PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740991

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740991

Auto Loan Origination Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

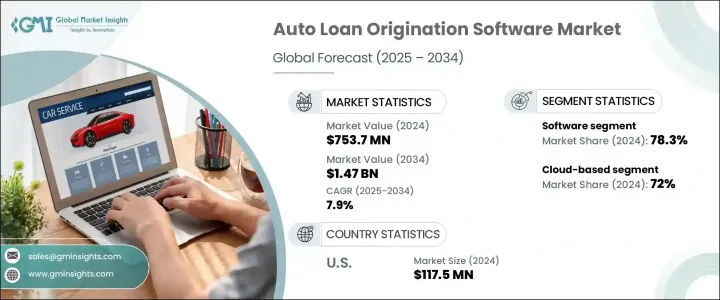

The Global Auto Loan Origination Software Market was valued at USD 753.7 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 1.47 billion by 2034. As demand rises for more efficient, accurate, and seamless lending processes, financial institutions are turning to technology to meet consumer expectations in today's digitally driven world. Auto loan origination software plays a vital role in automating complex tasks such as application intake, document verification, credit evaluation, and final approval, offering lenders an end-to-end digital lending solution. The market is gaining momentum as more lenders aim to cut down on processing time and operational overhead while improving borrower satisfaction. A key factor fueling this growth is the rising focus on customer experience. Borrowers today expect quick approvals, minimal paperwork, and personalized services, and loan origination platforms are enabling exactly that. By providing streamlined, transparent, and intuitive digital lending journeys, these solutions help financial institutions attract and retain customers in an increasingly competitive market. Institutions are also prioritizing secure, scalable, and adaptive solutions that offer a high degree of customization, allowing them to remain agile amid changing borrower behaviors and evolving regulations. With the growing popularity of digital channels for loan applications, the need for flexible and cloud-based systems has become more critical than ever.

The market is segmented based on components into software and services. In 2024, the software category held a dominant market share of approximately 78.3% and is projected to grow at a CAGR exceeding 8.3% throughout the forecast period. Software platforms are gaining preference for their scalability, flexibility, and ability to streamline loan processing from application to approval. These systems are engineered to automate time-intensive tasks such as risk analysis, identity validation, and credit scoring, integrating seamlessly into existing financial infrastructure. Financial organizations are increasingly opting for intelligent platforms that combine advanced functionalities, including AI-based scoring models, CRM systems, and real-time application tracking. These integrated solutions not only speed up the origination process but also contribute to a more secure and compliant lending ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $753.7 Million |

| Forecast Value | $1.47 Billion |

| CAGR | 7.9% |

Deployment-wise, the market is split into on-premises and cloud-based platforms. In 2024, cloud-based deployment led the market with a commanding 72% share and is expected to maintain a growth rate of over 8.4% through 2034. Lenders are increasingly favoring cloud solutions due to their ability to support dynamic scaling, real-time updates, and seamless integration across systems. By leveraging the cloud, institutions can cut down on infrastructure costs, benefit from regular security patches, and enable better access for both employees and customers. These platforms also enhance data privacy and facilitate smoother compliance with local and international regulations, making them particularly attractive in the current landscape of data-driven finance.

In terms of application, the market is divided between loans for passenger cars and commercial vehicles. The passenger car segment leads the application breakdown and is forecasted to continue its dominance due to the large volume of auto loans processed in this category. Most borrowers looking for personal vehicle financing seek easy and quick digital processes, which these platforms are well-equipped to deliver. The demand for simplified, mobile-first loan application systems is particularly strong among individual consumers, pushing lenders to prioritize the passenger vehicle segment when adopting or upgrading their origination software.

Geographically, North America leads the global auto loan origination software market, with the United States contributing around USD 117.5 million in revenue and accounting for roughly 79.6% of the regional share in 2024. The country's large volume of vehicle purchases, widespread use of credit for auto financing, and advanced financial infrastructure have contributed to this dominance. Financial institutions in the U.S. are also rapidly embracing AI-enabled systems, digital document handling, and real-time analytics, positioning the nation as a key innovator in auto lending technology.

As the market evolves, software providers are prioritizing features such as end-to-end encryption, real-time fraud detection, and automated compliance checks to meet the growing need for data security and transparency. Artificial intelligence and machine learning are now central to credit risk analysis, loan decisioning, and portfolio optimization. Integration with third-party ecosystems-including insurance firms, dealerships, and regulatory bodies-is further enabling real-time collaboration and a unified loan experience. This technology transformation is reshaping auto lending into a more responsive, efficient, and customer-focused process.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.2.1 Total Addressable Market (TAM), 2025-2034

- 2.3 Regional trends

- 2.4 Component trends

- 2.5 Deployment trends

- 2.6 Application trends

- 2.7 Enterprise Size trends

- 2.8 End use trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Financial Institutions and Lenders

- 3.2.2 Software provider

- 3.2.3 Service provider

- 3.2.4 End use

- 3.3 Impact of trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Use cases

- 3.9 Cost structure analysis

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Demand for streamlined efficient loan processing solutions

- 3.10.1.2 Focus on enhancing customer experience and satisfaction

- 3.10.1.3 Regulatory compliance requiremen driving software adoption

- 3.10.1.4 Shift toward cloud-based solutions for scalability

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Privacy concerns in handling sensitive information

- 3.10.2.2 Regulatory changes lead to frequent software updates

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light duty

- 7.3.2 Medium duty

- 7.3.3 Heavy duty

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Banks

- 9.3 Credit unions

- 9.4 Mortgage lenders & brokers

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Avant

- 11.2 Axcess Consulting Group

- 11.3 Black Knight Technologies

- 11.4 Byte Software

- 11.5 Calyx Technology

- 11.6 Financial Industry Computer Systems

- 11.7 Finastra

- 11.8 Fiserv

- 11.9 ICE Mortgage Technology

- 11.10 ISGN Corporation

- 11.11 Juris Technologies

- 11.12 Lending Qb

- 11.13 Mortgage Builder Software

- 11.14 Mortgage Cadence

- 11.15 Pegasystems

- 11.16 SPARK

- 11.17 Tavant

- 11.18 Turnkey Lender

- 11.19 VSC

- 11.20 Wipro