PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773268

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773268

Medium Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

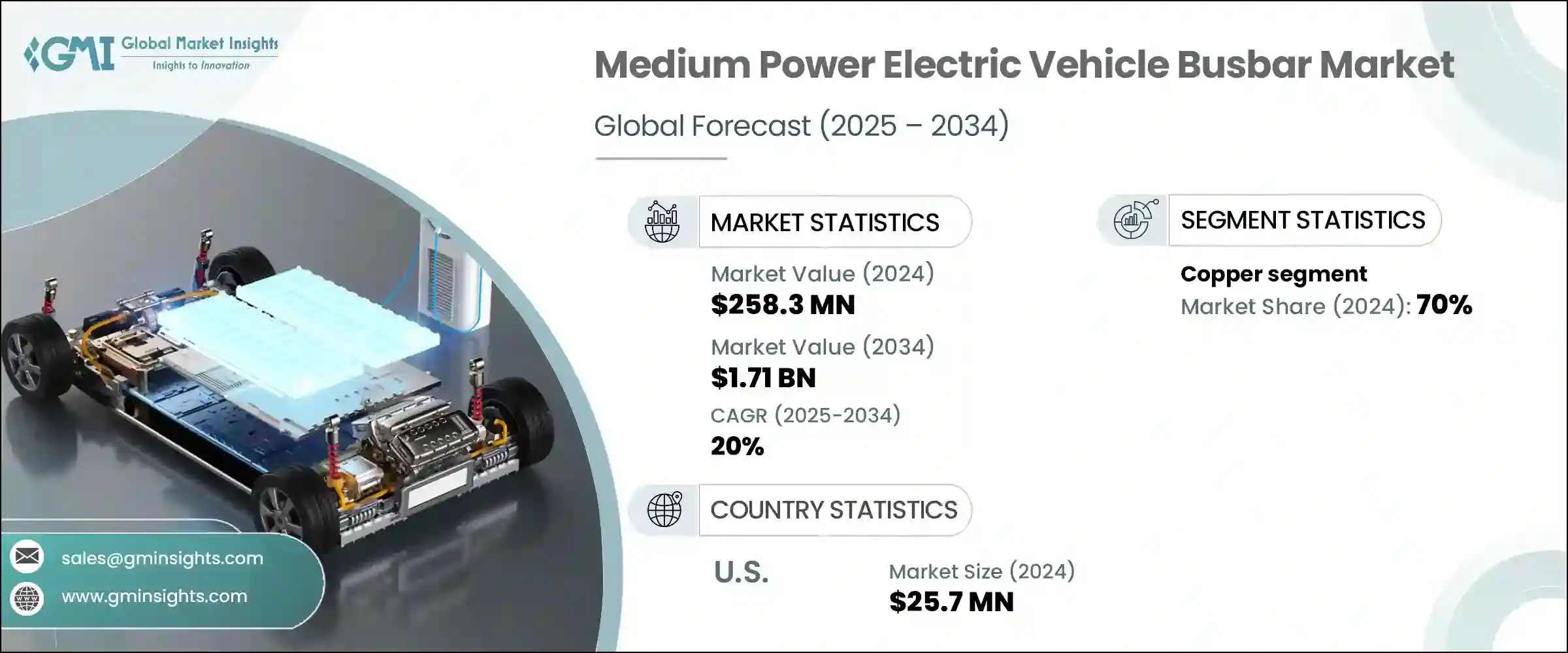

The Global Medium Power Electric Vehicle Busbar Market was valued at USD 258.3 million in 2024 and is estimated to grow at a CAGR of 20% to reach USD 1.71 billion by 2034. This impressive growth trajectory is being fueled by rising investments in electric mobility, favorable regulatory landscapes, and significant advancements in power distribution technologies. As electric vehicles continue gaining mainstream traction, strategic collaborations, innovations in material sciences, and evolving production technologies are reshaping how energy is routed within these vehicles. Market momentum is increasingly tied to the shift toward lightweight, high-efficiency systems tailored to optimize vehicle range and performance.

Material evolution is a key market driver. While copper remains dominant due to its unmatched electrical conductivity, it adds considerable weight-leading manufacturers to explore alternative materials. Lighter options like aluminum are now being integrated to reduce cost and improve energy efficiency. Custom-engineered solutions using advanced composites are gaining popularity for their superior thermal control and mechanical durability, offering a performance boost across various EV applications. Additionally, tailored busbar systems are helping manufacturers minimize material waste and optimize vehicle architecture. The convergence of smart technology integration, next-gen production lines, and evolving OEM specifications is opening new doors for market expansion and innovation across the value chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $258.3 Million |

| Forecast Value | $1.71 Billion |

| CAGR | 20% |

As of 2024, the copper segment in the medium-power electric vehicle busbar market held a 70% share due to its superior conductivity and thermal management. Its ability to minimize energy loss makes it vital for enhancing EV battery performance, ensuring better range, and maintaining system integrity. These characteristics remain critical for automakers striving to balance vehicle efficiency, safety, and power delivery.

United States Medium Power Electric Vehicle Busbar Market USD 25.7 million in 2024. Federal and state-led policies to accelerate EV adoption, coupled with rising demand for advanced grid infrastructure, are pushing manufacturers to scale up. Medium power busbars are essential in optimizing EV power distribution networks, ensuring both charging efficiency and load balancing. As EV production scales, the demand for reliable, compact, and heat-efficient busbar systems is increasing rapidly.

Key companies in the Global Medium Power Electric Vehicle Busbar Market include Amphenol Corporation, Infineon Technologies AG, Brar Elettromeccanica SpA, Littelfuse, Inc., Mersen SA, Siemens, EMS Group, Legrand, Rogers Corporation, Mitsubishi Electric Corporation, TE Connectivity, Schneider Electric, EAE Group, EG Electronics, and Weidmuller Interface GmbH & Co. KG. Leading players in this space are advancing their market footprint through a combination of material innovation, design optimization, and global manufacturing expansion. Many are prioritizing the development of lightweight, high-performance alloys and composites to meet the evolving efficiency standards of next-generation EVs. Strategic joint ventures with automakers and battery manufacturers are helping secure long-term supply agreements. Companies are also boosting investments in automation and precision tooling to enable scalable, cost-effective production of complex, vehicle-specific busbar assemblies. In parallel, they are expanding R&D efforts focused on heat dissipation, smart diagnostics, and system integration to deliver value-added solutions tailored to OEM requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG