PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831816

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1831816

Global Naval Ammunition Market 2025-2035

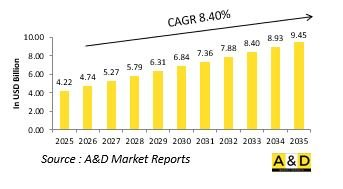

The Global Naval Ammunition market is estimated at USD 4.22 billion in 2025, projected to grow to USD 9.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.40% over the forecast period 2025-2035.

Introduction to Naval Ammunition Market:

The defense naval ammunition market is a critical component of modern maritime warfare, underpinning the offensive and defensive capabilities of naval fleets worldwide. Naval ammunition encompasses a wide range of munitions, including naval gun shells, missiles, torpedoes, depth charges, and close-in weapon system (CIWS) rounds, each designed to address different threats across surface, subsurface, and aerial domains. As naval forces evolve into multi-role, multi-mission platforms, the demand for versatile, high-precision, and long-range ammunition continues to grow. The strategic importance of sea power in safeguarding trade routes, projecting influence, and ensuring national security has elevated the role of advanced naval munitions. These weapons are vital not only for conventional naval engagements but also for deterrence, area denial, and power projection missions in contested maritime zones. The shift towards littoral operations, anti-access/area denial strategies, and integrated maritime defense has further expanded the scope of naval ammunition development. Modern navies are investing heavily in enhancing their munitions' range, accuracy, lethality, and adaptability, ensuring they remain prepared to counter evolving threats such as anti-ship missiles, submarines, and swarm attacks. Consequently, the naval ammunition market remains a cornerstone of maritime defense modernization and strategic capability development.

Technology Impact in Naval Ammunition Market:

Technological advancements are significantly transforming the naval ammunition landscape, driving improvements in range, precision, lethality, and versatility. Smart ammunition equipped with advanced guidance and navigation systems is enabling highly accurate targeting against moving and evasive threats, thereby enhancing engagement success rates. Innovations in propellants and warhead materials are increasing kinetic energy and penetration capabilities while reducing weight and storage requirements. The integration of programmable fuzes and multi-mode seekers is allowing ammunition to adapt dynamically to different target types, including surface vessels, aircraft, and submarines. Advances in electromagnetic railgun technology and directed-energy weapons are also influencing future naval ammunition development, promising extended range and reduced logistical burdens. Additionally, network-enabled munitions capable of receiving mid-course updates from command systems or unmanned platforms are improving real-time adaptability and mission effectiveness. Automation in loading and fire control systems is streamlining ammunition handling, reducing crew workload, and increasing firing rates. Furthermore, modular ammunition designs are enhancing mission flexibility, enabling ships to tailor their payloads to specific operational needs. These technological breakthroughs are redefining naval firepower, ensuring that modern fleets are equipped with the precision, responsiveness, and resilience required for high-intensity and multi-domain maritime operations.

Key Drivers in Naval Ammunition Market:

The growth of the naval ammunition market is driven by several strategic and operational imperatives. Rising geopolitical tensions and the increasing militarization of maritime zones are prompting nations to strengthen their naval strike and defensive capabilities. The expansion of blue-water navies and growing emphasis on sea control, deterrence, and power projection are fueling demand for advanced ammunition across surface combatants, submarines, and coastal defense systems. The shift towards multi-domain operations, where naval forces must counter threats from air, surface, subsurface, and land-based platforms, is accelerating the development of versatile and precision-guided munitions. Modernization programs focused on upgrading legacy naval platforms with next-generation weapons systems are also driving procurement activity. Additionally, the increasing frequency of naval exercises, joint operations, and maritime security missions is highlighting the need for reliable, scalable ammunition stocks. The proliferation of advanced anti-ship missiles, drone swarms, and stealth submarines is further pushing navies to invest in more sophisticated defensive and offensive ammunition solutions. Furthermore, collaboration between defense industries and research institutions is fostering innovation, leading to enhanced munitions performance and cost-efficiency. Collectively, these factors underscore the strategic importance of naval ammunition in ensuring maritime superiority and sustaining naval operational readiness.

