PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741014

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741014

Gas Fired Low Temperature Commercial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

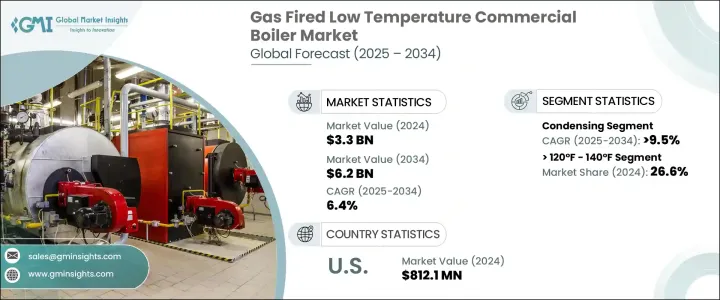

The Global Gas Fired Low Temperature Commercial Boiler Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 6.2 billion by 2034, driven by the rising demand for high-efficiency heating systems and growing government pressure to reduce energy consumption and minimize environmental impact. The market is witnessing strong momentum as businesses increasingly shift toward sustainable operations. With climate change concerns intensifying, commercial sectors are under mounting pressure to adopt cleaner technologies that align with international carbon reduction goals.

Rapid urbanization, expanding commercial real estate, and the growing need for energy-efficient retrofitting projects are also fueling adoption rates. Businesses are no longer viewing efficient heating systems as a luxury but as a necessity to stay competitive and compliant. Shifts in building codes, public funding for energy efficiency upgrades, and a sharper focus on lifecycle cost savings are further accelerating the market trajectory. Additionally, the rising integration of digital technologies such as IoT and AI into heating systems is transforming traditional boilers into smart, responsive assets that help optimize energy consumption and operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 6.4% |

Stricter emission regulations and the urgent need for sustainable energy solutions are pushing commercial sectors toward cleaner and more efficient heating technologies. Technological advancements in boiler systems, coupled with expanding commercial infrastructure worldwide, are shaping a promising market outlook. As efforts to control carbon emissions intensify, companies are moving rapidly toward low-emission technologies that offer both compliance and cost-efficiency. These boilers, fueled by natural gas, operate at lower temperatures, making them a perfect fit for commercial environments looking to cut energy use without compromising performance.

Investment in commercial construction and tertiary education is driving further growth, boosting the demand for efficient heating in schools, office complexes, and mixed-use buildings. While global trade policies may impact production costs due to tariffs on imported components, they are simultaneously encouraging domestic manufacturing expansion and fostering stronger, more resilient supply chains.

The condensing gas fired low temperature commercial boiler segment is projected to grow at a robust CAGR of 9.5% through 2034. These advanced systems are becoming increasingly connected, featuring cloud integration, predictive maintenance, and smart energy optimization. Such features significantly enhance performance while keeping operational costs in check. Supportive public funding for energy retrofitting in commercial spaces is giving an additional push to the adoption of smart boiler technologies.

The <= 120°F gas fired low temperature boiler market is forecasted to generate USD 1.4 billion by 2034. These boilers meet modern sustainability benchmarks and regulatory efficiency standards, offering better thermal performance than traditional systems. They are quickly becoming the preferred choice for businesses aiming to lower operational costs and meet evolving environmental mandates.

The U.S. Gas Fired Low Temperature Commercial Boiler Market reached USD 812.1 million in 2024. Growth in commercial construction activities continues to fuel the need for reliable, efficient heating solutions. Easy installation, low maintenance requirements, and enhanced safety features make these boilers an ideal option for large-scale commercial applications.

To strengthen their market position, companies such as Precision Boilers, Fondital, Bosch Industriekessel, Ariston Holding, Viessmann, Hurst Boiler & Welding, Immergas, Lochinvar, Burnham Commercial Boilers, Ferroli, Fulton, Cleaver-Brooks, Vaillant Group International, Bradford White Corporation, Weil-McLain, Hoval, Babcock & Wilcox, and Wolf are expanding their product lines with energy-efficient models, investing heavily in smart boiler technologies, and forming partnerships with construction firms and energy service companies. These firms are also accelerating R&D efforts for low-carbon systems and expanding manufacturing capabilities in key regions to align with global climate objectives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 ≤ 120°F

- 5.3 > 120°F - 140°F

- 5.4 > 140°F - 160°F

- 5.5 > 160°F - 180°F

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Offices

- 8.3 Healthcare facilities

- 8.4 Educational institutions

- 8.5 Lodgings

- 8.6 Retail stores

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 Ariston Holding

- 10.2 Babcock & Wilcox

- 10.3 Bosch Industriekessel

- 10.4 Bradford White Corporation

- 10.5 Burnham Commercial Boilers

- 10.6 Cleaver-Brooks

- 10.7 Ferroli

- 10.8 Fondital

- 10.9 Fulton

- 10.10 Hoval

- 10.11 Hurst Boiler & Welding

- 10.12 Immergas

- 10.13 Lochinvar

- 10.14 Precision Boilers

- 10.15 Vaillant Group International

- 10.16 Viessmann

- 10.17 Weil-McLain

- 10.18 Wolf