PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667149

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667149

Heavy Duty Vehicle Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

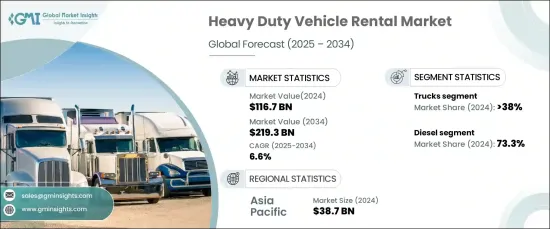

The Global Heavy Duty Vehicle Rental Market was valued at USD 116.7 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2034. This growth is driven by the rising Consumer Price Index (CPI) in vehicle maintenance and repair, which has caused businesses to look for more cost-effective alternatives. As maintenance expenses soar, many companies are opting for vehicle rental services, as renting allows them to meet transportation needs without the financial burden of rising upkeep costs.

Renting heavy-duty vehicles offers businesses a practical solution by eliminating the high upfront costs of purchasing vehicles. With rental fees often covering maintenance and repairs, companies can avoid unexpected expenses. This flexibility helps businesses optimize their budgets, especially for short-term projects or seasonal demands. Renting heavy-duty vehicles provides a financially prudent option, ensuring that companies can access the necessary vehicles without committing to long-term investments. The growing trend of renting vehicles instead of purchasing them is fostering greater financial stability and operational efficiency for businesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $116.7 Billion |

| Forecast Value | $219.3 Billion |

| CAGR | 6.6% |

The market is segmented into trucks, buses, trailers, and other vehicles. The truck segment holds the largest market share, accounting for over 38% in 2024. This segment's growth is driven by the availability of rental programs that guarantee reliable and uninterrupted service. These flexible rental options are particularly beneficial for businesses with fluctuating needs, such as seasonal demands or unexpected workload surges. Trucks play a critical role across numerous industries, including construction, logistics, mining, and agriculture, making them an essential part of the heavy-duty vehicle rental market.

Trucks are in high demand because they are essential for raw materials, transporting goods, and equipment over both long and short distances. Their ability to handle heavy loads and perform in various terrains makes them indispensable for companies with diverse logistical needs. Renting trucks is a cost-effective alternative to purchasing, as it allows businesses to scale their fleets without the significant upfront capital investment. The option to rent trucks provides companies with the flexibility to adjust their fleets as needed, making it an attractive choice for industries with ever-changing transportation requirements.

Regarding propulsion types, the market includes diesel, natural gas, electric, hybrid electric, and others. Diesel vehicles dominated the market in 2024, holding a 73.3% share. Diesel-powered vehicles are popular because of their extended driving range, making them suitable for long-distance tasks. Additionally, diesel vehicles have faster refueling times than electric options, which helps minimize downtime for businesses. These factors make diesel vehicles an appealing choice for various rental and operational needs, offering businesses both range and flexibility.

The Asia Pacific region is the largest market for heavy-duty vehicle rentals, accounting for USD 38.7 billion in 2024. The demand for flexible rental solutions is driving growth in this region. Businesses in the Asia Pacific prefer renting vehicles for specific projects or short-term requirements, as it allows them to avoid long-term financial commitments. Rental companies offer customizable plans that provide access to vehicles when needed, helping companies scale their operations based on demand without having to invest in purchasing vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Buyer behavior and preferences

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 High maintenance & repair costs

- 3.9.1.2 Rising need for eliminating the high upfront costs of purchasing heavy-duty vehicles

- 3.9.1.3 Increased flexibility in terms of vehicle types, duration, and quantity

- 3.9.1.4 Integration of various technologies in fleet management

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Shortage of drivers

- 3.9.2.2 Rising cost of fuel

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Trucks

- 5.3 Buses

- 5.4 Trailers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Natural gas

- 6.4 Electric

- 6.5 Hybrid electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Service Provider, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 OEM

- 7.3 3rd party companies

Chapter 8 Market Estimates & Forecast, By Rental, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Short term

- 8.3 Long term

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Logistics and transportation

- 9.4 Mining

- 9.5 Oil and gas

- 9.6 Agriculture

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Avis Budget

- 11.2 Bennett International Group

- 11.3 Budget Truck Rental

- 11.4 Daimler Truck

- 11.5 DOZR

- 11.6 Enterprise Truck Rental

- 11.7 Herc Rental

- 11.8 Hino Trucks Rental Services

- 11.9 Idealease

- 11.10 Keen Transport

- 11.11 Manhattan Beer

- 11.12 PacLease

- 11.13 Penske Truck Rental

- 11.14 Ryder System

- 11.15 Scania Rents

- 11.16 Sixt SE

- 11.17 Toyota

- 11.18 Transwest Rentals

- 11.19 U-Haul International

- 11.20 Volvo Truck Rentals