PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820818

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1820818

Global Small Caliber Ammunition Market 2025-2035

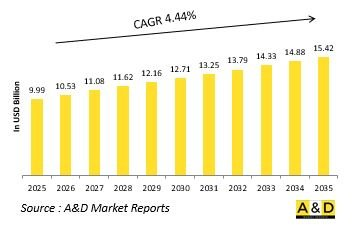

The Global Small Caliber Ammunition market is estimated at USD 9.99 billion in 2025, projected to grow to USD 15.42 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 4.44% over the forecast period 2025-2035.

Introduction to Small Caliber Ammunition Market

The defense small caliber ammunition market forms a fundamental component of military firepower, supporting a wide range of infantry weapons, including rifles, pistols, machine guns, and sniper systems. Small caliber ammunition is essential for close-quarters combat, tactical operations, and training exercises, serving as the primary tool for individual soldiers and special forces. Its reliability, precision, and versatility make it indispensable for conventional warfare, counterinsurgency missions, and peacekeeping operations. As global defense strategies evolve to address asymmetric threats and hybrid conflicts, the demand for improved small caliber ammunition continues to rise. Military forces seek enhanced accuracy, increased lethality, and optimized performance across varied environments - from urban terrain to rugged battlefields. Additionally, the role of small caliber ammunition extends beyond active combat to include law enforcement, homeland security, and border protection missions. Its cost-effectiveness and adaptability also make it a key element in sustained operational readiness and rapid deployment capabilities. With armed forces emphasizing soldier modernization and battlefield agility, small caliber ammunition remains central to achieving tactical superiority, force effectiveness, and mission success in increasingly dynamic and complex defense scenarios across the globe.

Technology Impact in Small Caliber Ammunition Market:

Technological advancements are significantly reshaping the defense small caliber ammunition market, enhancing its performance, safety, and operational efficiency. Innovations in materials science have led to the development of lighter, stronger projectiles with improved penetration and terminal ballistics. Enhanced propellants and primer compositions are boosting range, consistency, and reliability, ensuring superior performance in varied environmental conditions. Precision engineering and tighter manufacturing tolerances contribute to greater accuracy and reduced deviation, vital for modern combat where precision engagements are often decisive. Smart ammunition technologies, including programmable rounds and electronic fuzes, are emerging to deliver tailored effects against specific targets. Environmental considerations are also influencing design, with lead-free and reduced-toxicity ammunition gaining traction to minimize ecological impact during training and combat. Additive manufacturing techniques are streamlining production, enabling rapid prototyping and customization. Integration with advanced fire control systems and ballistic calculators is further optimizing effectiveness on the battlefield. Together, these technological trends are transforming small caliber ammunition into more effective, versatile, and sustainable tools of modern warfare, aligning with the broader goals of enhanced soldier lethality, operational flexibility, and readiness for diverse mission profiles.

Key Drivers in Small Caliber Ammunition Market:

The growth of the defense small caliber ammunition market is driven by evolving combat needs, modernization initiatives, and changing security dynamics. The rise of asymmetric warfare, counterterrorism operations, and urban combat scenarios has heightened the demand for precision-engineered, reliable ammunition capable of performing in complex environments. Soldier modernization programs aimed at increasing individual lethality and mobility are pushing armed forces to procure next-generation ammunition with enhanced performance characteristics. Expanding special operations units and rapid deployment forces require high-performance rounds optimized for diverse missions, from close-quarters engagements to long-range precision strikes. Additionally, regular training and readiness exercises fuel sustained demand, as military forces prioritize continuous skill development and operational preparedness. Border security, homeland defense, and peacekeeping missions also contribute to market growth, requiring significant stockpiles and varied ammunition types. Technological advancements, coupled with the need for interoperability with modern weapon systems, are prompting defense agencies to upgrade their ammunition inventories. Geopolitical tensions, territorial disputes, and rising defense budgets further amplify procurement activities, ensuring steady market momentum. Collectively, these factors underscore the strategic importance of small caliber ammunition as a critical enabler of defense capability and tactical effectiveness.

