PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721517

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1721517

Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

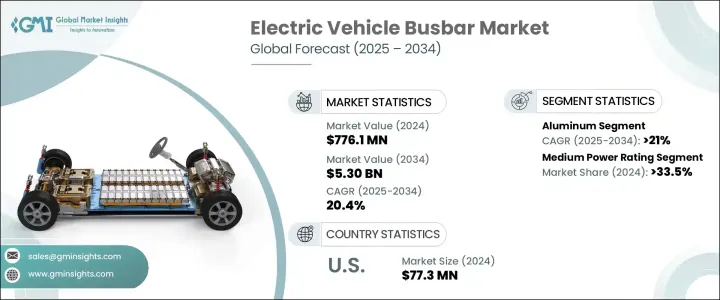

The Global Electric Vehicle Busbar Market was valued at USD 776.1 million in 2024 and is estimated to grow at a CAGR of 20.4% to reach USD 5.3 billion by 2034. The rapid acceleration in electric vehicle adoption is fueling a robust demand for efficient power distribution systems, and busbars are emerging as a critical component in this transition. As the automotive sector shifts toward electrification, busbars are becoming indispensable in EV battery systems for their ability to ensure streamlined power transfer and optimal energy efficiency. With EVs gaining momentum globally-driven by environmental regulations, fuel economy goals, and carbon neutrality commitments-automakers are integrating more advanced electrical systems that require high-performance busbars. The market is also witnessing increased traction due to rapid technological advancements in battery architecture and vehicle design, as well as ongoing efforts to scale EV manufacturing. Furthermore, the expansion of EV infrastructure, particularly in fast-charging networks, continues to boost demand for advanced busbar solutions that can withstand high voltage and extreme temperatures.

The rising installation of EV charging stations globally plays a key role in expanding the electric vehicle busbar market. These components are vital for managing high-voltage power transfers, especially in ultra-fast charging systems, which are now in high demand. As EV adoption grows, so does the requirement for fast, reliable, and efficient charging setups-further elevating the need for robust busbar technologies that enhance current flow while minimizing energy losses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $776.1 Million |

| Forecast Value | $5.3 Billion |

| CAGR | 20.4% |

The market is segmented by material, primarily into copper and aluminum. Aluminum busbars are expected to witness a CAGR of 21% through 2034, owing to their lightweight nature and cost benefits, making them ideal for compact EV models where weight and affordability are critical. Meanwhile, copper busbars maintain dominance in luxury and high-performance EVs due to their superior conductivity and thermal performance. These attributes make copper an essential material in applications where power density and energy efficiency are paramount.

Segmented by power rating, the market includes low, medium, and high categories. The medium power rating segment held a 33.5% share in 2024, driven by rising demand for electric sports cars and high-end vehicles that require rapid acceleration, fast charging, and reliable energy delivery. With innovations in battery design and increasing consumer interest in premium EVs, this segment is poised to witness steady growth.

The U.S. Electric Vehicle Busbar Market generated USD 77.3 million in 2024. A key contributor to this growth is the Inflation Reduction Act (IRA), which has propelled EV demand through tax incentives for vehicles using domestically produced components like busbars. This policy is pushing manufacturers to invest in advanced, high-efficiency busbar systems made within the U.S., further enhancing the nation's role in the global EV supply chain.

Key players in the global EV busbar market include Siemens, Schneider Electric, TE Connectivity, Mersen SA, Infineon Technologies AG, Legrand, Littelfuse, Inc., Amphenol Corporation, Mitsubishi Electric Corporation, Weidmuller Interface GmbH & Co. KG, EAE Group, EG Electronics, EMS Group, and Rogers Corporation. These companies are heavily investing in R&D, scaling up production, and forming strategic partnerships to deliver high-performance busbar systems tailored to next-generation electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Brar Elettromeccanica SpA

- 8.3 EAE Group

- 8.4 EG Electronics

- 8.5 EMS Group

- 8.6 Infineon Technologies AG

- 8.7 Legrand

- 8.8 Littelfuse, Inc.

- 8.9 Mersen SA

- 8.10 Mitsubishi Electric Corporation

- 8.11 Rogers Corporation

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 TE Connectivity

- 8.15 Weidmuller Interface GmbH & Co. KG