs have also evolved to deliver targeted effects, whether penetrating armor, disabling infrastructure, or neutralizing personnel with minimal surrounding disruption. Artificial intelligence and autonomous targeting features are beginning to reshape operational planning, as missiles gain the ability to identify and prioritize threats independently. Materials science contributes to lighter, stronger structures that improve range and payload flexibility. Additionally, modular design concepts allow for easy upgrades and customization, aligning with the varied requirements of modern combat scenarios. Secure communication links and advanced countermeasure resistance further enhance survivability against evolving threats. The result is a new generation of tactical missiles that are faster, smarter, and more lethal, designed to perform under the demands of rapidly shifting battlefield conditions. These technologies collectively redefine what is possible in tactical engagements, giving armed forces greater strategic agility.

Key Drivers in Tactical Missiles Market:

Several critical factors are pushing the evolution and proliferation of tactical missile systems in global defense strategies. Modern combat operations require rapid, precise, and reliable strike capabilities, making tactical missiles an attractive solution for engaging time-sensitive or mobile targets. Evolving threat landscapes, including the use of fortified positions, fast-moving vehicles, and aerial incursions, demand flexible weapons that can be deployed quickly and effectively. The increasing emphasis on deterrence without escalation also favors tactical missiles, which offer measured response options that can be scaled according to the situation. Shifts in military doctrines toward agile, multi-domain forces encourage the integration of missiles into joint command frameworks, enabling seamless coordination across air, land, and sea operations. Defense modernization efforts are another major driver, with many nations upgrading their missile arsenals to replace outdated systems and maintain parity with regional rivals. National security considerations, especially in volatile border areas or contested maritime zones, further stimulate investment in these capabilities. Additionally, the defense export market and alliances among technologically advanced nations encourage the development of standardized systems that can be deployed in collaborative missions. These diverse motivations shape procurement priorities and drive innovation across both offensive and defensive missile platforms.

Regional Trends in Tactical Missiles Market:

Regional security concerns and military postures heavily influence the development and deployment of tactical missile systems. In Asia-Pacific, territorial disputes and shifting alliances have prompted increased focus on rapid-strike capabilities, leading to the acquisition of mobile missile units and upgrades to targeting precision. Key players in the region are emphasizing indigenous development to reduce dependency and boost technological self-sufficiency. Europe, shaped by a collective defense mindset and heightened border tensions, emphasizes interoperability and coordination through integrated missile platforms suitable for NATO-led operations. Here, emphasis is placed on versatility and mobility to counter evolving threats without provoking large-scale escalation. The Middle East remains a hotspot for missile activity, where both state and non-state actors leverage these systems as strategic tools amid persistent conflicts. Tactical missiles are valued for their ability to deliver decisive blows in short bursts of combat. In North America, the focus is on sustaining technological leadership through investment in hypersonic variants, smarter guidance systems, and enhanced deterrent capabilities. Meanwhile, in parts of Africa and Latin America, where resources are more limited, tactical missiles are used primarily for border defense and internal security, often through cost-effective partnerships and selective modernization efforts. Each region's approach reflects its unique security needs and strategic outlook.

Key Tactical Missiles Program:

Lockheed Martin has been awarded a contract worth up to $226.8 million by the U.S. Army to deliver Army Tactical Missile System (ATACMS) missiles and launch assemblies. According to a Department of Defense announcement on Tuesday, the Army Contracting Command is overseeing the agreement. The hybrid contract was awarded based on a single proposal submitted through an online solicitation process. Work under the contract will be carried out at Lockheed Martin's facility in Grand Prairie, Texas, and is scheduled for completion by December 30, 2028. The full contract amount will be funded through foreign military sales allocations for fiscal year 2024. The ATACMS is a long-range, precision-guided missile capable of being launched from both the High Mobility Artillery Rocket System (HIMARS) and the M270 Multiple Launch Rocket System, offering commanders rapid and powerful strike capabilities.

Table of Contents

Tactical Missiles Market Report Definition

Tactical Missiles Market Segmentation

By Range

By Region

By Launch Platform

Tactical Missiles Market Analysis for next 10 Years

The 10-year tactical missiles market analysis would give a detailed overview of tactical missiles market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Tactical Missiles Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Tactical Missiles Market Forecast

The 10-year tactical missiles market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Tactical Missiles Market Trends & Forecast

The regional tactical missiles market rends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Tactical Missiles Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Tactical Missiles Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Tactical Missiles Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Range, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Launch Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Range, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Launch Platform, 2025-2035

List of Figures

- Figure 1: Global Tactical Missiles Market Forecast, 2025-2035

- Figure 2: Global Tactical Missiles Market Forecast, By Region, 2025-2035

- Figure 3: Global Tactical Missiles Market Forecast, By Range, 2025-2035

- Figure 4: Global Tactical Missiles Market Forecast, By Launch Platform, 2025-2035

- Figure 5: North America, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 6: Europe, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 8: APAC, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 9: South America, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 10: United States, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 11: United States, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 12: Canada, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 14: Italy, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 16: France, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 17: France, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 18: Germany, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 24: Spain, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 30: Australia, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 32: India, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 33: India, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 34: China, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 35: China, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 40: Japan, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Tactical Missiles Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Tactical Missiles Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Tactical Missiles Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Tactical Missiles Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Tactical Missiles Market, By Range (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Tactical Missiles Market, By Range (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Tactical Missiles Market, By Launch Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Tactical Missiles Market, By Launch Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Tactical Missiles Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Tactical Missiles Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Tactical Missiles Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Tactical Missiles Market, By Region, 2025-2035

- Figure 58: Scenario 1, Tactical Missiles Market, By Range, 2025-2035

- Figure 59: Scenario 1, Tactical Missiles Market, By Launch Platform, 2025-2035

- Figure 60: Scenario 2, Tactical Missiles Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Tactical Missiles Market, By Region, 2025-2035

- Figure 62: Scenario 2, Tactical Missiles Market, By Range, 2025-2035

- Figure 63: Scenario 2, Tactical Missiles Market, By Launch Platform, 2025-2035

- Figure 64: Company Benchmark, Tactical Missiles Market, 2025-2035