PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708693

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1708693

Carbon Offset Market, By Typ, By End-use Industry, By Geography

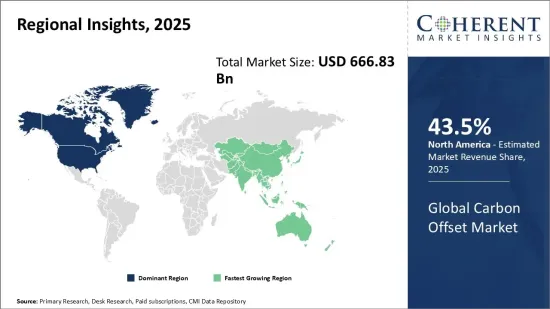

Global Carbon Offset Market is estimated to be valued at US$ 666.83 Bn in 2025 and is expected to reach US$ 2,922.01 Bn by 2032, growing at a compound annual growth rate (CAGR) of 23.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | US$ 666.83 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 23.50% | 2032 Value Projection: | US$ 2,922.01 Bn |

The carbon offset market refers to a platform that allows individuals and organizations to compensate for their carbon footprint by purchasing carbon credits from emission reduction projects. Over the past few decades, global emissions have steadily increased due to rapid industrialization and rising energy demands, leading to adverse effects of climate change such as rising sea levels and intensifying extreme weather events. As a result, there is a growing need to lower carbon emissions and transition to more sustainable energy sources. The carbon offset market provides an opportunity for polluters to offset their emissions through financing projects like renewable energy plants, energy efficiency upgrades, and forestry programs that remove carbon from the atmosphere. While offsets allow continued pollution, the funds support the development of green technologies and infrastructure that can help achieve long term decarbonization.

Market Dynamics:

The carbon offset market is driven by stringent government regulations and commitments to reduce greenhouse gas emissions. Many countries have pledged to become carbon neutral by mid-century and have implemented carbon pricing mechanisms to discourage fossil fuel use. However, high project costs and uncertainty over additionality of some offset projects pose challenges. Regulatory initiatives, corporate sustainability goals, and emission reduction targets are anticipated to drive the growth of the global carbon offset market over the forecast period. Moreover, the voluntary carbon market is expected to boost the growth of the global carbon offset market over the forecast period. Innovative project development, urban carbon solutions, supply chain sustainability, eco-tourism, and conservation are expected to create growth opportunities for the global carbon offset market during the forecast period.

Key features of the study:

- This report provides an in-depth analysis of the carbon offset market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period 2025-2032, considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the carbon offset market based on the following parameters - company highlights, product portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include 3Degrees Inc., NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool Effect, ClimateCare, MyClimate, Forest Carbon, and Verified Carbon Standard.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The carbon offset market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the carbon offset market

Carbon Offset Market Detailed Segmentation:

- By Type:

- Compliance Market

- Voluntary Market

- By End-Use Industry:

- Mining

- Energy

- Transportation

- Residential and Commercial

- Buildings

- Agriculture

- Forestry

- Other

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Company Profile:

- 3Degrees Inc.

- NativeEnergy

- ClimatePartner

- Carbon Credit Capital

- Terrapass

- Renewable Choice Energy

- Gold Standard

- Offsetters

- South Pole Group

- Veridium

- Cool Effect

- ClimateCare

- MyClimate

- Forest Carbon

- Verified Carbon Standard

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By End-Use Industry

- Market Snippet Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Regulatory initiatives

- Restraints

- Lack of standardization

- Opportunities

- Innovative project development

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Carbon Offset Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Carbon Offset Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Compliance Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Voluntary Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

6. Carbon Offset Market, By End-Use Industry Sectors, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Mining

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Energy

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Transportation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Residential and Commercial

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Buildings

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Agriculture

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Forestry

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Bn)

7. Carbon Offset Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Country 2021 -2032

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest Of Asia Pacific

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032(%)

- Brazil

- Mexico

- Rest Of Latin America

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Type, 2020-2032,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By End-Use Industry , 2020-2032,(US$ Bn)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- South Africa

- GCC Countries

- Rest of the Middle East and Africa

8. Competitive Landscape

- 3Degrees Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- NativeEnergy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- ClimatePartner

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Carbon Credit Capital

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Terrapass

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Renewable Choice Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Gold Standard

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Offsetters

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- South Pole Group

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Veridium

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Cool Effect

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- ClimateCare

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- MyClimate

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Forest Carbon

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Verified Carbon Standard

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

9. Section

- Research Methodology

- About us