PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1930537

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1930537

Global Ammunition Market 2026-2036

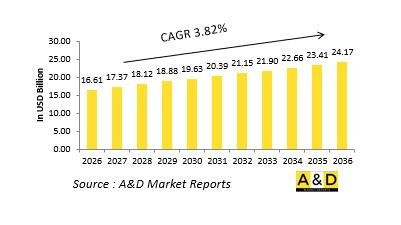

The Global Ammunition market is estimated at USD 16.61 billion in 2026, projected to grow to USD 24.17 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.82% over the forecast period 2026-2036.

Introduction

Ammunition remains one of the most essential and continuously consumed components of military capability, underpinning the effectiveness of small arms, artillery, armored systems, naval weapons, and air-delivered platforms. Unlike major platforms that are procured periodically, ammunition sustains day-to-day readiness, training cycles, and combat operations, making it a constant priority for defense forces. Its strategic importance extends beyond active conflict to include stockpiling, deterrence, and long-term force preparedness. Modern armed forces require a wide variety of ammunition types tailored to different operational roles, environments, and weapon systems. As military doctrines evolve toward sustained and high-tempo operations, the reliability, availability, and compatibility of ammunition become critical factors in operational success. The global focus on readiness and rapid response has elevated ammunition planning to a strategic level, influencing defense industrial policy and supply chain management. Indigenous production and secure sourcing are increasingly emphasized to reduce vulnerability to external disruptions. Ammunition continues to serve as a foundational element of military power, directly linking industrial capacity with battlefield effectiveness.

Technology Impact in Ammunition

Technological innovation is reshaping ammunition design, performance, and safety across multiple domains. Advances in propellant chemistry improve consistency, stability, and energy efficiency, enhancing accuracy and reducing barrel wear. Precision manufacturing techniques ensure tighter tolerances, leading to improved reliability and reduced misfire rates. Enhanced casing materials and sealing methods increase durability during storage and transport, particularly in extreme climates. In guided and smart ammunition categories, improved sensors and control mechanisms enhance targeting effectiveness while reducing collateral impact. Environmentally conscious technologies are also influencing development, with reduced-toxicity materials and cleaner combustion processes gaining attention. Automation in ammunition production improves output consistency and scalability while lowering human risk during manufacturing. Digital quality control systems enable real-time inspection and traceability throughout the production lifecycle. These technological advancements not only improve battlefield performance but also support safer handling, longer storage life, and more efficient logistics.

Key Drivers in Ammunition

The demand for ammunition is driven by a combination of operational readiness requirements, training intensity, and evolving threat environments. Ongoing military exercises and force preparedness programs consume significant volumes of ammunition even in peacetime. Heightened geopolitical tensions reinforce the importance of maintaining robust stockpiles. Modernization of weapon platforms necessitates compatible and upgraded ammunition types. Defense policies increasingly prioritize supply chain security, encouraging domestic production and long-term procurement agreements. Urban and asymmetric warfare environments drive demand for specialized ammunition optimized for precision and controlled effects. Additionally, the expansion of homeland security and border protection operations sustains consistent consumption. Lifecycle management considerations, including shelf-life extension and safe disposal, further influence procurement strategies. These drivers collectively create sustained and predictable demand for ammunition across global defense forces.

Regional Trends in Ammunition

Regional ammunition demand reflects distinct security postures and industrial capacities. In North America, emphasis is placed on maintaining large-scale production capability to support training, readiness, and expeditionary operations. European demand is shaped by coordinated stockpiling initiatives and efforts to standardize ammunition types among allied forces. Asia-Pacific regions experience growing demand driven by force expansion, maritime security concerns, and increased training intensity. Middle Eastern demand is closely tied to operational readiness and sustained security operations in high-risk environments. African demand is influenced by peacekeeping missions, internal security requirements, and gradual modernization efforts. Across regions, governments are investing in domestic manufacturing and storage infrastructure to reduce dependence on external suppliers. These regional dynamics demonstrate how ammunition planning is closely aligned with broader defense strategies and threat perceptions.

