PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716517

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716517

Forestry and Land Use Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

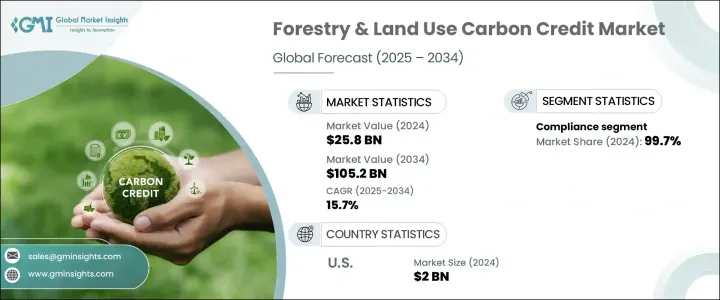

The Global Forestry & Land Use Carbon Credit Market was valued at USD 25.8 billion in 2024 and is projected to expand at a robust CAGR of 15.7% between 2025 and 2034. This significant growth is driven by the surging global focus on climate change mitigation and the increasing recognition of carbon credits as a crucial mechanism for reducing greenhouse gas emissions. As industries across sectors face mounting pressure to align with global climate goals, carbon credits are quickly becoming indispensable in incentivizing sustainable land management and conservation practices. Governments, corporations, and environmental organizations worldwide are embracing carbon credits to offset emissions and achieve carbon neutrality targets. The demand is further fueled by growing public awareness and investor interest in nature-based solutions, as stakeholders prioritize projects that contribute to biodiversity conservation, environmental restoration, and long-term carbon sequestration. With climate change mitigation strategies gaining momentum, the forestry & land use carbon credit market is set to become a central pillar in global decarbonization efforts.

In addition to this, increasing initiatives to restore critical ecosystems such as wetlands, peatlands, and mangroves are also fueling market growth. These ecosystems play a vital role in natural carbon sequestration, capturing and storing vast amounts of carbon dioxide over extended periods. As a result, organizations are actively exploring carbon credit programs specifically aimed at preserving and rehabilitating these landscapes, thereby elevating the demand for forestry and land use carbon credit services. Industries are also adopting sustainable land management strategies to align with evolving environmental regulations and meet ambitious emission reduction goals. The rising need to offset emissions and comply with international frameworks like the Paris Agreement is prompting companies to invest in verified and transparent carbon credit programs that contribute to both environmental and economic sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $105.2 Billion |

| CAGR | 15.7% |

The integration of advanced technologies such as remote sensing, drones, artificial intelligence (AI), machine learning, blockchain, and satellite imagery is revolutionizing the way carbon credits are monitored and verified. These innovations are streamlining the process of tracking emissions reductions and ensuring the integrity of carbon credit programs. Enhanced accuracy and efficiency in carbon capture validation are making it easier for industries and landowners to participate in these markets, thereby encouraging wider adoption and boosting market growth. As digital technologies continue to evolve, they are expected to play a critical role in strengthening transparency, reducing verification costs, and improving the overall scalability of carbon credit systems.

The forestry & land use carbon credit market is segmented into voluntary and compliance credits. In 2024, the compliance carbon credits segment dominated the market, accounting for a massive 99.7% share. These credits are issued under strict regulatory frameworks established by government agencies or international organizations to ensure that industries comply with mandated emission reduction targets. Strong governmental backing, coupled with favorable regulations, continues to drive the compliance segment as organizations work toward meeting stringent environmental standards.

United States Forestry & Land Use Carbon Credit Market generated USD 2 billion in 2024. The growth is primarily driven by the country's increasing industrial activities, heightened concerns over rising carbon emissions, and soaring energy demands. With stricter regulatory frameworks and an intensified focus on sustainability, the U.S. market is expected to maintain its upward trajectory as businesses strive to meet national and global climate commitments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.3 Europe

- 6.4 Asia Pacific

- 6.5 Middle East & Africa

- 6.6 Latin America

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 ALLCOT

- 7.3 Atmosfair

- 7.4 CarbonClear

- 7.5 Climate Impact Partners

- 7.6 ClimeCo LLC.

- 7.7 EcoAct

- 7.8 Ecosecurities

- 7.9 Green Mountain Energy Company

- 7.10 PwC

- 7.11 South Pole

- 7.12 Sterling Planet Inc.

- 7.13 TerraPass

- 7.14 The Carbon Collective Company

- 7.15 The Carbon Trust

- 7.16 VERRA

- 7.17 WGL Holdings, Inc.