Regional Trends in Small Caliber Ammunition Market:

Regional trends in the small caliber ammunition market reflect a balance between modernization priorities, strategic requirements, and evolving security challenges. North America leads in innovation and procurement, driven by advanced infantry programs, frequent training operations, and continuous upgrades to ammunition stockpiles. Europe is witnessing increased demand as nations modernize their forces, enhance rapid reaction capabilities, and strengthen collective defense initiatives. The Asia-Pacific region is experiencing robust growth, fueled by expanding military forces, rising territorial tensions, and investments in indigenous ammunition production capabilities. Middle Eastern countries are focusing on improving counterterrorism and internal security capacities, resulting in significant procurement of specialized and high-performance ammunition. Latin America and Africa, while smaller markets, are increasingly prioritizing ammunition acquisition for border protection, peacekeeping operations, and counterinsurgency missions. Across regions, collaboration between domestic manufacturers and international defense contractors is driving technology transfer and enhancing local production capabilities. Additionally, growing emphasis on self-reliance and strategic autonomy is encouraging indigenous development initiatives. These regional dynamics underscore the universal importance of small caliber ammunition as a foundational element of defense preparedness, supporting diverse operational requirements and strengthening the tactical effectiveness of armed forces worldwide.

Key Small Caliber Ammunition Program:

The Swedish Defence Materiel Administration (FMV) has awarded a contract valued at Skr1.8 billion ($185.8 million) to Norwegian-Finnish defense company Nammo for the supply of small-calibre ammunition. In addition, FMV placed an order with Norma worth Skr1.4 billion for fine-calibre ammunition. Both framework agreements with Nammo and Norma are set for a ten-year duration, including an initial three-year procurement period. Deliveries under these contracts are planned between 2026 and 2028. The 10-year agreement with Nammo is part of a broader framework recently established with FMV and represents Sweden's largest procurement of small-calibre ammunition from Nammo to date.

Table of Contents

Small Caliber Ammunition Market Report Definition

Small Caliber Ammunition Market Segmentation

By Region

By Caliber

By End User

Small Caliber Ammunition Market Analysis for next 10 Years

The 10-year Small Caliber Ammunition Market analysis would give a detailed overview of Small Caliber Ammunition Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Small Caliber Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Small Caliber Ammunition Market Forecast

The 10-year Small Caliber Ammunition Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Small Caliber Ammunition Market Trends & Forecast

The regional Small Caliber Ammunition Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Small Caliber Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Small Caliber Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Small Caliber Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Caliber, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Caliber, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Small Caliber Ammunition Market Forecast, 2025-2035

- Figure 2: Global Small Caliber Ammunition Market Forecast, By Region, 2025-2035

- Figure 3: Global Small Caliber Ammunition Market Forecast, By Caliber, 2025-2035

- Figure 4: Global Small Caliber Ammunition Market Forecast, By End User, 2025-2035

- Figure 5: North America, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 6: Europe, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 8: APAC, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 9: South America, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 10: United States, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 11: United States, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 12: Canada, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 14: Italy, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 16: France, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 17: France, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 18: Germany, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 24: Spain, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 30: Australia, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 32: India, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 33: India, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 34: China, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 35: China, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 40: Japan, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Small Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Small Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Small Caliber Ammunition Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Small Caliber Ammunition Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Small Caliber Ammunition Market, By Caliber (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Small Caliber Ammunition Market, By Caliber (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Small Caliber Ammunition Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Small Caliber Ammunition Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Small Caliber Ammunition Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Small Caliber Ammunition Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Small Caliber Ammunition Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Small Caliber Ammunition Market, By Region, 2025-2035

- Figure 58: Scenario 1, Small Caliber Ammunition Market, By Caliber, 2025-2035

- Figure 59: Scenario 1, Small Caliber Ammunition Market, By End User, 2025-2035

- Figure 60: Scenario 2, Small Caliber Ammunition Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Small Caliber Ammunition Market, By Region, 2025-2035

- Figure 62: Scenario 2, Small Caliber Ammunition Market, By Caliber, 2025-2035

- Figure 63: Scenario 2, Small Caliber Ammunition Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Small Caliber Ammunition Market, 2025-2035