Key Ammunition Program:

General Dynamics Ordnance and Tactical Systems received a $727.8 million U.S. Army contract in April 2025 for 120mm Insensitive Munition High Explosive with Tracer tank ammunition. The firm-fixed-price award covers production of next-generation tank rounds featuring enhanced safety characteristics that reduce accidental detonation risks during storage, transport, or combat damage. Additional contracts included $465 million for 120mm training ammunition, reflecting sustained demand for both live-fire and simulation rounds amid global armored warfare modernization efforts.

Table of Contents

Ammunition Market - Table of Contents

Ammunition Market Report Definition

Ammunition Market Segmentation

By Region

By Caliber

By End User

Ammunition Market Analysis for next 10 Years

The 10-year ammunition market analysis would give a detailed overview of ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ammunition Market Forecast

The 10-year ammunition market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Ammunition Market Trends & Forecast

The regional ammunition market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Ammunition Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on (Market name) Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Caliber, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By End User, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Caliber, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By End User, 2026-2036

List of Figures

- Figure 1: Global Ammunition Market Forecast, 2026-2036

- Figure 2: Global Ammunition Market Forecast, By Region, 2026-2036

- Figure 3: Global Ammunition Market Forecast, By Caliber, 2026-2036

- Figure 4: Global Ammunition Market Forecast, By End User, 2026-2036

- Figure 5: North America, Ammunition Market, Market Forecast, 2026-2036

- Figure 6: Europe, Ammunition Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Ammunition Market, Market Forecast, 2026-2036

- Figure 8: APAC, Ammunition Market, Market Forecast, 2026-2036

- Figure 9: South America, Ammunition Market, Market Forecast, 2026-2036

- Figure 10: United States, Ammunition Market, Technology Maturation, 2026-2036

- Figure 11: United States, Ammunition Market, Market Forecast, 2026-2036

- Figure 12: Canada, Ammunition Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Ammunition Market, Market Forecast, 2026-2036

- Figure 14: Italy, Ammunition Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Ammunition Market, Market Forecast, 2026-2036

- Figure 16: France, Ammunition Market, Technology Maturation, 2026-2036

- Figure 17: France, Ammunition Market, Market Forecast, 2026-2036

- Figure 18: Germany, Ammunition Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Ammunition Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Ammunition Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Ammunition Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Ammunition Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Ammunition Market, Market Forecast, 2026-2036

- Figure 24: Spain, Ammunition Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Ammunition Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Ammunition Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Ammunition Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Ammunition Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Ammunition Market, Market Forecast, 2026-2036

- Figure 30: Australia, Ammunition Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Ammunition Market, Market Forecast, 2026-2036

- Figure 32: India, Ammunition Market, Technology Maturation, 2026-2036

- Figure 33: India, Ammunition Market, Market Forecast, 2026-2036

- Figure 34: China, Ammunition Market, Technology Maturation, 2026-2036

- Figure 35: China, Ammunition Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Ammunition Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Ammunition Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Ammunition Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Ammunition Market, Market Forecast, 2026-2036

- Figure 40: Japan, Ammunition Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Ammunition Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Ammunition Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Ammunition Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Ammunition Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Ammunition Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Ammunition Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Ammunition Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Ammunition Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Ammunition Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Ammunition Market, By Caliber (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Ammunition Market, By Caliber (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Ammunition Market, By End User (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Ammunition Market, By End User (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Ammunition Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Ammunition Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Ammunition Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Ammunition Market, By Region, 2026-2036

- Figure 58: Scenario 1, Ammunition Market, By Caliber, 2026-2036

- Figure 59: Scenario 1, Ammunition Market, By End User, 2026-2036

- Figure 60: Scenario 2, Ammunition Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Ammunition Market, By Region, 2026-2036

- Figure 62: Scenario 2, Ammunition Market, By Caliber, 2026-2036

- Figure 63: Scenario 2, Ammunition Market, By End User, 2026-2036

- Figure 64: Company Benchmark, Ammunition Market, 2026-2036