Regional Trends in Naval Ammunition Market:

Regional dynamics in the naval ammunition market are shaped by distinct security priorities, maritime strategies, and defense modernization efforts. In North America, investments focus on enhancing precision strike capabilities and developing next-generation munitions to support carrier strike groups and expeditionary fleets. European nations are prioritizing multi-role ammunition to strengthen collective maritime defense under alliance frameworks and respond to increasing activities in contested waters. The Asia-Pacific region is witnessing rapid growth, driven by territorial disputes, expanding naval fleets, and the pursuit of anti-access and area-denial capabilities. Nations in this region are emphasizing both indigenous production and technology partnerships to enhance self-reliance and operational flexibility. In the Middle East, coastal defense and anti-ship capabilities are receiving significant attention as countries seek to protect strategic waterways and offshore infrastructure. Latin America and Africa are gradually increasing procurement of cost-effective naval munitions, focusing on maritime patrol, counter-piracy, and exclusive economic zone security. Across all regions, there is a clear trend toward integrating smart, networked ammunition with advanced sensor and targeting systems, reflecting the broader shift toward information-driven naval warfare. This global evolution highlights the enduring and expanding role of naval ammunition in shaping future maritime defense capabilities.

Key Defense Naval Ammunition Program:

A contract for the construction and delivery of eleven ammunition barges was signed with M/s Suryadipta Projects Pvt Ltd, Thane an MSME in alignment with the Government of India's Atmanirbhar Bharat initiative. The second barge in the series, LSAM 16 (Yard 126), was handed over to the Indian Navy on 06 September 2023 in the presence of Cmde MV Raj Krishna, CoY (Mbi). Built under the classification standards of the Indian Register of Shipping (IRS), the barge is designed for a service life of 30 years. Featuring major and auxiliary systems sourced entirely from domestic manufacturers, it stands as a strong example of the Ministry of Defence's Make in India efforts. The induction of the ACTCM barge will significantly enhance the Indian Navy's operational capabilities by enabling efficient transportation, embarkation, and disembarkation of ammunition and other materials to naval ships, both at jetties and in outer harbours.

Table of Contents

Naval Ammunition Market - Table of Contents

Naval Ammunition Market Report Definition

Naval Ammunition Market Segmentation

By Type

By Technology

By Region

By Caliber

Naval Ammunition Market Analysis for next 10 Years

The 10-year naval ammunition market analysis would give a detailed overview of naval ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Naval Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval Ammunition Market Forecast

The 10-year naval ammunition market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Naval Ammunition Market Trends & Forecast

The regional naval ammunition market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Naval Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Naval Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Naval Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Caliber, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Caliber, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Naval Ammunition Market Forecast, 2025-2035

- Figure 2: Global Naval Ammunition Market Forecast, By Region, 2025-2035

- Figure 3: Global Naval Ammunition Market Forecast, By Caliber, 2025-2035

- Figure 4: Global Naval Ammunition Market Forecast, By Type, 2025-2035

- Figure 5: North America, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 6: Europe, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 8: APAC, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 9: South America, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 10: United States, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 11: United States, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 12: Canada, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 14: Italy, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 16: France, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 17: France, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 18: Germany, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 24: Spain, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 30: Australia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 32: India, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 33: India, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 34: China, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 35: China, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 40: Japan, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Naval Ammunition Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Naval Ammunition Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Naval Ammunition Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Naval Ammunition Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Naval Ammunition Market, By Caliber (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Naval Ammunition Market, By Caliber (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Naval Ammunition Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Naval Ammunition Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Naval Ammunition Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Naval Ammunition Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Naval Ammunition Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Naval Ammunition Market, By Region, 2025-2035

- Figure 58: Scenario 1, Naval Ammunition Market, By Caliber, 2025-2035

- Figure 59: Scenario 1, Naval Ammunition Market, By Type, 2025-2035

- Figure 60: Scenario 2, Naval Ammunition Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Naval Ammunition Market, By Region, 2025-2035

- Figure 62: Scenario 2, Naval Ammunition Market, By Caliber, 2025-2035

- Figure 63: Scenario 2, Naval Ammunition Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Naval Ammunition Market, 2025-2035