PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667082

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667082

Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

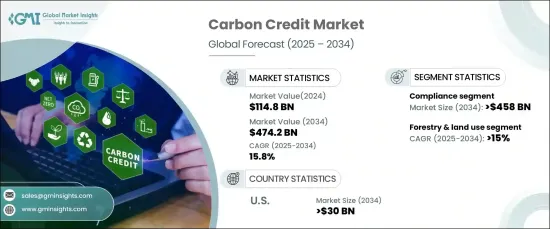

The Global Carbon Credit Market, valued at USD 114.8 billion in 2024, is projected to expand at a remarkable CAGR of 15.8% between 2025 and 2034. Carbon credits have become a cornerstone in tackling climate challenges, offering businesses and governments a mechanism to offset emissions while advancing sustainability. This dynamic market is driven by the growing importance of meeting Environmental, Social, and Governance (ESG) goals, alongside stricter regulations and corporate commitments to carbon neutrality. As industries increasingly prioritize environmental accountability, demand for carbon credits has surged, catalyzing innovation in trading platforms and carbon offset initiatives. The integration of carbon credits with renewable energy certificates and biodiversity credits underscores a shift toward holistic environmental solutions, further fueling market growth.

The compliance carbon credit segment is expected to generate USD 458 billion by 2034, reflecting the expanding global commitment to regulated carbon markets. Enhanced by science-based initiatives and global collaboration, over a hundred projects are underway to establish uniform standards and methodologies. These initiatives are driving market expansion and facilitating the alignment of compliance markets with broader environmental strategies. As carbon credit exchanges link with other environmental markets, the path to comprehensive sustainability solutions is becoming more defined, offering opportunities for businesses to reduce their carbon footprints effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $114.8 Billion |

| Forecast Value | $474.2 Billion |

| CAGR | 15.8% |

Forestry and land-use initiatives are gaining prominence in the carbon credit market, with this segment projected to grow at a CAGR of 15% through 2034. Reforestation and afforestation efforts are pivotal in generating carbon credits while addressing climate change. These projects, often referred to as "natural climate solutions," deliver critical environmental benefits, such as carbon sequestration, ecosystem restoration, and biodiversity preservation. Additionally, they foster community engagement, making them a vital part of climate mitigation strategies. As corporations and governments increasingly adopt these nature-based solutions, their role in offsetting emissions and achieving global sustainability goals continues to grow.

The US carbon credit market is forecasted to generate USD 30 billion by 2034, bolstered by corporations' focus on sustainability and voluntary carbon offset programs. Companies are leveraging high-quality, verified carbon credits to meet ambitious net-zero emission targets. Technological advancements, including artificial intelligence and blockchain, are enhancing transparency and efficiency in carbon credit trading, making the process more accessible and trustworthy. The rising emphasis on co-benefits, such as community development and biodiversity conservation, is also driving demand. As businesses incorporate these additional benefits into their sustainability plans, the US market is becoming a hub for innovation and growth in the global carbon credit landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Carbon capture & storage

- 6.4 Chemical process

- 6.5 Energy efficiency

- 6.6 Industrial

- 6.7 Forestry & land use

- 6.8 Renewable energy

- 6.9 Transportation

- 6.10 Waste management

- 6.11 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Middle East & Africa

- 7.6 Latin America

Chapter 8 Company Profiles

- 8.1 3Degrees

- 8.2 Allcot

- 8.3 Atmosfair

- 8.4 Carbon Clear

- 8.5 Carbon Collective

- 8.6 Carbon Trust

- 8.7 Climeco

- 8.8 Climate Impact Partners

- 8.9 EcoAct

- 8.10 Ecosecurities

- 8.11 Green Mountain Energy

- 8.12 Shell

- 8.13 South Pole

- 8.14 Sterling Planet

- 8.15 Terrapass

- 8.16 Verra

- 8.17 WGL Holdings